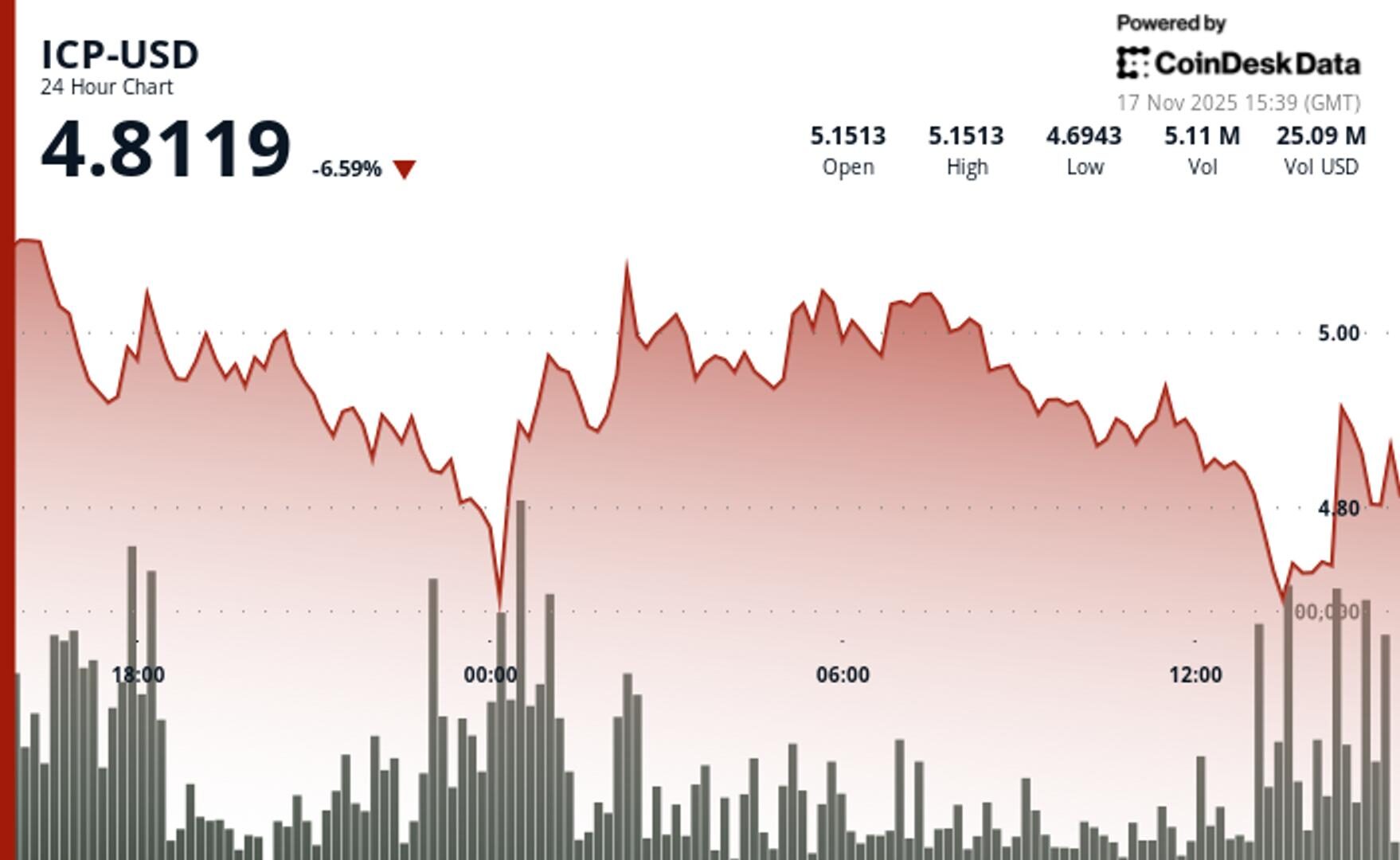

ICP Drops as Breakdown Below $5.00 Extends Multi-Session Weakness

ICP extended its pullback from November highs after rejecting key resistance levels, with elevated volume underscoring the market’s focus on support near $4.70.

By Jamie Crawley, CD Analytics

Nov 17, 2025, 3:51 p.m.

- ICP dropped 5.57% to $4.8119, continuing a broader unwind from its November rally.

- Volume spiked to nearly twice the daily average during the move below $5.00.

- Key support sits near $4.69–$4.70, where intraday reversal attempts emerged.

ICP declined to $4.8119 over the last 24 hours, down 5.57%, as the token extended its retracement from last week’s highs.

The move pushed ICP firmly below the $5.00 threshold—a level that has repeatedly acted as a pivot throughout recent months, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

The decline unfolded across a wide trading range, with prices touching $4.69 at the day’s lows.

Trading activity rose sharply, with volume jumping 98% above the daily average, marking one of the most active sessions of November. The increase coincided with repeated failures to regain the $5.00 area, establishing a clearer resistance zone following the steep pullback from earlier monthly highs near $9.50.

Intraday data shows several attempts to stabilize around $4.70, where brief recovery moves produced a series of higher lows alongside volume bursts of 207K and 167K tokens. These signals point to early signs of stabilization even as ICP remains below key resistance.

The broader structure now reflects a shift into short-term consolidation. Immediate resistance sits near $4.75, followed by the more consequential $5.00 threshold. Support between $4.69–$4.70 remains the key zone determining whether ICP can avoid a deeper retracement in the sessions ahead.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Helene Braun, AI Boost|Edited by Jamie Crawley

22 minutes ago

The new offering uses SOL staking and futures to deliver returns without price exposure, targeting compliance-minded investors.

What to know:

- Figment, OpenTrade, and Crypto.com are offering a stablecoin yield product targeting institutions seeking returns without direct crypto exposure.

- The structure earns around 15% annually by staking SOL and using perpetual futures to neutralize price volatility.

- Assets are held in segregated custody by Crypto.com, aiming to meet compliance standards and reduce counterparty risk.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language