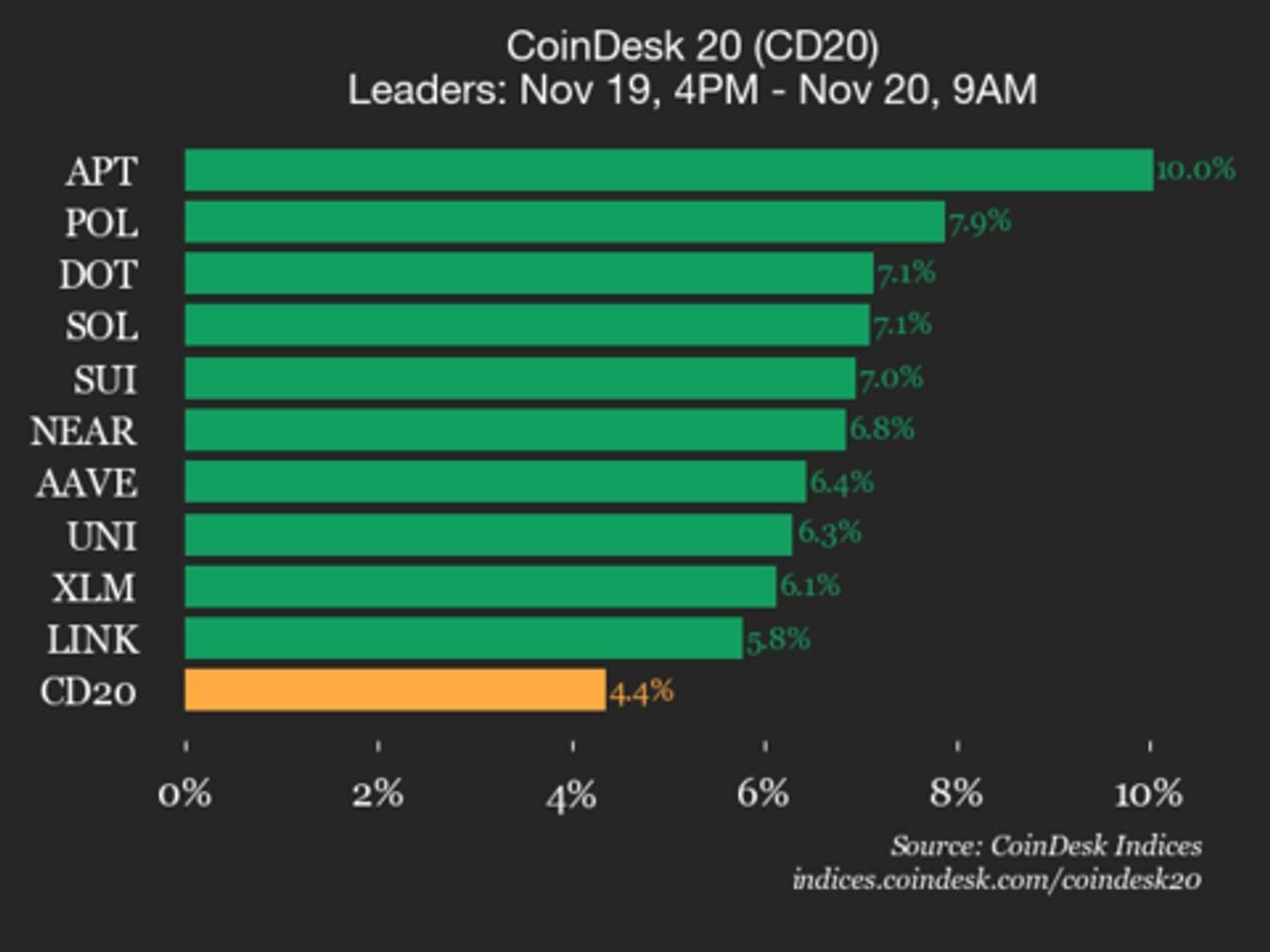

CoinDesk 20 Performance Update: Aptos (APT) Gains 10% as All Index Constituents Rise

Nov 20, 2025, 2:20 p.m.

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2954.76, up 4.4% (+123.58) since 4 p.m. ET on Wednesday.

STORY CONTINUES BELOW

All 20 assets are trading higher.

Leaders: APT (+10.0%) and POL (+7.9%).

Laggards: LTC (+2.6%) and BTC (+3.2%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Joshua de Vos, Andy Baehr, Francisco Rodrigues|Edited by Alexandra Levis

21 hours ago

In this week’s Crypto Long & Short Newsletter, Joshua de Vos shares insights from a recent Benchmark report on how the exchange landscape is maturing and becoming more execution-focused, but increasingly uneven as regional licensing diverges, liquidity fragments, and transparency advances inconsistently. Then, we take a look at where the digital assets market may be headed in the final weeks of 2025 with Andy Baehr’s “Vibe Check.”

What to know:

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language