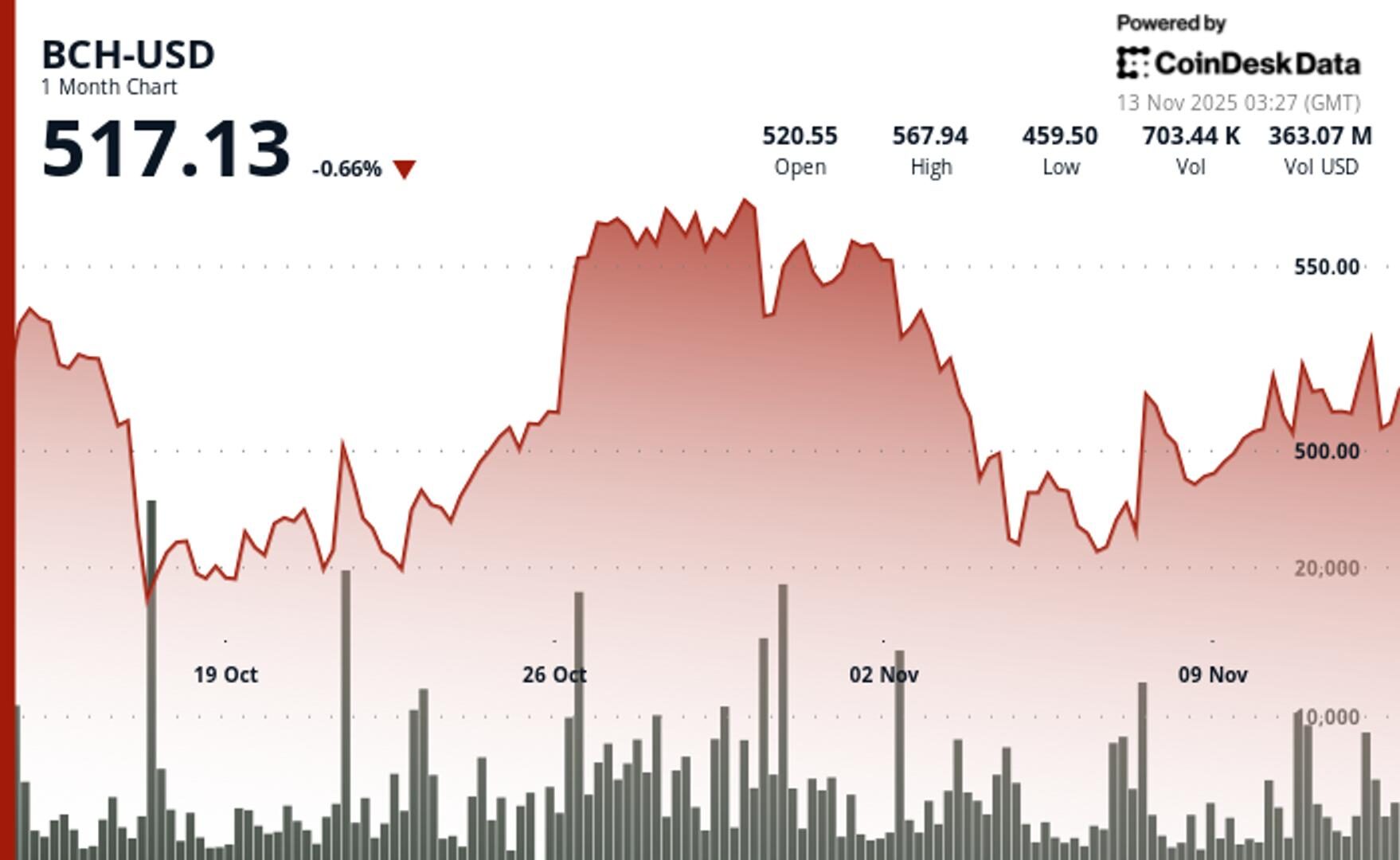

Bitcoin Cash Price Analysis: BCH Gains 1.9% to $518 Breaking Key Resistance

By CD Analytics, Siamak Masnavi

Nov 13, 2025, 3:41 a.m.

- BCH climbed from $508.32 to $518.01 on volume 158% above average.

- Breakout pierced $530 resistance before establishing support at $515.

- 60-minute data shows controlled buying above previous resistance levels.

According to CoinDesk Research’s technical analysis data model, BCH$520.17 posted solid gains during Wednesday’s session, advancing 1.9% from $508.32 to $518.01 amid heightened volatility across crypto markets. The move established clear bullish momentum within a $32.78 trading range, representing 6.4% intraday volatility as BCH outperformed while most altcoins stumbled at key resistance zones.

The decisive break came at 13:00 UTC on Wednesday when BCH pierced resistance at $530.00 on exceptional volume of 39.3K units — 158% above the 24-hour moving average. After touching $532.16, the token consolidated in a descending channel with declining volume while maintaining higher lows and cementing support at $515.00.

STORY CONTINUES BELOW

Recent 60-minute action revealed a two-phase surge starting at 02:35 UTC on Thursday, with BCH jumping from $516.34 to $521.66 on volume of 3,276 units before pulling back toward $518.07. This pattern tested resistance near $521.50 before establishing fresh support around $518.00, reinforcing the broader bullish structure.

With no fundamental catalysts driving BCH specifically, technical levels dominated as the cryptocurrency navigated broader market chop. While BTC faced rejection near $107,000 and most altcoins sold off from resistance, BCH’s hold above $515.00 support suggested accumulation by larger players.

The post-breakout consolidation indicated healthy price discovery, with diminishing volume during pullbacks showing limited selling interest. Traders now watch whether BCH maintains its technical edge as crypto markets work through overhead supply.

Support/Resistance:

- Primary support locked at $515.00 following successful breakout sequence

- Secondary support zone between $499-503, tested twice on selling waves

- Key resistance at $521.50 based on recent 60-minute rejection patterns

- Upper target remains $530-532 area from previous session highs

Volume Analysis:

- Volume surge to 39.3K units (158% above SMA) confirmed breakout validity

- Declining volume during consolidation shows limited distribution pressure

- 60-minute volume of 3,276 units supported momentum testing higher

- Accumulation patterns evident above $515 support zone

Chart Patterns:

- Bullish trend intact with higher lows maintained through consolidation

- Descending channel following breakout suggests controlled profit-taking

- Two-phase movement shows continued institutional interest

- Support testing reinforces structural integrity of uptrend

Targets & Risk Management:

- Immediate target: $521.50 resistance retest with volume confirmation

- Extended objective: Return to $530-532 breakout highs on follow-through

- Risk threshold: Break below $515.00 support signals trend failure

- Stop placement: Conservative exits below $499 support for swing trades

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By CD Analytics, Siamak Masnavi

26 minutes ago

BTC pulls back from session peaks above $105,300 with exceptional selling pressure before finding footing near $102,000 psychological threshold.

What to know:

- BTC dropped from $103,177 to $102,203, wiping out gains after touching $105,342 session peak.

- Trading volume spiked 138% above 24-hour average during decisive midday Tuesday breakdown.

- Price found stability in $101,500-$102,200 band during final eight hours as activity cooled.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language