BONK Slides Toward Lower Range as Volatility Expands

The Solana-based memecoin drifted back toward recent lows after failing to hold higher levels during a high-volume session.

By Jamie Crawley, CD Analytics

Updated Dec 15, 2025, 3:48 p.m. Published Dec 15, 2025, 3:41 p.m.

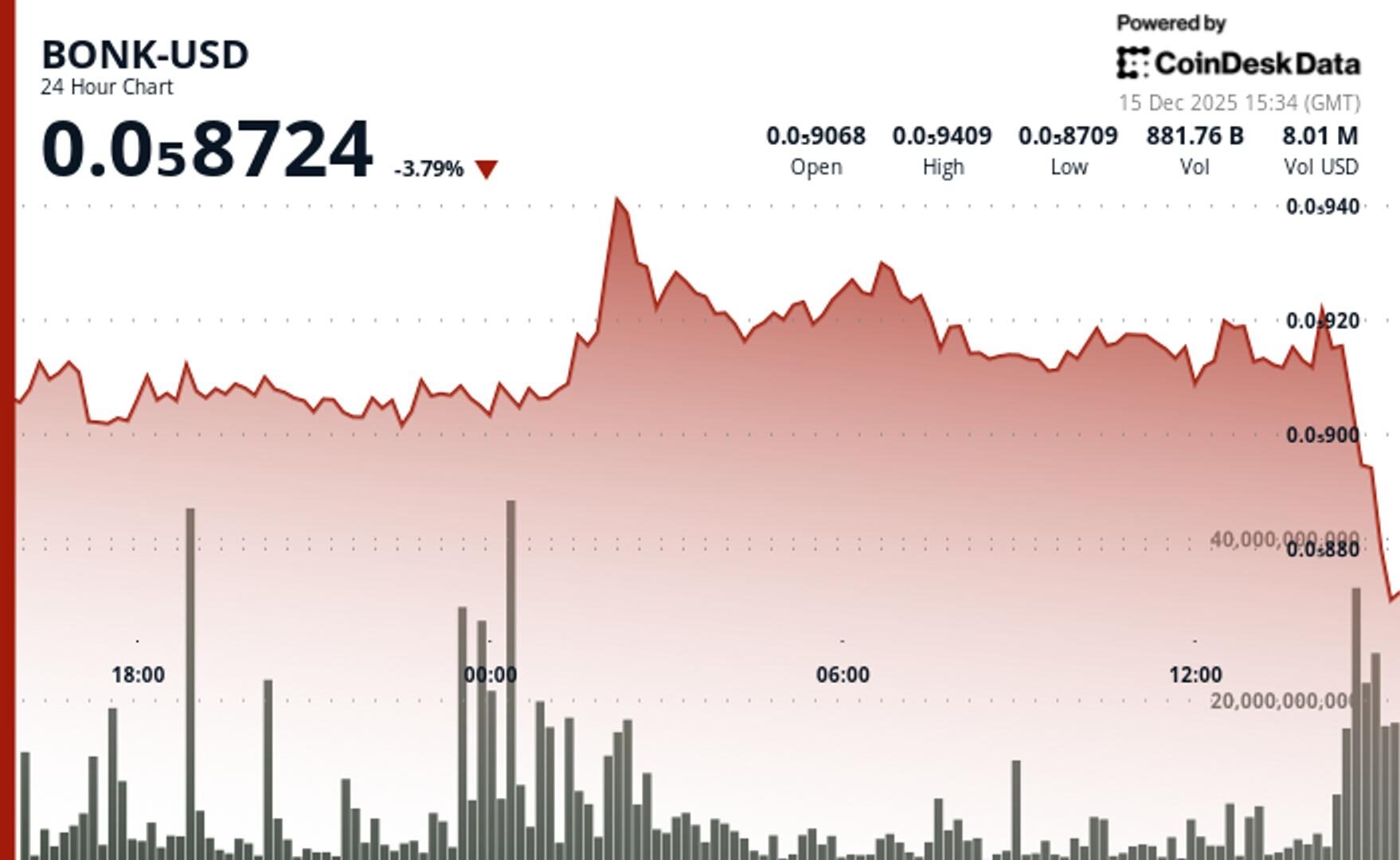

- BONK traded down to around $0.0000087 after rejecting higher intraday levels.

- Volume expanded sharply during the move, highlighting activity around resistance.

- Price remains pinned near the lower end of its recent range.

BONK traded lower over the past 24 hours, slipping to approximately $0.0000087 as earlier attempts to hold higher levels faded.

The token moved through a wide intraday range before settling near recent lows, reflecting heightened volatility rather than directional follow-through, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Activity intensified as volume expanded well above recent averages while BONK approached short-term resistance near the $0.0000090 area. Price failed to maintain traction above that zone, and the subsequent pullback carried the token back toward the lower boundary of its established range.

BONK subsequently stabilized near $0.0000086–$0.0000088, a zone that has repeatedly acted as a short-term reference point in recent sessions. While price compression emerged into the close, the broader structure remained unchanged, with the token still trading below prior support levels that now cap upside attempts.

From a technical standpoint, BONK continues to oscillate within a defined range, with elevated volume underscoring sensitivity around nearby resistance. Until price reclaims levels above $0.0000090, movement remains consistent with consolidation near the lower end of the range rather than a confirmed shift in trend.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Francisco Rodrigues, AI Boost|Edited by Nikhilesh De

16 minutes ago

These are CME’s smallest crypto contracts to date, aimed at active participants who prefer to trade in spot market terms without managing contract expiries or rollovers.

What to know:

- CME Group has launched Spot-Quoted futures for XRP (XRP) and Solana (SOL), allowing for trading closer to real-time market prices.

- These are CME’s smallest crypto contracts to date, aimed at active participants who prefer to trade in spot market terms without managing contract expiries or rollovers.

- The launch also includes Trading at Settlement (TAS) for XRP, SOL and Micro futures, enabling traders to manage risk around crypto ETFs with added flexibility.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language