XRP Price News: Slides 7% as Technical Breakdown Opens Move to $1.80

Dec 1, 2025, 4:45 a.m.

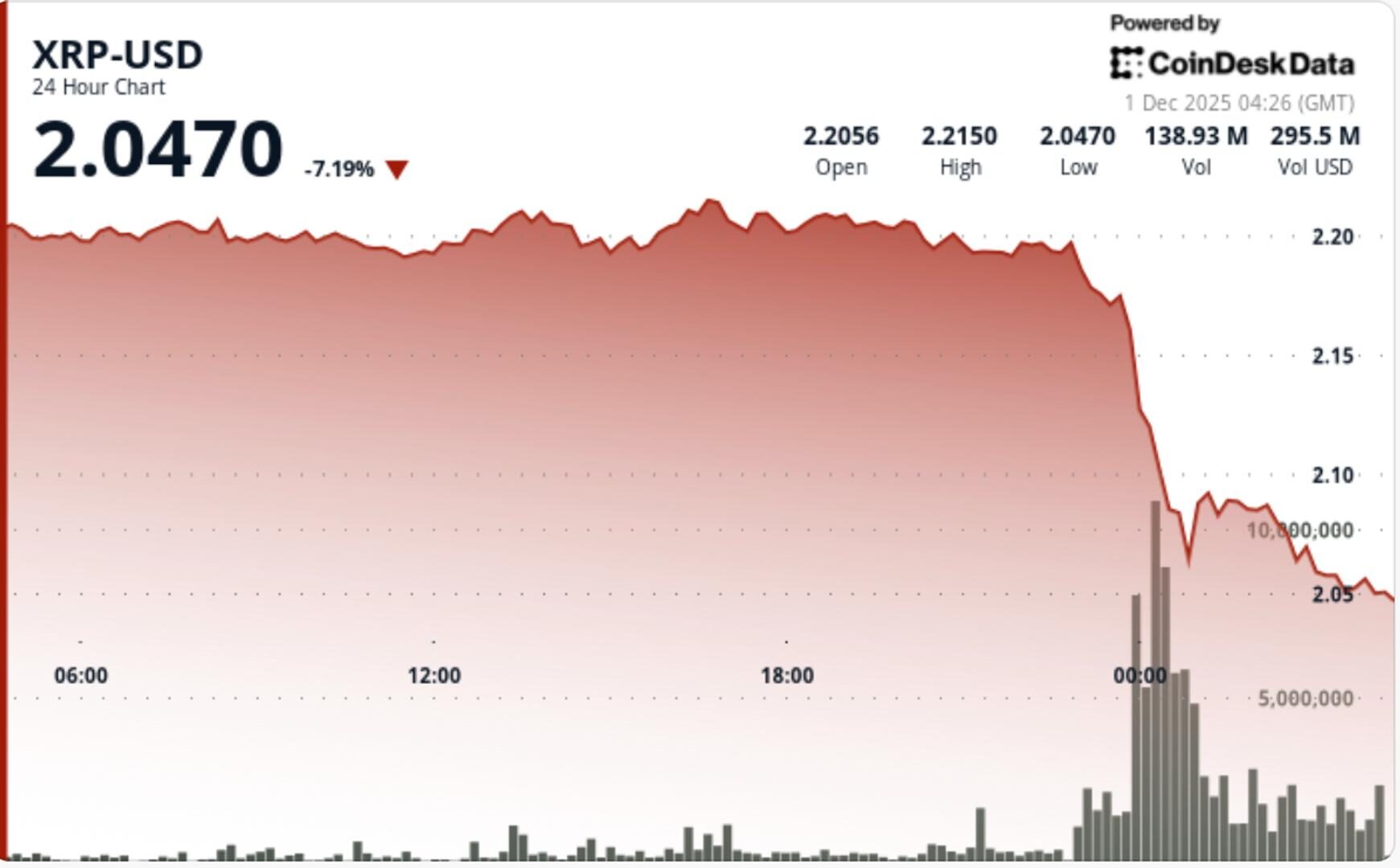

- XRP plunged 7% to $2.05 as institutional selling overpowered ETF inflows, pushing the token back into its November correction range.

- The breakdown below $2.16 marked a failure of XRP’s consolidation, with volume spiking to confirm institutional exit flows.

- Holding $2.05 is critical for XRP, as losing this level could expose the $1.80–$1.87 demand band.

XRP plunged 7% to $2.05 as a violent wave of institutional selling broke through critical support levels, overpowering strong ETF inflows and forcing the token back into its November correction range.

• XRP spot ETF inflows reached $666.6M this month, led by 21Shares’ new TOXR listing

• Exchange supply dropped 45% over 60 days, showing large-scale accumulation

• Whale wallets added 150M XRP since Nov 25 despite the latest breakdown

• Selling pressure intensified Tuesday as risk assets weakened broadly

STORY CONTINUES BELOW

Despite expanding institutional infrastructure around XRP, short-term flows turned sharply bearish. ETF demand appeared unable to counter heavy derivatives unwind and large-lot selling through the afternoon session. Market liquidity thinned as broader crypto benchmarks softened, accelerating the downside.

The breakdown beneath $2.16 marked a decisive failure of XRP’s recent consolidation structure. That level served as a pivot during the last three weeks, making its loss a key signal that sellers regained momentum.

The move pushed XRP back into a descending channel defined by consecutive lower highs from $2.38, $2.30, and $2.22. The structure reflects increasing control by bears, with each bounce producing diminishing follow-through.

Volume confirmed the legitimacy of the breakdown—spiking to 309.2M, more than 4.6× the rolling average. This level of activity typically signals institutional exit flows rather than noise. Multiple intraday retests of $2.05—each accompanied by 3M+ spikes—showed buyers defending the psychological floor, but with no confirmed reversal.

Momentum indicators reflect deep short-term oversold conditions, yet not enough divergence to indicate a completed corrective wave. The $2.05–$2.00 zone remains pivotal; losing it exposes the larger November demand band between $1.80 and $1.87.

XRP fell from $2.21 to $2.05 during a steep 7.2% decline. The most aggressive selling occurred after $2.16 gave way, triggering cascading liquidations into the close. Volume surged to 309.2M—up 464% from the daily average—confirming intense distribution.

Hourly candles formed a descending channel with lower highs and tightening range behavior. Multiple failed recoveries near $2.12 indicated persistent sell pressure. Buyers repeatedly absorbed dips at $2.05 but without momentum strong enough to reclaim broken support.

• Holding $2.05 is critical; a breakdown exposes $1.87–$1.80 next

• Reclaiming $2.16 is required to invalidate the bearish structure

• ETF inflows support long-term outlook, but short-term tape remains heavy

• Watch for bullish divergence on hourly RSI and MACD as early reversal signals

• A high-volume reclaim of $2.12–$2.16 would signal accumulation is resuming

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

17 minutes ago

Binance, Hyperliquid, and Bybit saw over $160 million in liquidations each, with longs making up almost 90% of the total.

What to know:

- Crypto markets experienced significant forced liquidations on Monday, wiping out nearly $646 million in leveraged positions.

- Binance, Hyperliquid, and Bybit saw over $160 million in liquidations each, with longs making up almost 90% of the total.

- Bitcoin and ether prices fell sharply, with bitcoin dropping over 5% and ether over 6%, as market sentiment and liquidity issues contributed to the downturn.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language