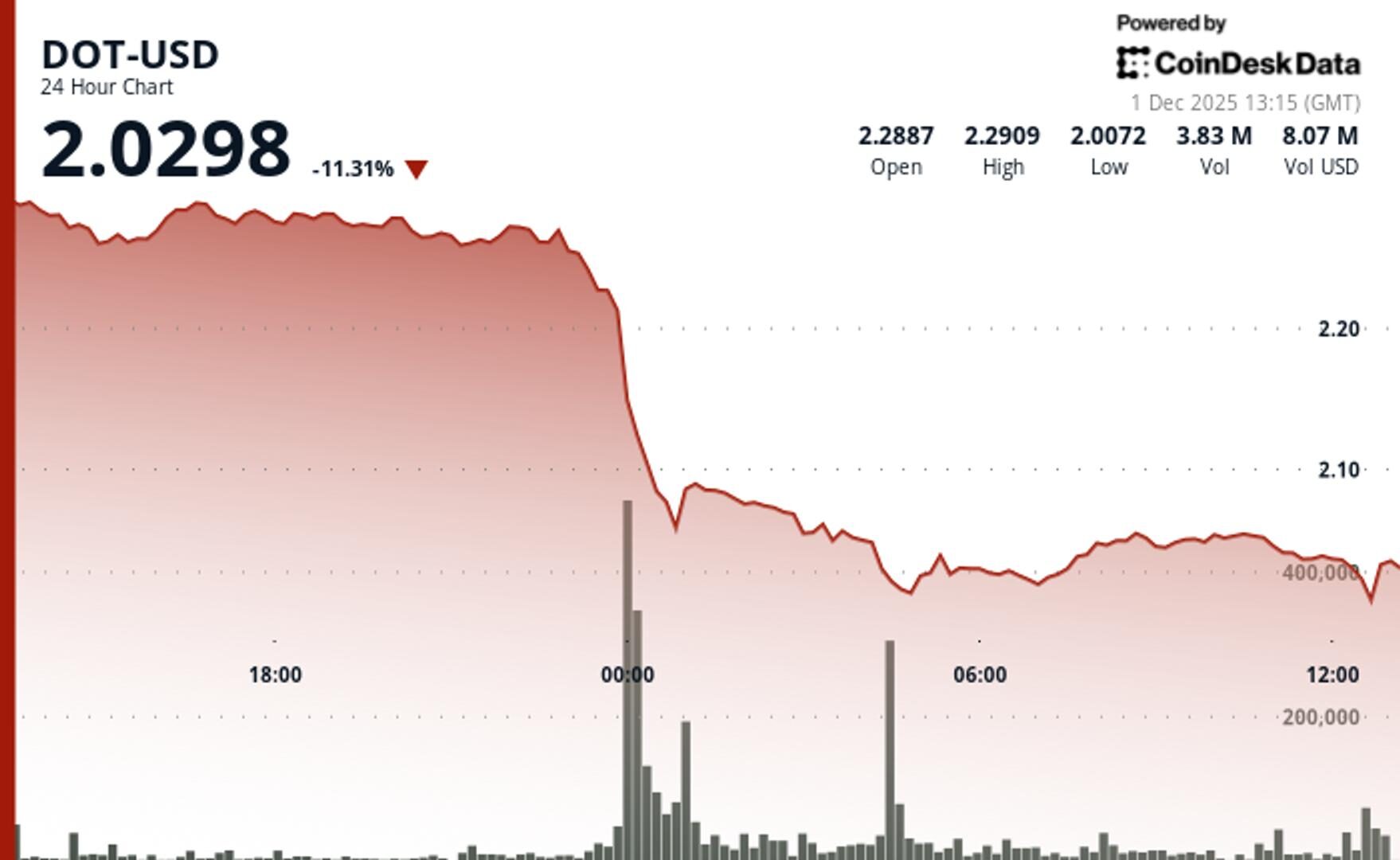

Polkadot (DOT) Plunges 11% Breaking Below $2.05 Support Level

DOT collapsed to $2.02 as technical breakdown accelerated on massive volume, exposing the psychological $2.00 level.

By CD Analytics, Will Canny|Edited by Aoyon Ashraf

Dec 1, 2025, 1:37 p.m.

- DOT plunged from $2.27 to $2.02, breaking critical support.

- Volume surged 280% above average during the decisive breakdown at midnight.

- Technical structure turned bearish with resistance capping recovery attempts at $2.09.

DOT$2.0241 crashed through critical support on Monday, sending the token to $2.02 from $2.27 in a sharp technical breakdown, according to CoinDesk Research’s technical analysis model.

The 11.4% decline ranks among the worst single-session losses for the ecosystem token this year, the model said. The volume surged to 14.6 million tokens, 280% above the 24-hour average, as sellers overwhelmed buyers.

STORY CONTINUES BELOW

The model showed that the breakdown gained momentum during overnight trading, as DOT fell through the $2.05 support level at midnight.

Recovery attempts failed repeatedly, and buyers couldn’t reclaim even modest levels around $2.09 and $2.06, confirming the shift to bearish momentum through relentless selling pressure, according to the model.

The selloff exposes the critical $2.00 psychological level as the next major downside target.

Wider crypto markets also fell, with the CoinDesk 20 index, lower by 7.5%.

Technical Analysis:

- Primary resistance now sits at $2.27

- Secondary resistance caps recovery at $2.09-$2.06 range

- Critical support target at $2.00 psychological level

- Exceptional volume surge to 14.56 million during midnight breakdown (280% above average)

- Sustained elevated volume throughout decline validates bearish momentum

- Decisive breakdown from consolidation range with gap creation

- Failed recovery attempts creating lower highs at $2.09, $2.06

- Momentum cascade pattern emerges in final trading hour

- Technical structure turns bearish with resistance capping upside

- Immediate downside target: $2.00 psychological support level

- Recovery resistance: $2.09 must be reclaimed for short-term stabilization

- Current risk/reward favors continued downside until volume stabilizes

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Will Canny, AI Boost|Edited by Sheldon Reback

20 minutes ago

The broker said fears over Strategy’s solvency are misplaced and the stock remains the strongest asymmetric bet on bitcoin.

What to know:

- Benchmark said Strategy’s share-price pullback has revived an unfounded doom narrative that ignores its bitcoin reserves and capital structure.

- The broker argued that MSTR’s perpetual preferred stock and low-cost convertibles give it unmatched bitcoin leverage with limited solvency risk.

- Analyst Mark Palmer reiterated his buy rating on the stock and $705 price target.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language