By Shaurya Malwa, CD Analytics

Updated Dec 4, 2025, 4:26 a.m. Published Dec 4, 2025, 4:26 a.m.

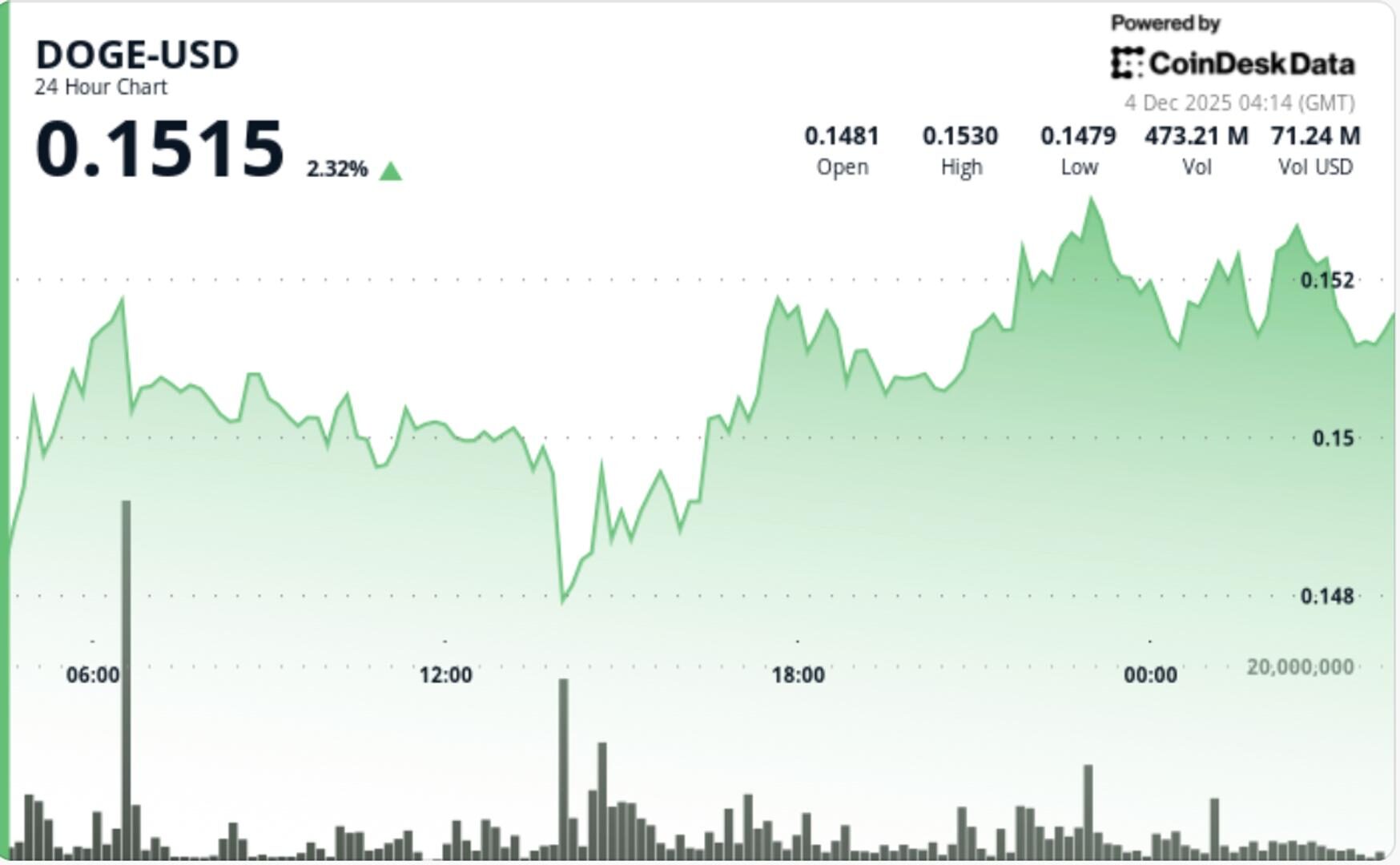

- Dogecoin surged 2.7% as it broke through key resistance with a significant increase in trading volume.

