BNB drops nearly 3% to as bitcoin whipsaw and tech selloff hit crypto market

The decline was accompanied by sharp volatility in bitcoin and weakness in U.S. tech stocks, suggesting a return of risk-off sentiment.

By CD Analytics, Francisco Rodrigues|Edited by Stephen Alpher

Dec 17, 2025, 5:20 p.m.

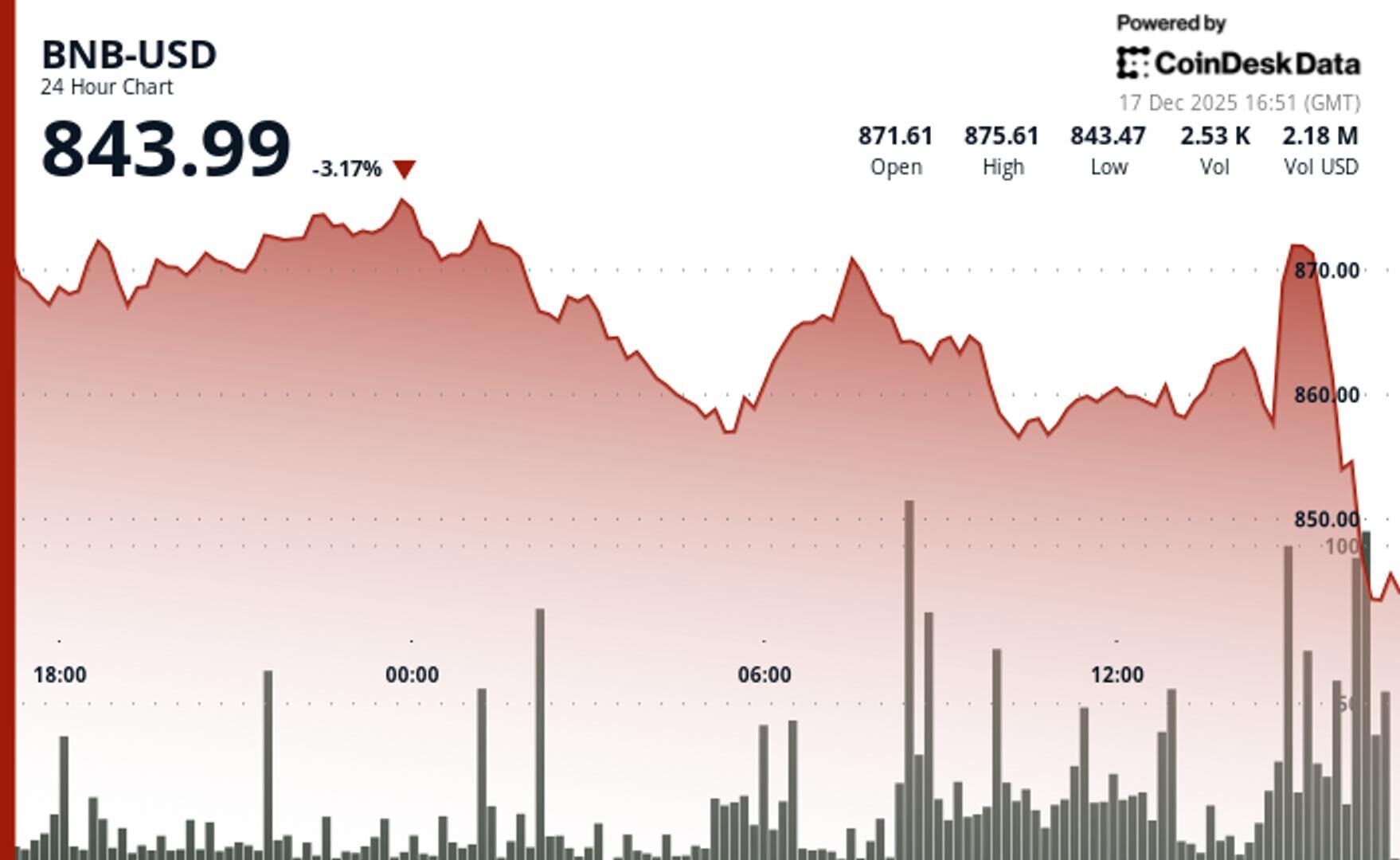

- BNB fell nearly 3% to around $844 over the past 24 hours, breaking below the $855-$857 support area and experiencing heavy selling pressure.

- The decline was accompanied by sharp volatility in bitcoin and weakness in U.S. tech stocks.

- To avoid a deeper decline towards $830, BNB needs to hold above $840, while a recovery above $855 would be needed to stabilize the trend and reopen a path towards $870.

BNB slid nearly 3% over the past 24 hours, falling to around $844 as a sharp reversal in bitcoin and renewed weakness in U.S. tech stocks rippled through crypto markets.

The token minutes earlier had risen to $872, but failed to hold gains before selling pressure accelerated, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

The move marked a shift from recent consolidation. After several sessions of defending the $855–$857 area, BNB broke below that support during U.S. trading hours. Prices briefly bounced toward $860, but sellers quickly regained control, pushing the token to session lows near $843.

The decline unfolded alongside heavy volatility in bitcoin, which briefly surged above $90,000 before tumbling back below $86,600. Losses in artificial intelligence-linked stocks such as Nvidia and Broadcom dragged the Nasdaq lower, reinforcing risk-off sentiment across risk assets.

Volume on BNB surged during the breakdown, with several large spikes appearing as prices slipped through support. The pattern suggests forced selling or stop-loss triggers rather than the orderly pullbacks seen earlier in the week.

On short-term charts, BNB’s structure deteriorated as the break below $855 ended the prior consolidation range. That level now acts as near-term resistance.

Holding above $840 will be critical to avoid a deeper move toward $830. A recovery back above $855 would be needed to stabilize the trend and reopen a path toward $870.

BNB’s slide mirrors the broader tone in crypto markets, where shrinking liquidity has amplified price swings. For traders, the latest move underscores how quickly conditions can shift when macro pressure collides with thin year-end trading.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By CD Analytics, Will Canny|Edited by Stephen Alpher

17 minutes ago

The token has resistance at the $1.53 and then the $1.64 levels.

What to know:

- APT fell from $1.59 to $1.51 over the 24-hour period.

- Volume jumped 23% above the 30-day moving average, signaling institutional participation.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language