HBAR Dives 3% Breaking Below Support as Crypto Market Plunges

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

By CD Analytics, Oliver Knight

Updated Nov 20, 2025, 5:17 p.m. Published Nov 20, 2025, 5:17 p.m.

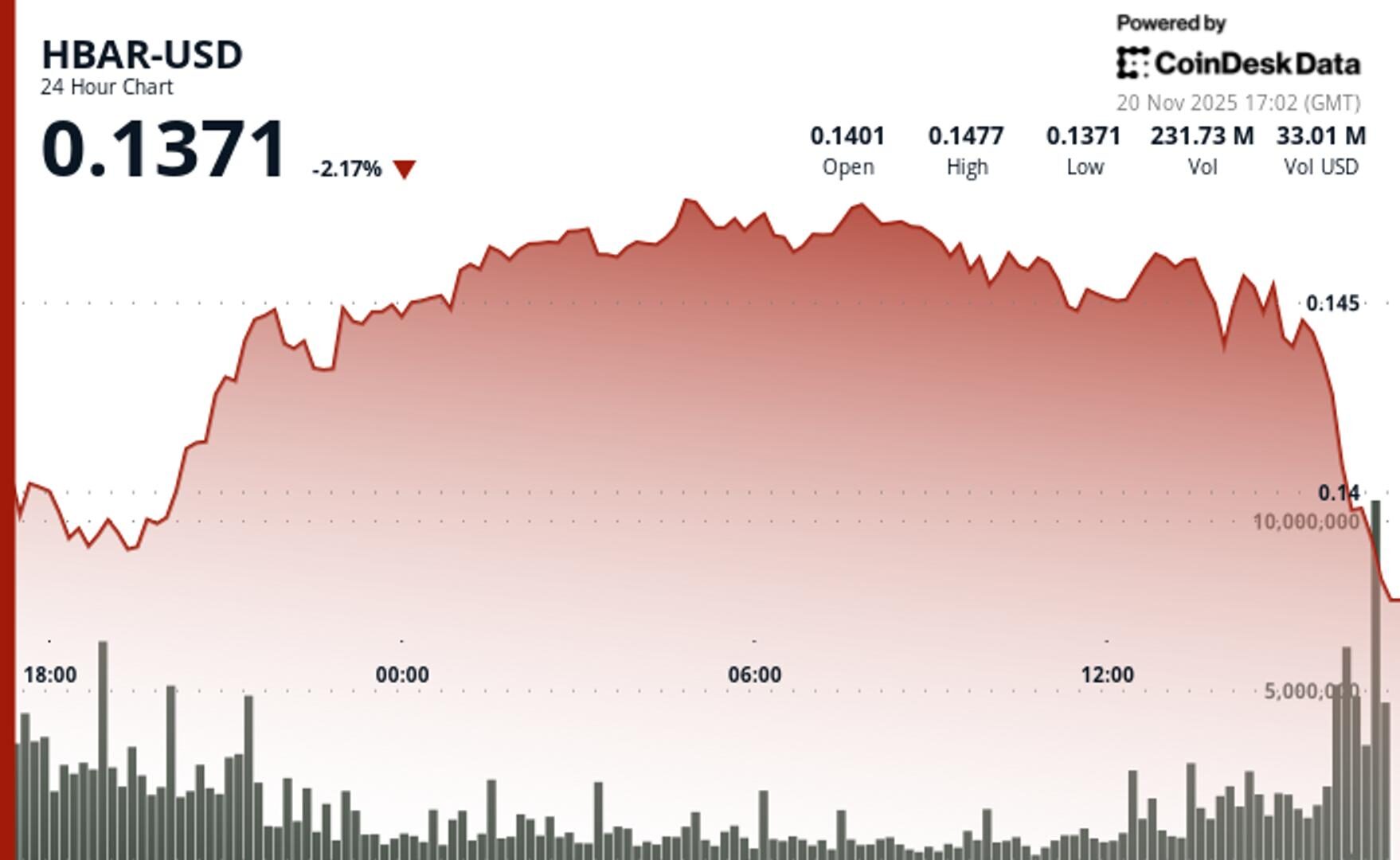

- HBAR’s drop to $0.1373 confirms a decisive break below its former $0.145 support, turning a neutral consolidation into a bearish setup.

- A zero-volume trading halt between 14:12 and 14:14 underscores potential technical disruption or acute liquidity shortage during the breakdown.

- Despite a 138% volume spike near $0.1486 resistance, buying momentum evaporated, leaving $0.1382 as critical support and $0.1445 as immediate resistance on any rebound.

HBAR slipped to $0.1373, breaking decisively below its established $0.145 support after failing to sustain its consolidation range. The token’s late-session selloff confirmed a shift from neutral structure to a clear bearish setup as price action deteriorated into the close.

Liquidity fractured sharply in the final hour, including a brief trading halt between 14:12 and 14:14 in which zero volume was recorded. That pause in trading activity raises red flags about potential structural issues or a short-term liquidity crunch, both of which can amplify downside pressure during stress periods.

STORY CONTINUES BELOW

Earlier in the session, a 138% surge in volume highlighted heavy resistance at $0.1486. Although HBAR initially staged a V-shaped rebound from its $0.1382 intraday low, buying momentum faded quickly, leaving the asset vulnerable to the subsequent breakdown.

Support/Resistance Analysis:

- Primary support at $0.1382 becomes critical after consolidation range failure.

- Former support at $0.1445 likely acts as resistance on recovery attempts.

- Key resistance remains at $0.1486 where volume surge marked rejection.

Volume Analysis:

- 146.94 million token spike 138% above 61.8 million average signals distribution phase.

- Volume contraction to 9.76 million tokens precedes critical breakdown.

- Zero volume trading halt indicates severe liquidity stress.

Chart Patterns:

- Consolidation range between $0.1446-$0.1477 invalidated by breakdown.

- V-shaped recovery pattern from $0.1382 fails to sustain momentum.

- Total trading range of $0.0096 (6.5%) suggests increased volatility potential.

Risk/Reward Assessment:

- Breakdown below $0.1440 targets support at $0.1382 level.

- Recovery faces immediate resistance at $0.1445 former support.

- Trading suspension raises concerns about market depth and liquidity infrastructure.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Jamie Crawley, CD Analytics|Edited by Cheyenne Ligon

48 minutes ago

Heavy trading activity during a failed rebound attempt pushed ICP into a tighter consolidation zone below $4.95, reinforcing short-term downside risk.

What to know:

- ICP is trading near $4.80, up 0.75% over the most recent 24-hour window despite earlier breakdown signals.

- A 5.63M volume spike, 85% above average, aligned with rejection near $4.98.

- Support now sits at $4.63, with resistance forming around $4.98–$5.13.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language