By Shaurya Malwa, CD Analytics

Updated Nov 20, 2025, 6:08 a.m. Published Nov 20, 2025, 6:08 a.m.

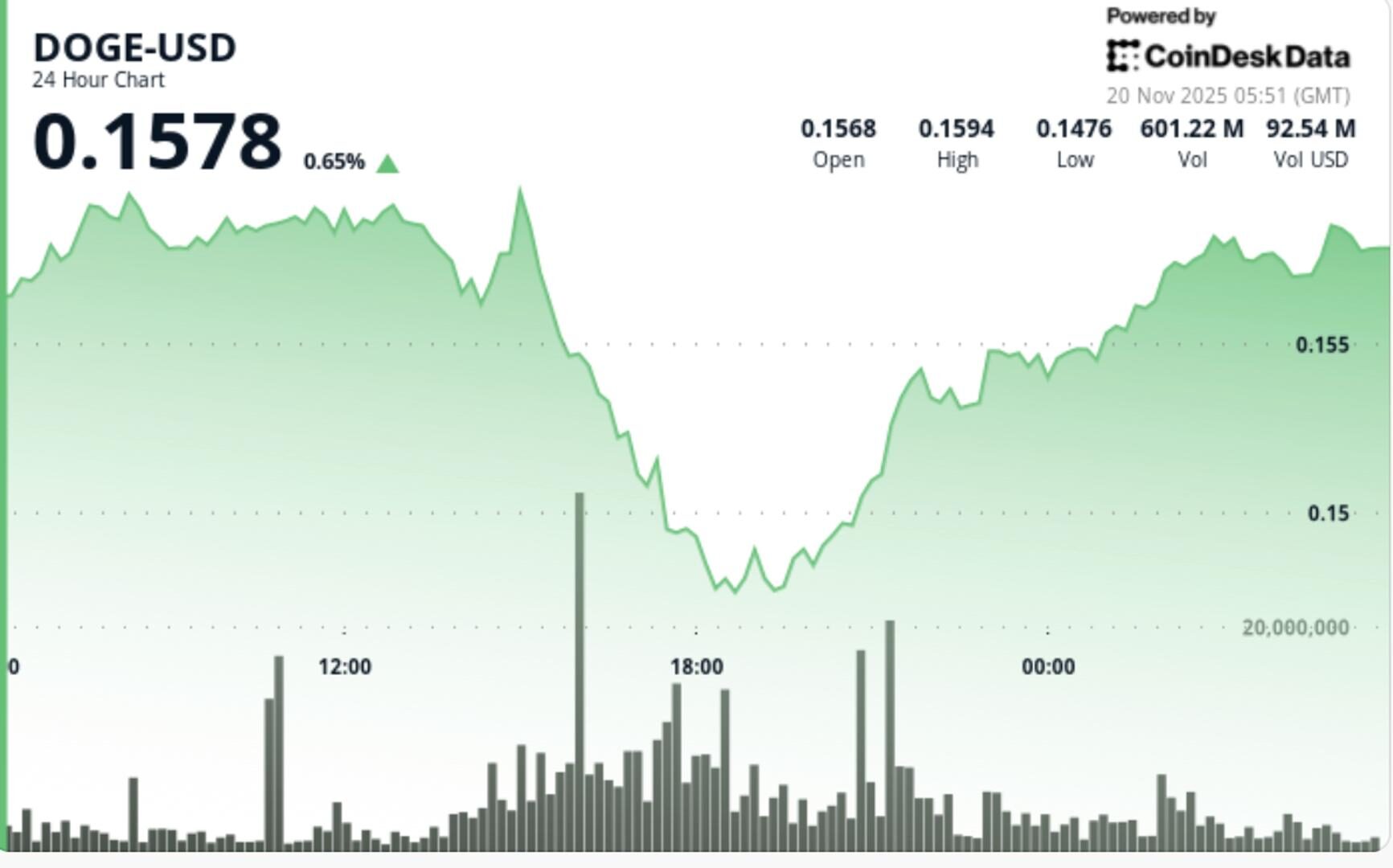

- Dogecoin’s price fell from $0.160 to $0.149, breaking the critical support level at $0.155.

