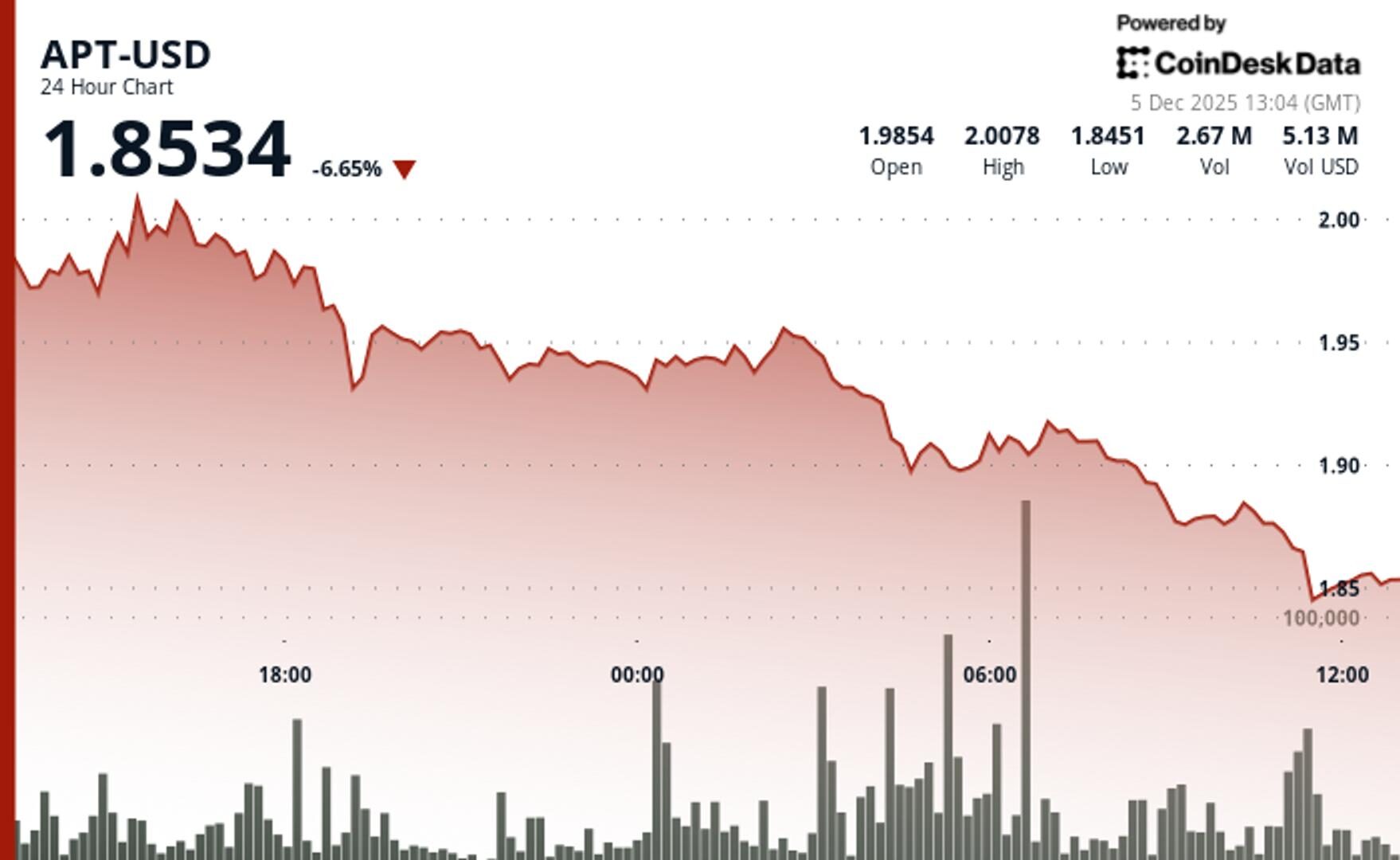

Aptos (APT) Drops 6% to $1.85 as Technical Breakdown Accelerates

By CD Analytics, Will Canny|Edited by Stephen Alpher

Dec 5, 2025, 1:39 p.m.

- APT fell from $1.98 to $1.85, breaking through critical $1.87 support on heavy volume.

- A double-bottom pattern has emerged near $1.84 as buyers step in at key technical level.

APT$1.9078 weakened sharply during Friday’s session, dropping 6% to $1.85 as technical selling overwhelmed buyers.

The token lagged the broader crypto market, with the CoinDesk 20 index down 2.5% at publication time.

STORY CONTINUES BELOW

Trading volume remained subdued at just 10.8% of the 30-day average, suggesting APT’s decline lacks broad participation, according to CoinDesk Research’s technical analysis model.

The model showed that Aptos carved out a $0.17 trading range representing 8.5% volatility as multiple waves of selling pressure established fresh session lows.

Recent price action shows signs of stabilization.

The token formed a potential double-bottom pattern near $1.842, suggesting that institutional buyers have emerged at these depressed levels, according to the model.

This constructive development provides the first technical bright spot after days of persistent weakness, the model said.

Technical Analysis:

- Double-bottom support holds at $1.842 with psychological resistance at $1.90 and breakdown level at $1.87 now acting as overhead supply

- Heavy selling volume of 3.54 million confirms breakdown legitimacy while subsequent light volume suggests reduced selling pressure

- Descending trendline break completes $0.17 range decline with double-bottom formation indicating potential floor

- Immediate resistance targets $1.87 former support with downside exposure to $1.80 if double-bottom fails

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By James Van Straten|Edited by Stephen Alpher

18 minutes ago

The company’s senior preferred stock has rebounded 20% from November lows, with investors apparently favoring that over the more junior issues.

What to know:

- The credit spread between senior STRF and junior STRD hit a record 1.5 in late November, signaling strong investor preference for senior exposure before normalizing to a 1.3 spread.

- STRF’s premium price reflects strong demand for senior protections even as its effective yield, at 9.03%, is now the lowest among Strategy’s preferred offerings.

- Strategy’s stock has recovered from its December low of $155 to about $185, reinforcing improving sentiment across the company’s capital structure.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language