BNB Recovers Above $970 After Brief Drop as Market Volatility Pressures Token

Despite the bounce, the token’s broader setup remains cautious, with resistance building near $980 and subdued volume suggesting a lack of conviction.

By CD Analytics, Francisco Rodrigues|Edited by Jamie Crawley

Nov 12, 2025, 1:49 p.m.

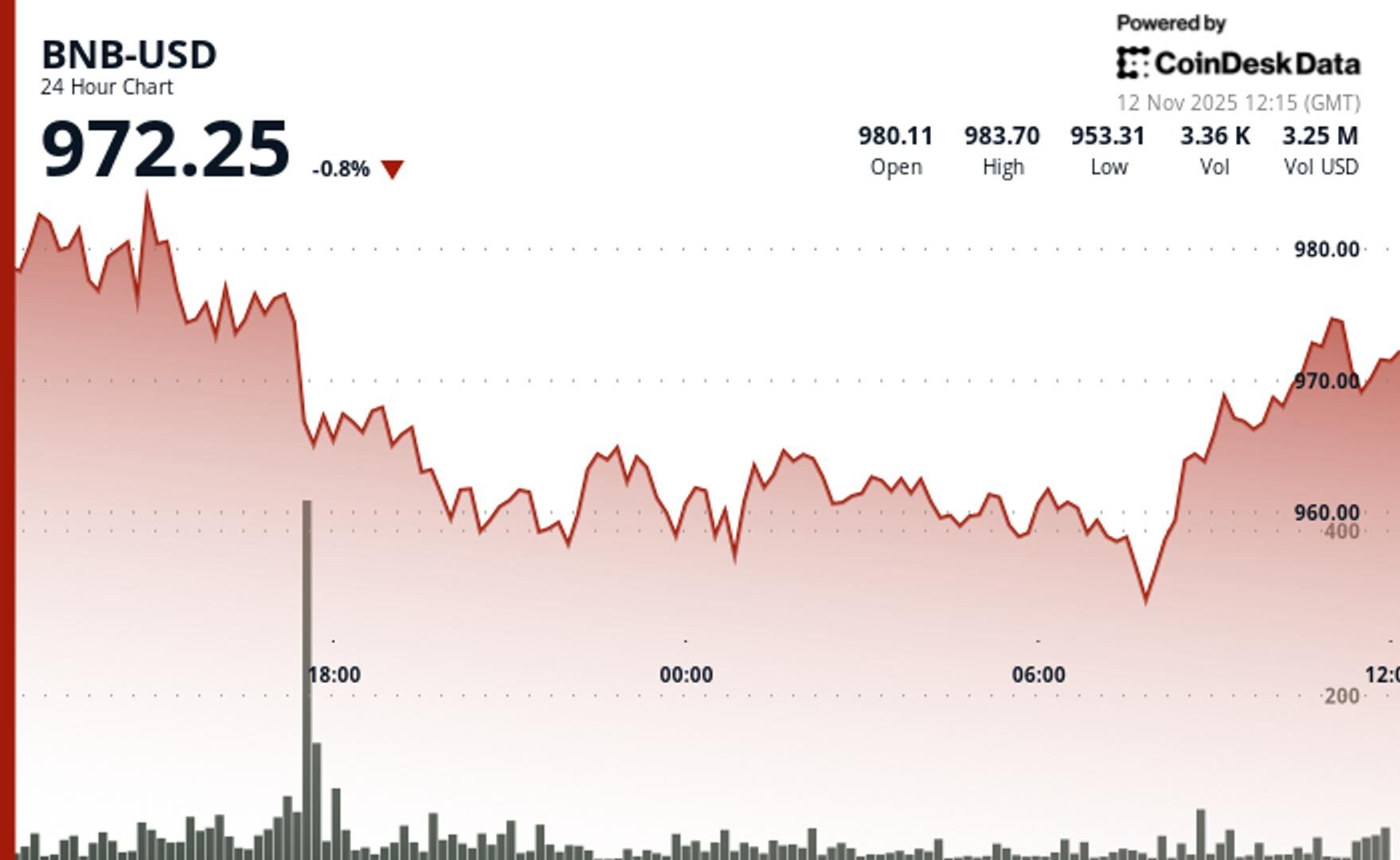

- BNB briefly fell to $953 before recovering above $970 over the last 24-hour period, driven by technical breakdowns and selling pressure.

- Despite the bounce, the token’s broader setup remains cautious, with resistance building near $980 and subdued volume suggesting a lack of conviction.

- BNB’s ability to stay above $970 may offer short-term support, but traders are watching whether it can retake the $975-$980 zone to avoid consolidating or drifting lower.

BNB recovered above $970 over the last 24-hour period after briefly falling to $953 during a volatile stretch that saw the token lose as much as 2.3% before it started recovering.

The move comes amid mounting selling pressure driven by both technical breakdowns according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

The initial drop, which saw BNB fall from an opening price of $980.18 to an intraday low of $953.31, came on elevated volume and confirmed a breakdown below key support levels.

Despite the bounce, the broader setup for BNB remains cautious. The token is struggling to hold gains near $970, with resistance building near $980. Volume remains subdued compared to the earlier sell-off, suggesting the move higher may lack conviction.

There weren’t significant developments affecting the token other than the crypto market’s turbulence. The broader market, based on the CoinDesk 20 (CD20) index, lost 0.44% of its value over the last 24 hours.

BNB’s ability to stay above $970 could offer short-term support, but traders are watching whether the token can retake the $975–$980 zone.

Without a strong move above those levels, BNB may continue to consolidate or drift lower as the market reacts to weaker exchange activity and reduced liquidity signals.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Di più per voi

3 nov 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

Cosa sapere:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

Di più per voi

Di Will Canny, AI Boost|Editor Jamie Crawley

34 minuti fa

The bank said USDC remains the frontrunner to dominate digital dollars as the company’s third-quarter results topped forecasts.

Cosa sapere:

- Circle’s 3Q results beat expectations on all major metrics, William Blair said.

- USDC remains the frontrunner to become the stablecoin standard.

- The bank advised buying Circle shares on weakness amid limited near-term catalysts.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language