DOT Price News: Polkadot Surges 13% After Breaking Above Key Resistance

By CD Analytics, Will Canny|Edited by Aoyon Ashraf

Dec 2, 2025, 4:58 p.m.

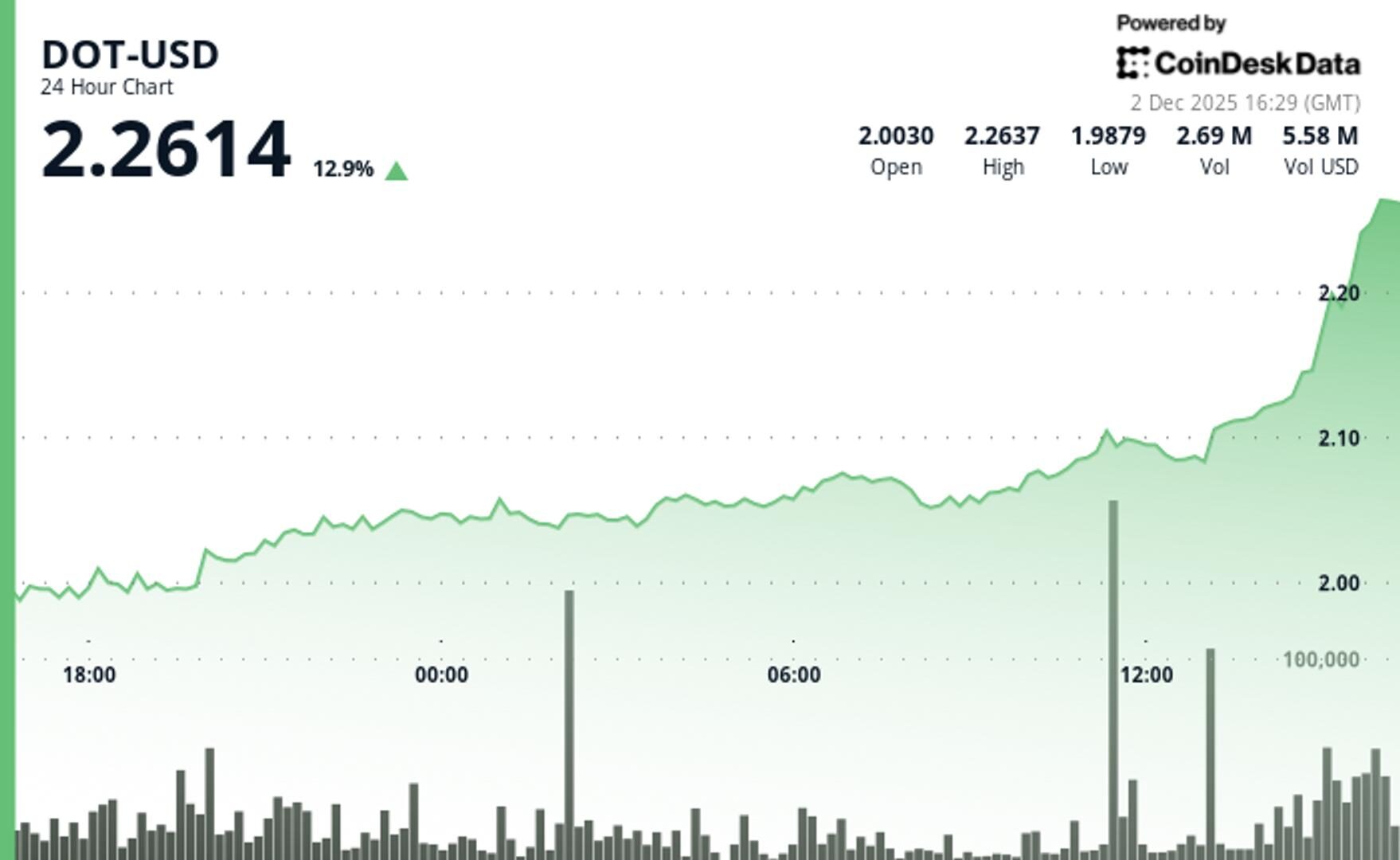

- DOT jumped 13% to $2.25, outperforming the broader crypto market.

- Trading volume spiked 34% above 7-day averages, signaling institutional flows.

- Price cleared $2.15 resistance decisively with momentum targeting $2.30.

DOT$2.2620 rallied 13% to $2.26 over the last 24 hours as volume surged.

The token opened at $1.99 and carved a steady uptrend throughout the 24-hour period, establishing clear technical dominance over broader cryptocurrency markets, according to CoinDesk Research’s technical analysis model.

STORY CONTINUES BELOW

Volume patterns confirmed genuine institutional interest rather than retail speculation, the model said. DOT’s 24-hour trading activity exceeded weekly averages by 34%.

The broader market index, the CoinDesk 20 index, rose 9% in the same time period. DOT’s outperformance suggests asset-specific drivers dominated price action.

Recent price action shows sustained bullish momentum, according to the model. DOT extended gains from $2.141 to $2.245 in the latest hour, posting a 4.9% advance beyond initial breakout levels.

The rally carved higher lows at $2.186 and $2.193 before accelerating through the $2.220 resistance on exceptional volume, exceeding 200K, in a concentrated three-minute window.

Technical Analysis:

- Primary support holds at $2.05 with former $2.15 resistance now acting as support; next target at $2.30 psychological level

- Breakout volume of 6.43M exceeded 24-hour SMA by 195%, confirming institutional backing for the advance

- Ascending trend with higher highs and lows; successful breakout from $2.00-$2.15 consolidation range

- Immediate target at $2.30; stop below $2.05 support maintains favorable 3:1 reward-to-risk profile

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By James Van Straten, AI Boost|Edited by Sheldon Reback

37 minutes ago

The company also plans to sell shares to fund the repurchase of existing debt.

What to know:

- Bitcoin minder IREN plans to issue as much as $2.3 billion of new convertible notes.

- It also plans to sell equity to fund buybacks of its 2029 and 2030 notes.

- The shares fell 5% on Tuesday, a move likely driven by delta hedging from banks involved in the transaction.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language