BONK Weakens as Repeated Resistance Tests Cap Meme-Token Momentum

BONK slipped back into its lower range after multiple failed pushes toward $0.00001090, with elevated trading activity underscoring consolidation.

By Jamie Crawley, CD Analytics

Nov 17, 2025, 12:34 p.m.

- BONK underperformed broader crypto benchmarks, continuing a multi-session relative weakness trend.

- A major volume spike — 58% above session norms — aligned with resistance rejection near $0.00001090.

- Price remains range-bound, with support clustered at $0.00001050–$0.00001040 and no clear catalyst for reversal.

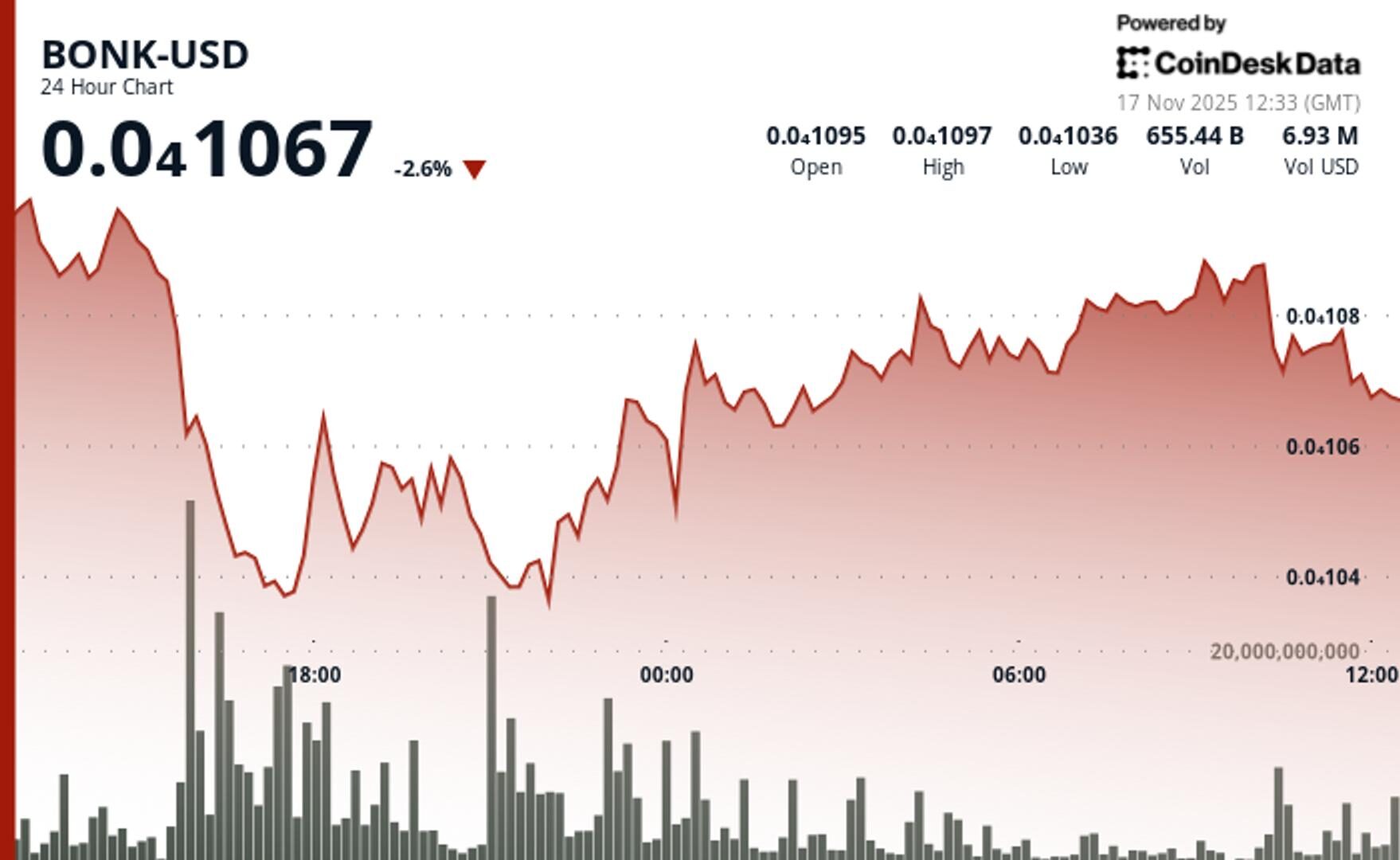

BONK eased to $0.00001073,down 2.1% over the latest 24-hour window, as another attempt to reclaim higher ground faltered beneath the familiar $0.00001090 resistance band.

The token lagged broader crypto benchmarks by roughly 3.5 percentage points, extending a multi-session trend of relative underperformance even as major assets posted modest gains, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Volume picked up sharply, rising 11.46% above BONK’s weekly average to 557.6 billion tokens. A major spike at 16:00 UTC pushed turnover to 879.0 billion — around 58% above typical session levels — coinciding with yet another rejection at the upper end of the range. Trading then shifted decisively lower, with BONK slipping through $0.00001080 after several failed rebounds.

A brief move from $0.00001085 to $0.00001072 marked the session’s sharpest decline, supported by 63.3 billion in volume and reinforcing the lower-high pattern that has shaped BONK’s chart throughout November. Support remains concentrated around $0.00001050–$0.00001040, while a sustained recovery would require a break back above $0.00001090 on strengthening volume.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By James Van Straten, AI Boost|Edited by Stephen Alpher

14 minutes ago

Rising whale activity hints at strategic positioning during bitcoin’s downturn.

What to know:

- The count of entities holding at least 1,000 BTC has risen to 1,436 over the past week as bitcoin has plunged to multi-month lows.

- This is a reversal in trend from most of 2025, which saw net selling from larger holders.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language