- Whale accumulation and positive exchange net inflows suggest potential for a market bottom despite ongoing price declines.

- Traders should watch for a DOGE ETF decision and price movements around $0.155 and $0.150 as key indicators.

Major support at $0.155 collapsed under heavy selling pressure, yet improving exchange flows and accelerating whale accumulation suggest downside exhaustion may be nearing.

• DOGE dropped from $0.160 to $0.149, breaking major support at $0.155

• Exchange net inflows turned positive for the first time in months — a historical precursor to relief rallies

• Analysts flag a potential DOGE ETF approval window under Section 8(a) within the next seven days

• Whale accumulation totals 4.72B DOGE ($770M) over two weeks despite falling prices

• Broader crypto market remains in extreme fear, with sentiment at its lowest since April

STORY CONTINUES BELOW

Crypto markets continue to deteriorate as Bitcoin’s “Death Cross” and risk-off conditions pressure altcoins. However, DOGE’s exchange flow dynamics flipped positive — a structural shift that historically appears near market bottoms. Analyst Ali Martinez notes similar inflection points preceded reversible capitulation phases in prior cycles.

Dogecoin plunged 7.42% during the 24-hour session, collapsing from $0.160 to $0.149 in a breakdown that shattered the critical $0.155 support that anchored the previous consolidation range. Volume jumped 18.39% above weekly averages, confirming institutional participation rather than retail panic.

The selloff marked a clean violation of the 0.5 Fibonacci retracement from the prior bull cycle and drove price directly into the lower boundary of DOGE’s year-long descending triangle. The decline extended through multiple intraday floors before stabilizing near $0.149-$0.151. Oversold conditions emerged as RSI built bullish divergence against fresh price lows, while short-lived MACD death crosses hinted at exhaustion in downward momentum.

Dogecoin now sits at a high-stakes intersection of breakdown confirmation versus reversal potential. The collapse below $0.155 completes the descending-triangle resolution, traditionally projecting continuation down toward the $0.145-$0.140 zone. However, counter-signals are building.

Whale accumulation has intensified materially, with high-value wallets absorbing over 4.7B DOGE as price dropped — a sign of strong hands stepping in against weak retail flows. Simultaneously, exchange net inflows have flipped positive for the first time in months, a structural shift that previously preceded tradable bottoms.

Momentum indicators support this divergence: RSI continues to push higher even as price prints lower lows, and MACD’s bearish signals are rapidly fading. This creates a mixed but increasingly interesting setup where the technical breakdown clashes with early reversal signals rooted in on-chain behavior.

DOGE’s price will likely remain compressed between $0.149 support and $0.158 resistance until ETF catalysts or macro sentiment provide a decisive push.

Traders face a binary setup shaped by both regulatory catalysts and technical inflection:

• Monday’s Section 8(a) DOGE ETF deadline — a surprise approval could trigger immediate repricing

• Reclaim of $0.155 — essential for negating the breakdown and reopening path to $0.162-$0.165

• Failure at $0.150 — exposes fast continuation toward $0.115-$0.085 demand zones

• Exchange flow direction — continued positive net inflows would strengthen reversal thesis

• Macro sentiment — extreme fear across BTC and altcoins may produce sharp relief moves, but also increases breakdown risk

The risk/reward setup becomes highly favorable for directional traders as DOGE approaches the apex of a multi-year structure while ETF catalysts converge with on-chain accumulation dynamics.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Shaurya Malwa, CD Analytics

11 minutes ago

Despite no major catalysts, broader crypto market weakness and Bitcoin’s ‘Death Cross’ contributed to XRP’s decline.

What to know:

- XRP fell 3.6% amid heavy selling, breaking the critical $2.15 support level before stabilizing above $2.11.

- Despite no major catalysts, broader crypto market weakness and Bitcoin’s ‘Death Cross’ contributed to XRP’s decline.

- Traders are watching if XRP can reclaim $2.15 to neutralize bearish momentum, as current conditions suggest continued volatility.