ICP Inches Higher as Cross-Chain Themes Draw Market Interest

Internet Computer edged higher as broader market consolidation kept price action pinned to key support and resistance levels.

By Jamie Crawley, CD Analytics|Edited by Sheldon Reback

Dec 4, 2025, 4:20 p.m.

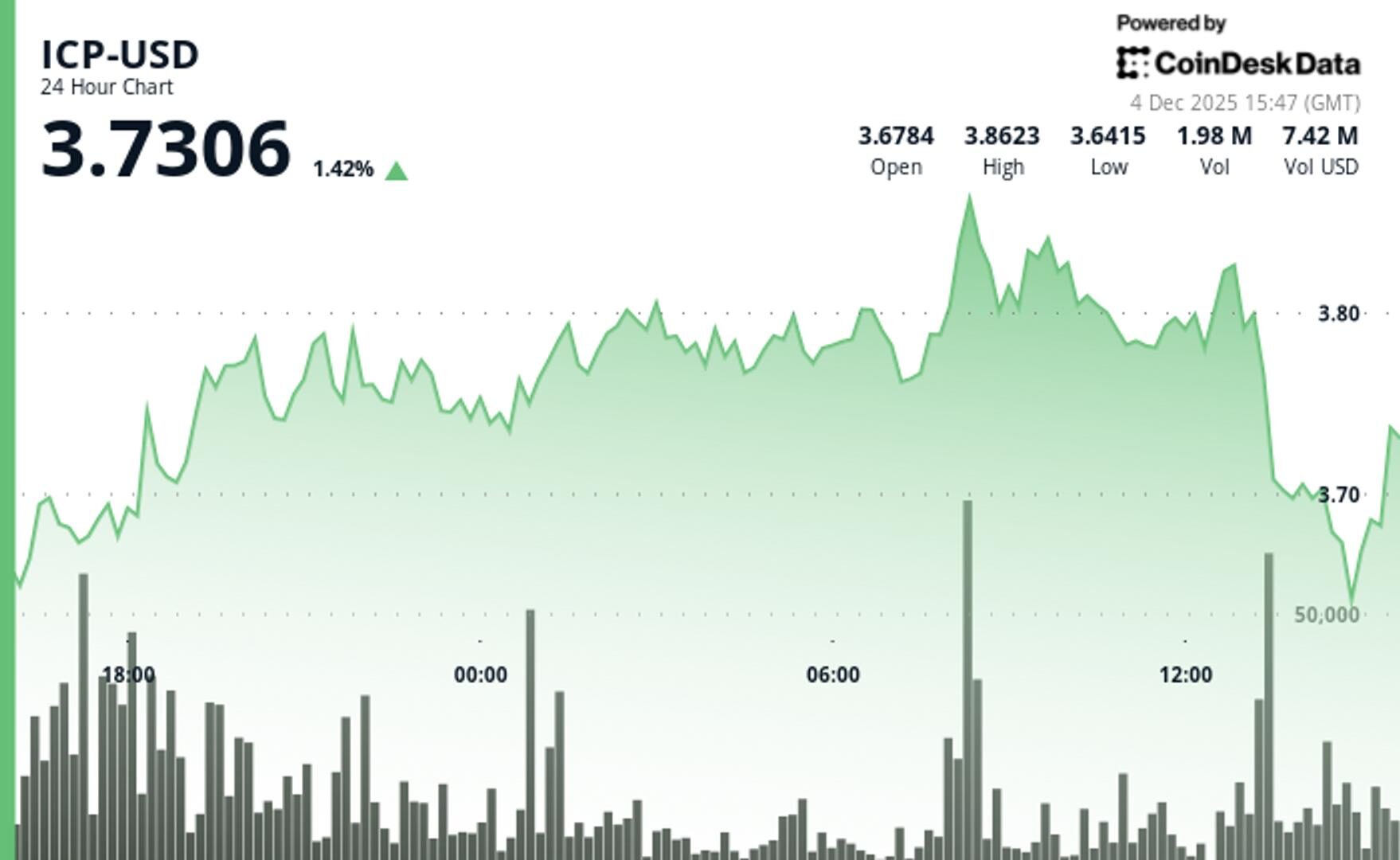

- ICP rose 1.1% to $3.70 and volume surged 124% above average.

- The token failed to sustain momentum through the $3.83 resistance zone.

- The price is constrained inside a descending channel, with $3.69–$3.70 acting as key short-term support.

ICP$3.7195 rose 1.1% in the past 24 hours with volatility dominating price action.

The token traded within a 5.5% intraday range, moving between repeated support tests and brief rallies that failed to overcome near-term resistance. according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

A volume expansion defined early trading. ICP saw 1.96 million tokens change hands during the morning — 124% above the 24-hour average — pushing the price briefly toward $3.87 before momentum stalled at $3.83. As the session progressed, price action shifted into steady retracement, with a 2.6% pullback testing the psychological $3.70 level.

The decline reflects a clear descending channel that has contained price since the morning high. A 244,000-token spike during the 13:39 UTC move lower underscored persistent supply at higher levels. Despite the pressure, ICP held above the $3.69–$3.70 support zone, preserving its short-term structure.

Traders attributed the attention on ICP to cross-chain development narratives across the ecosystem, though immediate market behavior remained technically driven. Positive sentiment around related assets did little to offset the day’s consolidation pattern.

The token now sits in a tight range: Buyers continue to defend $3.69–$3.70, while $3.83 remains the level to watch for any attempt at upside continuation. With volume cooling after the morning spike, a breakout from the current channel will likely require fresh participation.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Helene Braun, AI Boost|Edited by Sheldon Reback

20 minutes ago

Horizon Worlds and Quest are facing layoffs as Meta retreats further from its $70 billion bet on virtual reality, people familiar with the matter told Bloomberg.

What to know:

- Meta is considering cutting up to 30% of its metaverse division’s budget in 2026, with layoffs expected to follow, Bloomberg reported.

- The company’s virtual reality unit, including Quest headsets and Horizon Worlds, is likely to face the steepest reductions.

- Slower-than-expected industry adoption and shifting tech priorities have pushed Meta to scale back its once-flagship investment in the metaverse.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language