Despite no major catalysts, broader crypto market weakness and Bitcoin’s ‘Death Cross’ contributed to XRP’s decline.

By Shaurya Malwa, CD Analytics

Updated Nov 20, 2025, 6:01 a.m. Published Nov 20, 2025, 6:01 a.m.

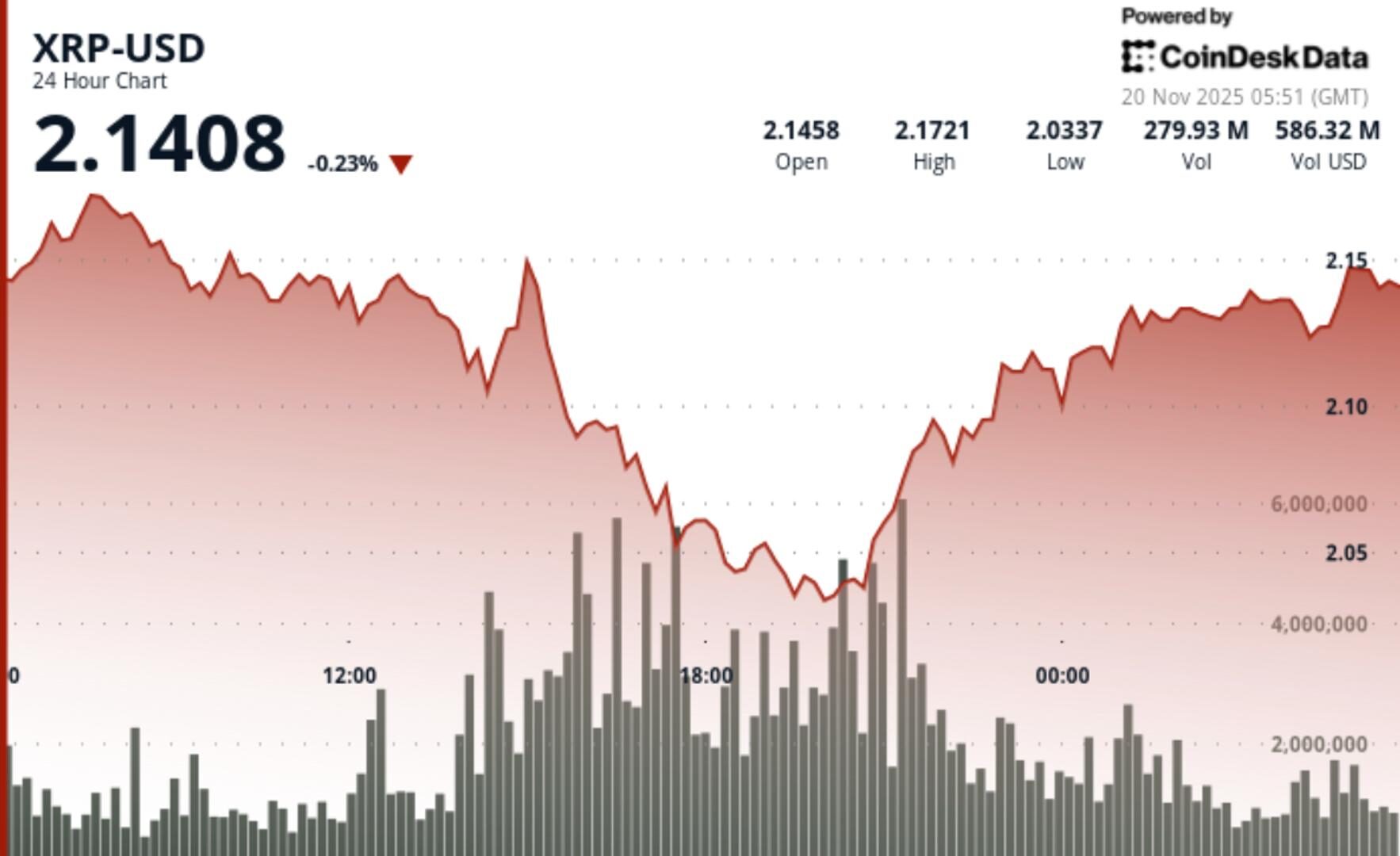

- XRP fell 3.6% amid heavy selling, breaking the critical $2.15 support level before stabilizing above $2.11.

- Despite no major catalysts, broader crypto market weakness and Bitcoin’s ‘Death Cross’ contributed to XRP’s decline.

- Traders are watching if XRP can reclaim $2.15 to neutralize bearish momentum, as current conditions suggest continued volatility.

XRP breaks critical technical level amid heavy selling pressure, finding temporary support at $2.05 before stabilizing above $2.11 in volatile session.

• No major fundamental catalysts accompanied the decline, though broader crypto markets weakened

• Sentiment remains fragile as Bitcoin’s “Death Cross” heightens risk-off conditions across majors

• Institutional flows rotated defensively with XRP underperforming CD5 despite recent ETF launches

• Analysts warn that support failures across altcoins may signal early-stage distribution cycles

STORY CONTINUES BELOW

• XRP dropped 3.6% from $2.21 → $2.13, breaking the critical $2.15 support

• Daily trading range expanded 7.8% with price testing the $2.04–$2.05 demand zone

• Volume surged to 177.9M (+76% above average) during the breakdown sequence

• Recovery attempts lifted price back above $2.11, but follow-through faded on declining volume

XRP endured another technical breakdown Tuesday, sliding 3.6% to $2.13 as institutional selling intensified below the key $2.15 support level. The decline unfolded across a volatile $0.17 range, with volume spiking 76% above 24-hour norms to 177.9M tokens — confirming large-order participation during the structural failure.

Sellers overwhelmed bids during evening trade, forcing XRP into the $2.04–$2.05 demand pocket where buyers finally emerged. The rebound pushed the token back toward $2.11–$2.12, but the recovery lacked depth as volume evaporated into the session close. Market structure now reflects a clear lower-high, lower-low formation consistent with persistent bearish momentum.

Despite ETF-linked inflow narratives, XRP underperformed broader crypto benchmarks — a sign that structural supply outweighs fundamental optimism in the near term.

The rejection at $2.21 and subsequent collapse below $2.15 underline the market’s sensitivity to technical failure points. The $2.05 support reaction suggests oversold conditions temporarily halted the decline, but the rebound lacks sufficient volume to confirm a durable shift in momentum.

Traders now watch whether XRP can reclaim $2.15, which would neutralize immediate bearish bias. Failure to do so keeps downside targets open, especially as lower-timeframe charts show supply clusters forming at $2.13–$2.15 with no sign of aggressive bid absorption.

Momentum remains pressured by macro correlations. Bitcoin’s Death Cross, weakening liquidity, and risk-off flows across altcoins suggest volatility may persist, and XRP — typically a high-beta asset — remains exposed to sector-wide unwind scenarios.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Sam Reynolds

3 hours ago

With CryptoQuant flagging an exhausted demand wave and Polymarket traders clustering around an 85,000 retest, the market is trading without the catalysts that drove last year’s gains.

What to know:

- Bitcoin’s market structure is weakening as demand diminishes, with rallies likely stalling below the 365-day moving average.

- Short-term Bitcoin holders are realizing losses rapidly, and derivatives markets are in risk-off mode, signaling potential bearish momentum.

- Bitcoin is trading around $92,000, while Ether is at $3,038, both reflecting a broader defensive market tone.