- Retail investors drove the rally, while whale transactions fell to their lowest in two months.

- The $0.1470 level is crucial for maintaining the breakout structure, with $0.1530 as the immediate upside target.

Dogecoin pushed through key resistance with its strongest volume in weeks, signaling retail-driven momentum even as whale activity fell to multi-month lows.

- Dogecoin’s latest move unfolded against a backdrop of modest but steady ETF participation.

- The two newly launched U.S. spot Dogecoin ETFs — Grayscale’s GDOG and Bitwise’s BWOW — recorded $177,250 in net inflows on December 3, bringing cumulative inflows since launch to $2.85 million, according to SoSoValue data.

- While not explosive, the flows indicate early-stage adoption among traditional investors as regulated DOGE products begin to establish a foothold. The broader memecoin market remained subdued, but continued ETF demand provided a small yet notable tailwind as DOGE attempted to reclaim key technical levels.

- DOGE’s structure strengthened notably as price confirmed an ascending channel built across three higher lows at $0.1469, $0.1488, and $0.1512. This pattern reflects sustained accumulation, with volume expanding sharply on every upward leg and contracting during pullbacks—exact behavior traders look for when differentiating true trend shifts from noise.

- The breakout above $0.1505 marked the first resistance clearance since late November. Tuesday’s volume expansion—triple the daily average—reinforced the legitimacy of the move.

- Despite declining whale involvement, the chart shows constructive momentum: upward-sloping support, increasing amplitude on each breakout attempt, and clean reactions to intraday dips.

- Importantly, DOGE maintains structural integrity above the $0.1470 support band. This area now acts as the technical pivot for continuation and defines the lower boundary of the ascending channel.

- On a higher timeframe, the $0.138 region remains the major structural floor aligning with the 0.382 Fibonacci retracement and 200-week moving average—levels that continue to attract long-term buyers.

- DOGE opened with steady accumulation before breaking resistance at $0.1505. The rally accelerated around 14:00 GMT as the volume spike hit 874.7M tokens. Price briefly pulled back to $0.1513 before buyers reasserted control, confirming the new support.

- Intraday action displayed clean bid absorption at each higher low while the upper channel boundary guided rallies toward the $0.1530 region. The session closed inside the upper half of the day’s range, signaling bulls maintained dominance.

• $0.1470 is now the key support level; holding it preserves the breakout structure

• Immediate upside target sits at $0.1530, with $0.1580-$0.1600 as the next resistance band

• Volume confirmation remains essential — a drop back below average may slow continuation

• Retail-driven rallies can accelerate quickly but also fade without institutional reinforcement

• Loss of $0.1470 risks a deeper pullback toward $0.1430 and, in extreme cases, the $0.138 macro support

STORY CONTINUES BELOW

- Market structure shows early signs of a momentum shift, backed by mixed but improving indicator signals. Analyst Ali Martinez highlighted a fresh “Buy” signal on Dogecoin’s weekly chart using the TD Sequential indicator — a tool designed to identify trend exhaustion and potential reversal points.

- Historically, TD Sequential “Buy” signals on DOGE have preceded sharp multi-week rallies, making the appearance of a new signal notable as the coin tests the upper boundary of its ascending channel.

- However, not all indicators align cleanly. TradingView’s Bull Bear Power tool — which measures the balance between bullish and bearish pressure — flashed a sell signal, suggesting sellers still maintain influence during intraday swings.

- In contrast, the MACD indicator, which tracks momentum through moving-average convergence and divergence, flipped bullish as the MACD line crossed above its signal line, typically interpreted as building upside momentum.

- Together, the mixed indicator profile implies DOGE is in the early stages of a potential trend transition, where bullish momentum is emerging but not yet dominant.

- Traders are watching for confirmation through sustained closes above resistance and rising volume, both of which would validate the TD Sequential signal and negate short-term bearish readings.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

46 minutes ago

BTC’s volatility meltdown offers bullish cues to the spot price.

What to know:

- Bitcoin’s 30-day implied volatility index has sharply contracted, indicating reduced panic and potential for further volatility compression.

- XRP is building a base near $2.20, with underlying strength suggesting continued move higher.

- Ether is advancing with strong buyer control.

- Solana is teasing a breakout.