Toncoin (TON) Climbs to $1.50 as Cocoon Launch Sparks Surge in Trading Volume

Cocoon lets GPU owners rent out computing power for AI tasks and receive TON tokens as compensation, with Telegram as the first user.

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

Dec 2, 2025, 12:59 p.m.

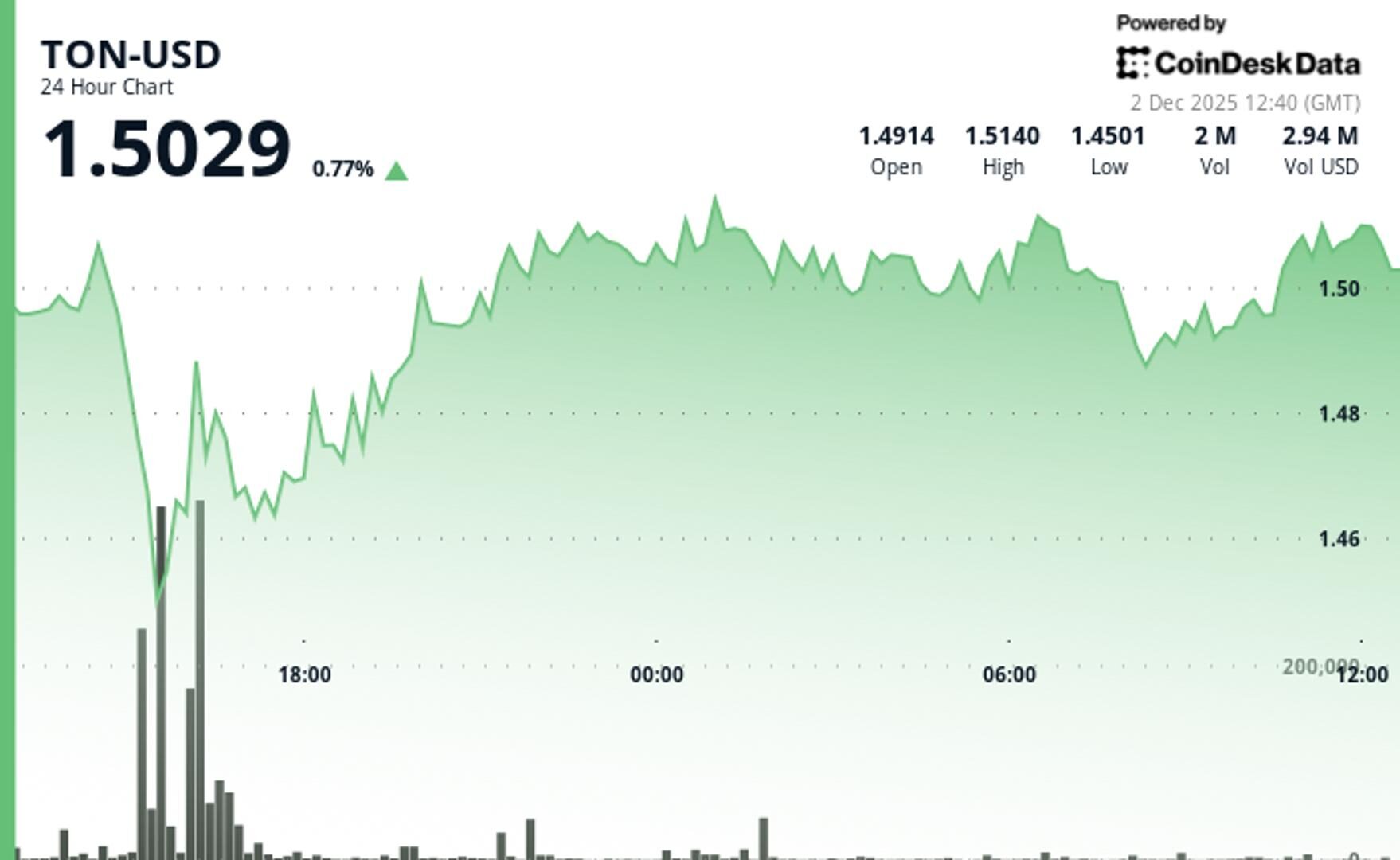

- TON’s price rose 0.77% to $1.5029 as trading volume spiked 37% after the introduction of Cocoon, a decentralized AI compute platform.

- Cocoon lets GPU owners rent out computing power for AI tasks and receive TON tokens as compensation, with Telegram as the first user.

- TON’s volume surge and ecosystem developments suggest growing interest in its decentralized AI infrastructure, with key support and resistance levels near $1.44 and $1.51.

TON rose 0.77% in 24 hours to $1.5029 as trading activity intensified following the introduction of Cocoon, a decentralized AI compute platform built on The Open Network.

Volume spiked to 2.95 million, marking a 37% increase over the weekly average, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

The price action comes as Cocoon starts processing live user requests. The platform enables GPU owners to rent out computing power for AI inference tasks and receive TON tokens as compensation.

Telegram, which has deep ties to the TON ecosystem, is serving as the first user of Cocoon’s AI infrastructure.

While TON’s gains trail broader crypto benchmarks, underperforming the CoinDesk 20 (CD20) index, which rose by 1.47% in the period, the surge in volume suggests large market particpants may be building positions.

Despite dips to a session low of $1.4501, the token showed strength through the period, closing well above its open of $1.4914 and holding onto the key support level around $1.45.

The price remained confined within a narrow range, suggesting a consolidation phase. Still, the elevated volume and ecosystem developments point to growing interest in TON’s role as infrastructure for decentralized AI.

Support is also seen around $1.44, with resistance near $1.51. A sustained move above that level could set up a test of $1.53 in the near term.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By CD Analytics, Will Canny|Edited by Sheldon Reback

40 minutes ago

The gains were accompanied by a surge in trading volume signaling potential institutional positioning.

What to know:

- APT advanced 2.4% to $1.90.

- Trading volume jumped 40% above the 30-day average.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language