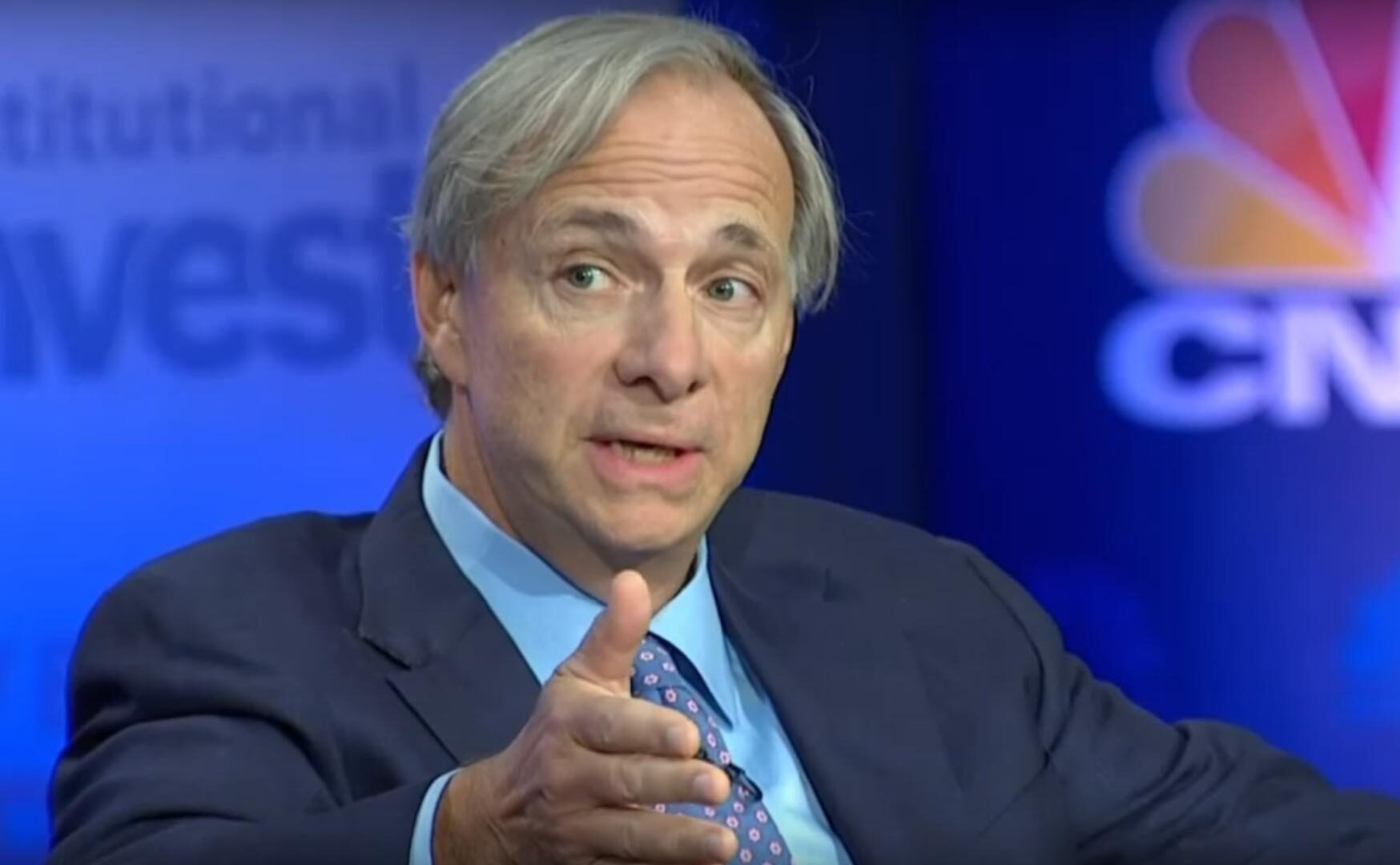

Bridgewater Founder Ray Dalio Says He Holds About 1% of Wealth in BTC

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

By Olivier Acuna|Edited by Stephen Alpher

Nov 20, 2025, 5:54 p.m.

- Ray Dalio said he has about a 1% allocation to bitcoin.

- Dalio believes bitcoin faces challenges as a global reserve asset due to its traceability and potential vulnerabilities from quantum computing.

- He warns that the U.S. economy is nearing a bubble similar to those before the 1929 crash and the 2000 dot-com collapse.

Bridgewater Associates founder Ray Dalio, who has in the past has said he owns some bitcoin BTC$92,123.27, put a clearer figure on it, saying it’s been about 1% of his portfolio for some time.

However, the hedge fund mogul said bitcoin still faces significant structural challenges before it can realistically be considered a global reserve asset.

STORY CONTINUES BELOW

“I have a small percentage of bitcoin,” he told CNBC on Thursday. “I’ve had it forever, like 1% of my portfolio.”

Hindering its adoption as a reserve currency, said Dalio, are issues such as its traceability, transactional transparency and vulnerabilities in light of the progress of quantum computing.

“I think the problem of bitcoin is it’s not going to be a reserve currency for major countries because it can be tracked and it could be, conceivably with quantum computing controlled, hacked, and so on and so forth,” Dalio said, stressing governments will not adopt financial products that record in a public and permanent way.

Recently, Dalio called on investors to allocate 15% of their portfolios to bitcoin and gold, an asset which he says he prefers. “The advantage of gold is that it’s an asset you can hold, and you’re not dependent on someone to provide it.”

In a broader sense, Dalio warned the U.S. economy is nearly 80% of the way into a bubble similar to those that preceded the 1929 crash and the dot-com era collapse of 2000.

The multi-billionaire hedge fund manager explained his predictions come from his bubble indicator, which tracks data going back to 1900. He said it tracks multiple metrics, including leverage, money supply, and wealth concentration, to evaluate market vulnerability.

“The picture is pretty clear, in that we are in that territory of a bubble,” Dalio said.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By CD Analytics, Oliver Knight

42 minutes ago

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

What to know:

- HBAR’s drop to $0.1373 confirms a decisive break below its former $0.145 support, turning a neutral consolidation into a bearish setup.

- A zero-volume trading halt between 14:12 and 14:14 underscores potential technical disruption or acute liquidity shortage during the breakdown.

- Despite a 138% volume spike near $0.1486 resistance, buying momentum evaporated, leaving $0.1382 as critical support and $0.1445 as immediate resistance on any rebound.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language