Internet Computer (ICP) Advances as Consolidation Holds Below $6.66 Resistance Price

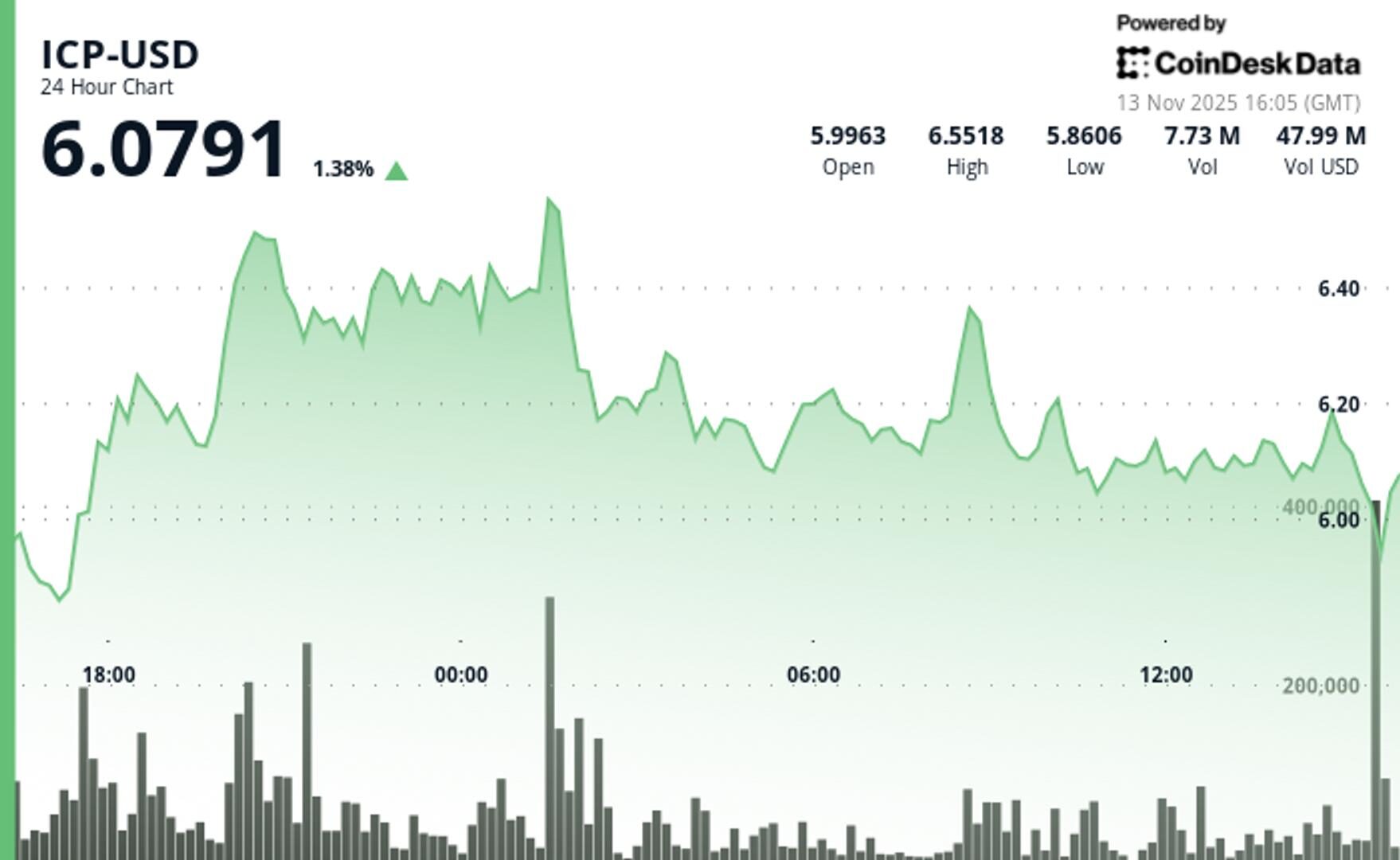

Internet Computer trades within a narrow range after an early-volume breakout attempt stalled, keeping the token pinned between key support at $6.05 and $6.66.

By Jamie Crawley, CD Analytics|Edited by Sheldon Reback

Nov 13, 2025, 4:40 p.m.

- ICP experienced a 68% above-average volume spike during a test of $6.66 resistance that failed to break through.

- Activity fell sharply, including several minutes of zero trades, underscoring the current equilibrium.

- ICP remains bound between $6.05 support and $6.66 resistance as traders await a volume-driven directional move.

ICP$6,0843 hovered near $6.03, adding 2.25% in the past 24 hours while remaining locked in a tight consolidation structure that has defined its price behavior since last week’s sharp retracement from early-November highs above $9.80.

Despite the advance, ICP continues to trade within a well-established corridor between $6.05 support and resistance at $6.66, levels that have repeatedly capped momentum throughout the past year, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

A burst of trading activity early in the session — 4.27 million tokens, roughly 68% above the 24-hour average — accompanied a renewed attempt to break above $6.66. The move failed to push through the ceiling, reinforcing that band as a key near-term obstacle. Once momentum faded, ICP slipped back toward the midpoint of its range as no fresh catalysts emerged to support directional follow-through.

Volume then thinned sharply, falling to just 171,000 tokens, with several minutes recording no trades. The dramatic slowdown underscores a temporary equilibrium rather than a decisive shift in sentiment, reflecting the broader range-bound structure now governing price action.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Helene Braun, AI Boost|Edited by Stephen Alpher

19 minutes ago

The managers of the Georgia university’s endowment are showing an inclination towards hard assets, opening a sizable position in a gold ETF as well.

What to know:

- Emory University more than doubled its holdings of the Grayscale Bitcoin Mini Trust in the third quarter.

- The university also added a new position in BlackRock’s iShares Gold Trust (IAU).

-

Kembali ke menu

Harga

-

Kembali ke menu

-

Kembali ke menu

Indeks -

Kembali ke menu

Riset

-

Kembali ke menu

Consensus 2026 -

Kembali ke menu

Bersponsor

-

Kembali ke menu

-

Kembali ke menu

-

Kembali ke menu

-

Kembali ke menu

Webinar

Pilih Bahasa