TON Slides as Yearly Losses Near 72%, but Potential Reversal Signs Emerge

The token’s price found support at $1.6025, which held firm despite initial selling pressure, and has since shown signs of a potential reversal.

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

Dec 9, 2025, 2:49 p.m.

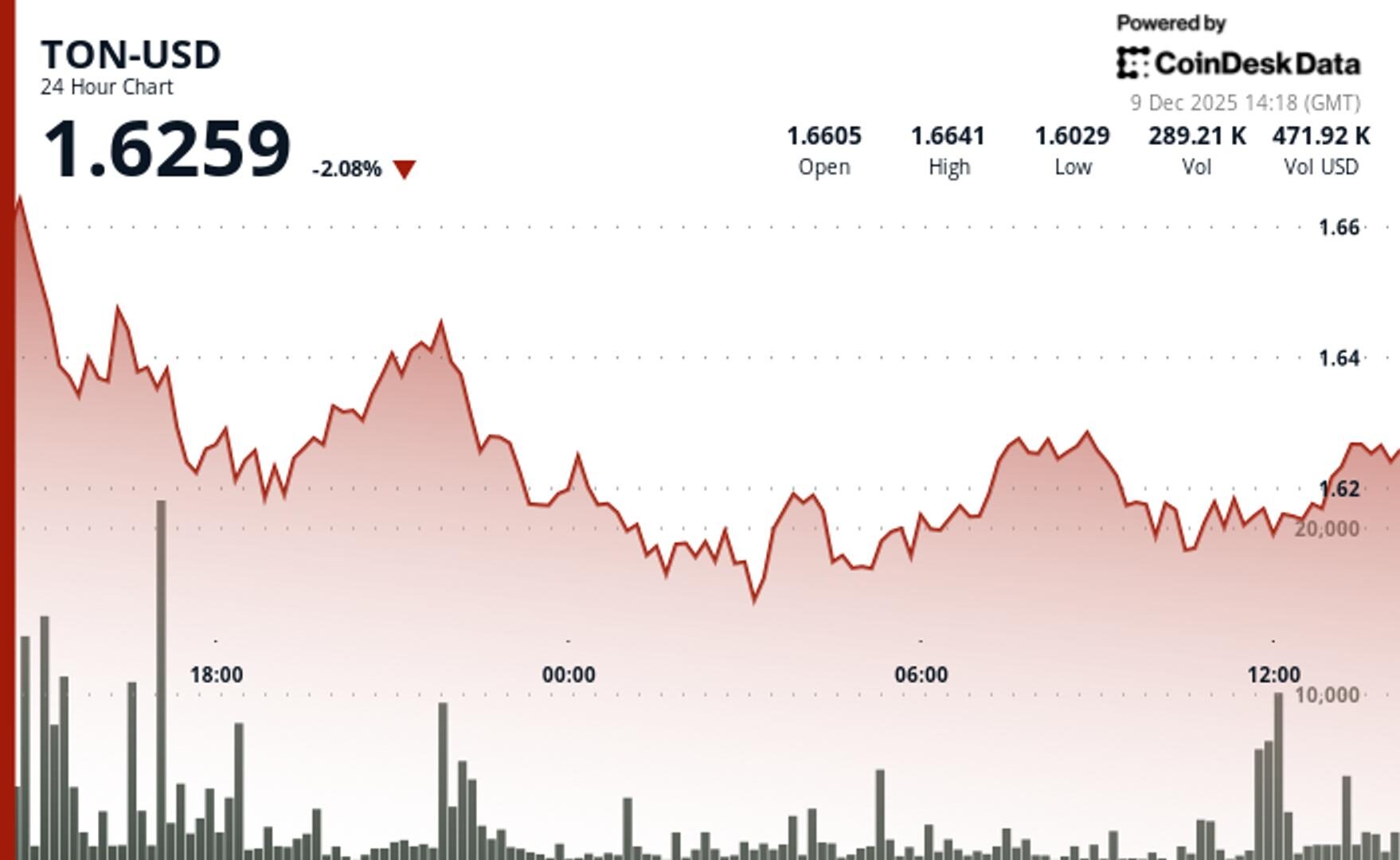

- Toncoin (TON) fell 2% to $1.625, extending decline to 72% over the past 12 months.

- The token’s price found support at $1.6025, which held firm despite initial selling pressure, and has since shown signs of a potential reversal with rising volume and an ascending pattern.

- TON’s price is now at a technical crossroads, with a push past $1.635 potentially confirming a trend reversal, while a drop below $1.602 could reopen downside risk.

TON$1.6335 lost ground over the past 24 hours, sliding more than2% to $1.625 as selling pressure drove the token down to now post a near 72% decline over the past 12 months.

The move came amid a failed breakout near $1.668, with the downturn carving out a clear downtrend pattern of lower highs and lows across a narrow range.

STORY CONTINUES BELOW

Trading volume during the selloff spiked to 3.02 million TON, a 43% increase above the daily average, according to CoinDesk Research’s technical analysis data model. That surge in activitycoincided with a breakdown below key support levels, further dampening sentiment.

However, TON’s price action found a floor at $1.6025. Multiple retests of that support held firm while volume tapered off, indicating that aggressive selling had cooled.

More notably, the last few hours of trading saw a potential shift in momentum. Price climbed back above $1.620 on rising volume, forming an ascending pattern of higher lows that often points to systematic buying.

TON now sits at a technical crossroads. A push past $1.635 could confirm the reversal, while a drop below $1.602 would reopen downside risk. Traders watching the $1.620 pivot will likely treat it as a deciding level for whether this bounce becomes a broader trend change.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Shaurya Malwa|Edited by Omkar Godbole

1 hour ago

Early PeerDAS performance is proof that the Ethereum Foundation can now ship complex networking improvements at scale.

What to know:

- Ethereum co-founder Vitalik Buterin said that the network is addressing its lack of peer-to-peer networking expertise, highlighting the progress of PeerDAS.

- PeerDAS, a prototype for Data Availability Sampling, is crucial for Ethereum’s scalability and decentralization through sharding.

- BitMine Immersion Technologies has significantly increased its Ethereum holdings, viewing it as a strategic investment in the network’s future scaling capabilities.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language