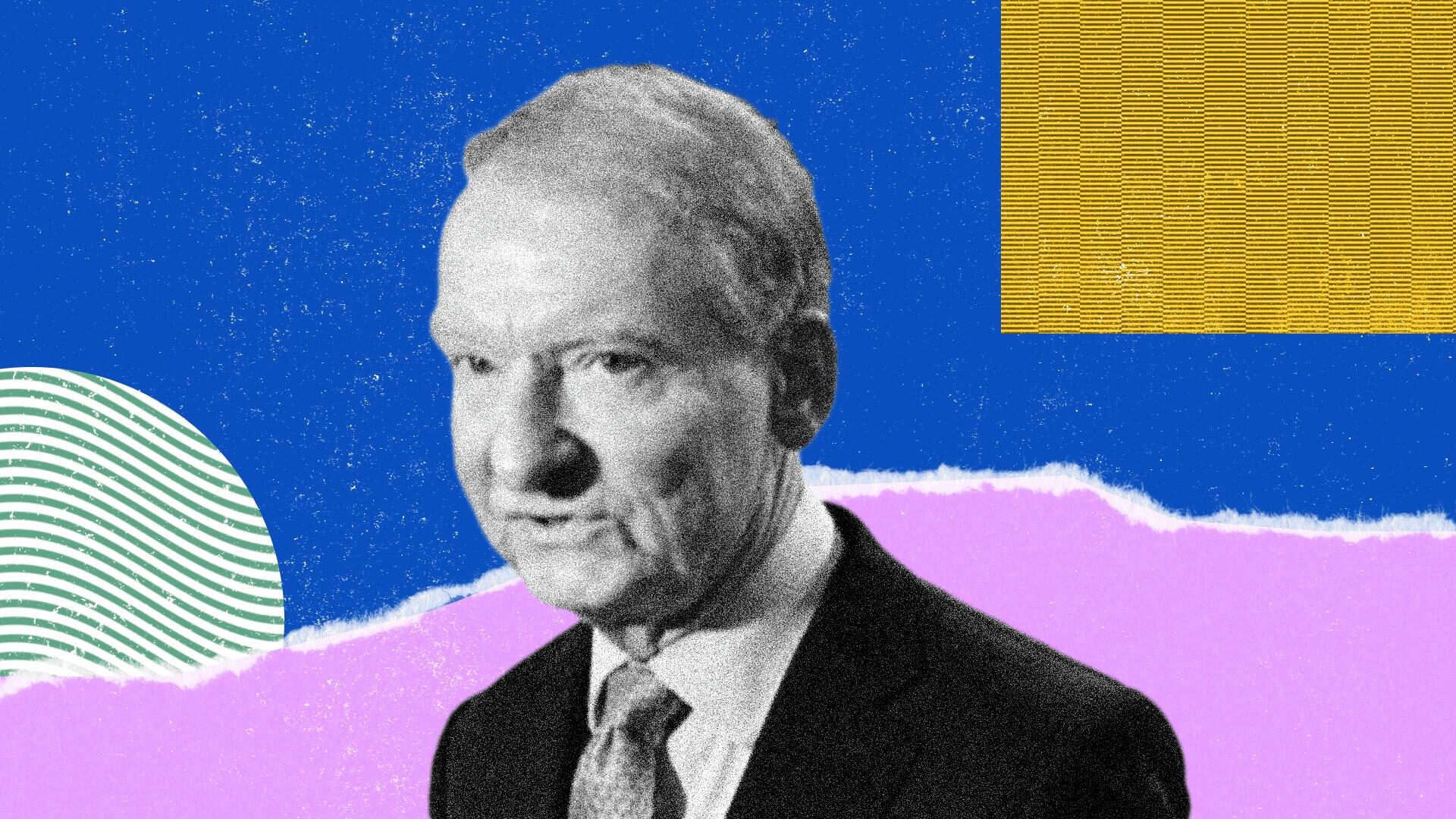

Most Influential: Paul Atkins

Under Atkins’ leadership, the U.S. Securities and Exchange Commission (SEC) has undergone a near-complete reversal of the way it regulates crypto.

By Nikhilesh De|Edited by Cheyenne Ligon

Dec 17, 2025, 3:00 p.m.

Paul S. Atkins leads one of the most consequential financial regulators in Washington, dominating the discourse around crypto and joining his immediate predecessor, Acting Chairman and current Commissioner Mark Uyeda, in dismantling much of former Chair Gary Gensler’s work around crypto.

This feature is a part of CoinDesk’s Most Influential 2025 list.

STORY CONTINUES BELOW

Having been sworn in on April 21 as the 34th chair of the U.S. Securities and Exchange Commission (SEC) following nomination by President Donald J. Trump on Jan. 20 and confirmation by the Senate on April 9, he returned to an agency he served as commissioner from 2002 to 2008 during George W. Bush’s administration with a brief to rewrite how Washington deals with digital assets.

In a May 12 keynote address at the Crypto Task Force Roundtable on Tokenization, Atkins said, “the migration to on-chain securities has the potential to remodel aspects of the securities market by enabling entirely new methods of issuing, trading, owning, and using securities.”

It’s a common refrain for the longtime businessman, who has praised digital assets repeatedly and called for the U.S. government to facilitate the sector’s growth during his time in office.

Atkins said that one of his key priorities would be “to develop a rational regulatory framework for crypto asset markets that establishes clear rules of the road for the issuance, custody, and trading of crypto assets while continuing to discourage bad actors from violating the law,” in that May 12 speech. He also pledged that policymaking would “no longer result from ad hoc enforcement actions.”

Under Atkins’ watch, the SEC continued to drop investigations and lawsuits against crypto companies, a practice begun under Uyeda. The SEC also continues to publish staff statements addressing various aspects of the crypto sector, including tokenization, stablecoins and what sorts of disclosures the SEC would like to see from crypto companies that might be engaged in securities work. Though not binding guidance, they nevertheless set a new tone for how the SEC would engage with crypto.

Paul Atkins will be speaking at CoinDesk’s upcoming Consensus 2026 in Miami in May.

Atkins said in a speech on July 31 that he had asked the Commission staff to develop clearer guidelines to help projects determine if a crypto asset is a security or not.

Commission staff have also been asked to “propose purpose-fit disclosures, exemptions, and safe harbors, including for so-called ‘initial coin offerings,’ ‘airdrops,’ and network rewards,” he said. And finally, he wants the Commission to engage with firms wishing to distribute tokenized securities within the U.S. to prevent such projects from being forced to go offshore.

He told reporters in December that the agency was looking for any and all input from the industry as well when discussing a new token taxonomy.

“We’re looking at everything, and we’re not in a hermetically sealed environment. We … want, need input,” he said. “And so that means we’re looking at things that have gone before, that private sector has come up with, that other government agencies have done. And so we need to consider all that input.”

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Jesse Hamilton|Edited by Cheyenne Ligon

53 minutes ago

As an acting chairman at the Commodity Futures Trading Commission, Caroline Pham pulled no punches in pursuing crypto-friendly policy aims.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language