BTC Long term holder supply hits 8 month low as this cycle breaks from historical patterns

Repeated distribution waves from long-term holders highlight how this bitcoin cycle is breaking from historical norms.

By James Van Straten|Edited by Oliver Knight

Updated Dec 17, 2025, 11:18 a.m. Published Dec 17, 2025, 11:12 a.m.

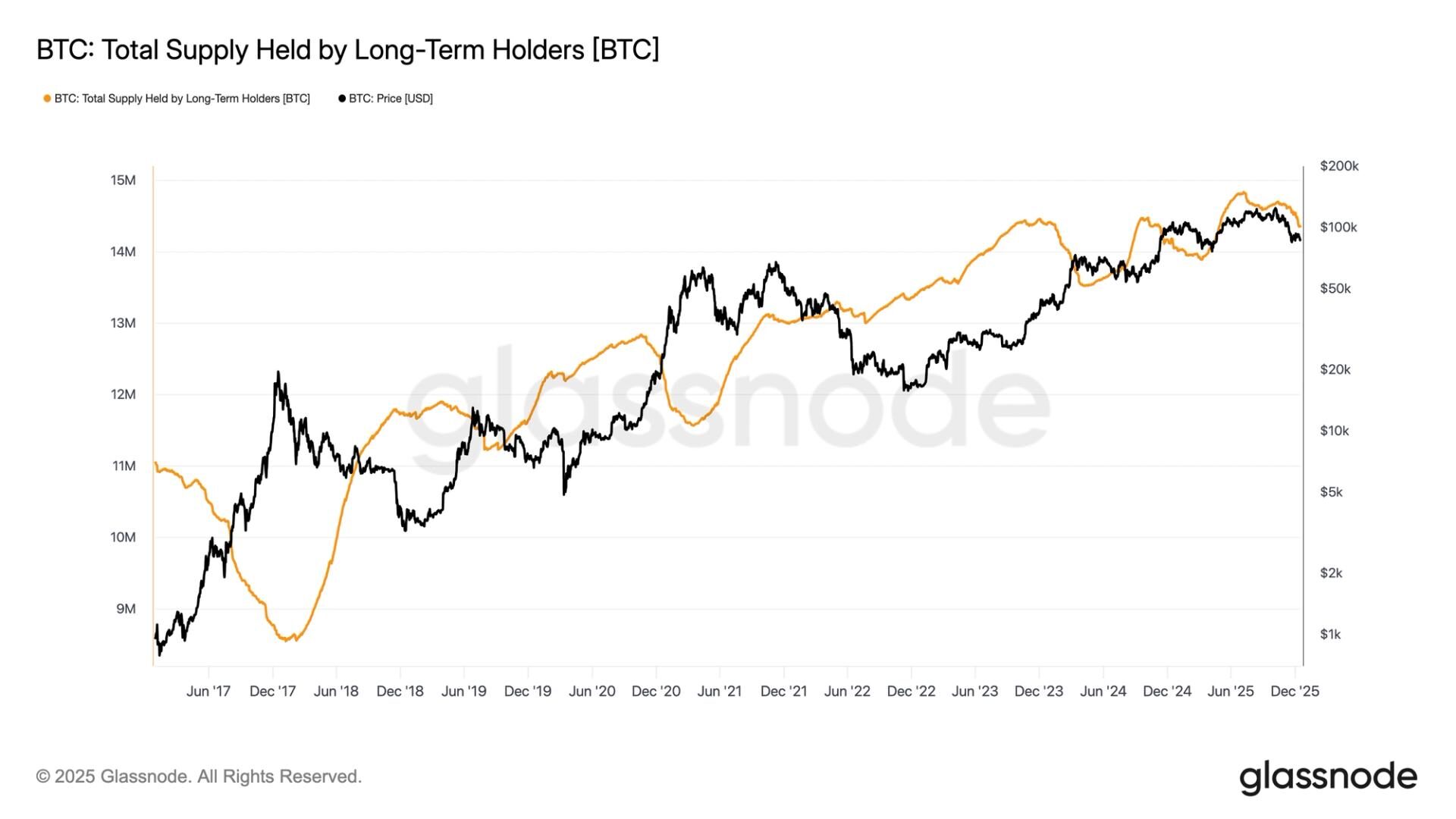

- Bitcoin long-term holder supply has fallen to 14.34 million BTC, its lowest level since May, marking the third wave of long term holder selling this cycle after earlier distribution around ETF approvals and the move to $100,000 after President Trump’s election win.

- Unlike prior bull markets that saw a single blow off distribution phase, this cycle is characterized by multiple LTH sell waves that have been absorbed by the market.

Bitcoin BTC$87.018,43 long term holder (LTH), supply has fallen to an eight month low of 14,342,207 BTC, a level last seen in May, which has coincided with bitcoin falling almost 40% from its October all-time high.

Glassnode defines a long term holder as an entity that has held bitcoin for at least 155 days, placing the current cohort cutoff around mid July, so any buyer then and has held would be classified as a LTH.

STORY CONTINUES BELOW

This decline marks the third distinct wave of LTH distribution in the current cycle since early 2023.

The first wave occurred from late 2023 into early 2024 following the launch of U.S. spot bitcoin ETFs, when LTH’s sold into strength as bitcoin rallied from roughly $25,000 to a peak near $73,000 by March 2024.

The second wave emerged later in the year when bitcoin ran towards $100,000, driven by optimism surrounding President Trump’s election victory. The market is now experiencing a third iteration of LTH selling as bitcoin remained above $100,000 for much of the year.

This behavior stands in contrast to prior bull markets in 2013, 2017, and 2021, where LTH supply typically followed a single boom and bust pattern, bottoming near euphoric cycle peaks before gradually recovering.

Instead, this cycle has seen repeated waves of distribution without a clear blow off top, a dynamic highlighted by Alec, co-founder of Checkonchain, who noted that bitcoin LTH spending this cycle is unlike anything seen in recent history, with the market absorbing a third sell wave remarkably well.

LTH distribution remains one of the largest sources of sell side pressure in bitcoin and has been a key contributor to the nearly 40% correction from October’s all-time high.

Lebih untuk Anda

Oleh CoinDesk Research

14 Nov 2025

Yang perlu diketahui:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

Lebih untuk Anda

Oleh Shaurya Malwa|Diedit oleh Oliver Knight

8 menit yang lalu

SBI Digital Markets, a unit regulated by Singapore’s Monetary Authority, has been appointed as the institutional custodian, offering segregated custody for client assets.

Yang perlu diketahui:

- SBI Ripple Asia has partnered with Doppler Finance to explore XRP-based yield products and asset tokenization on the XRP Ledger.

- The collaboration aims to build institutional-grade yield infrastructure and expand the use of tokenized real-world assets.

- SBI Digital Markets will serve as the institutional custodian, providing segregated custody for client assets.

-

Kembali ke menu

-

Kembali ke menu

Harga

-

Kembali ke menu

-

Kembali ke menu

Indeks -

Kembali ke menu

Riset

-

Kembali ke menu

Consensus 2026 -

Kembali ke menu

Bersponsor

-

Kembali ke menu

-

Kembali ke menu

-

Kembali ke menu

-

Kembali ke menu

Webinar

Pilih Bahasa