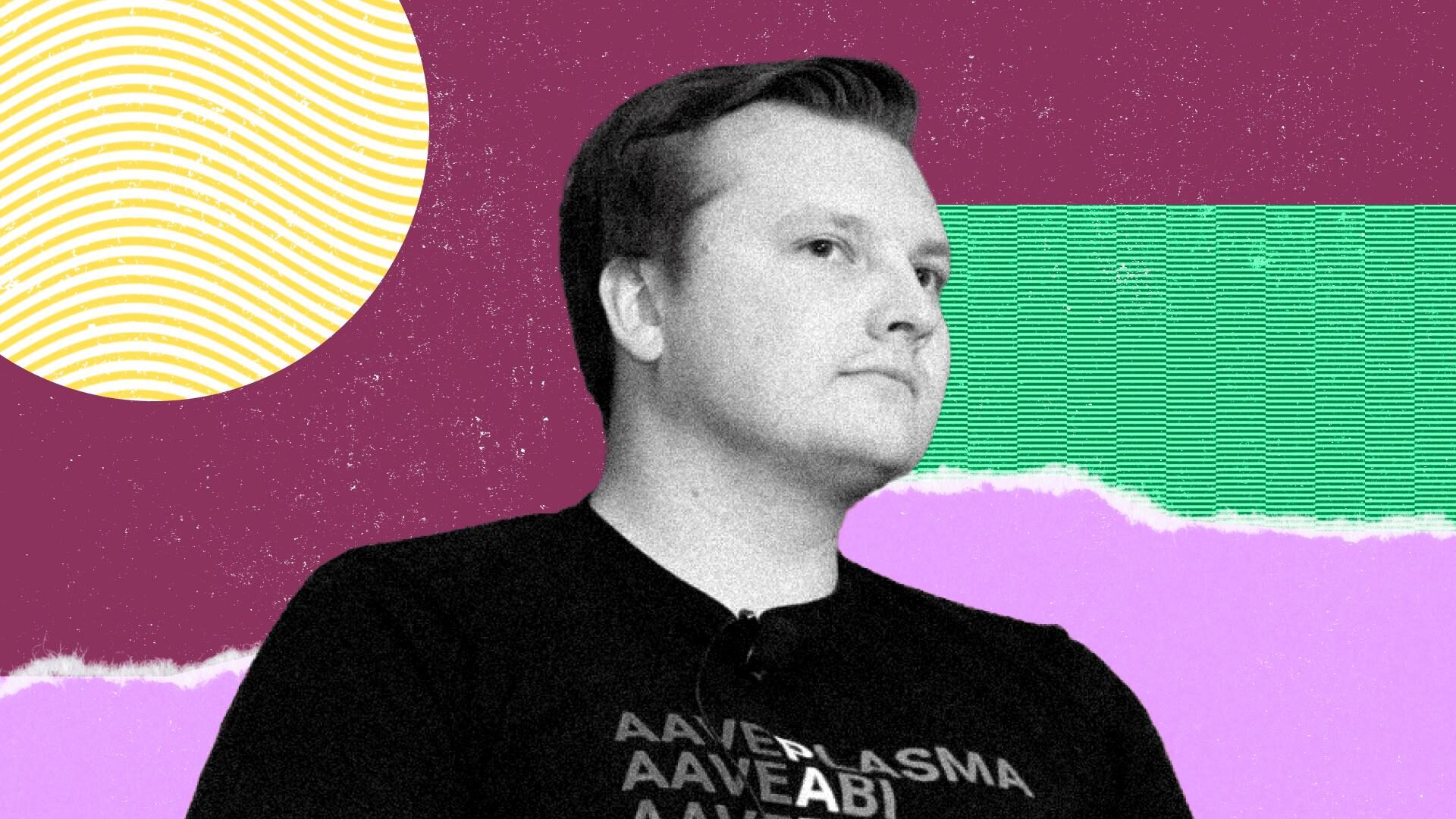

Most Influential: Stani Kulechov

By Krisztian Sandor|Edited by Cheyenne Ligon

Dec 19, 2025, 3:00 p.m.

Aave isn’t just big for DeFi. It’s the largest lending protocol in the sector by a mile, with more than $50 billion in assets deposited across its markets. That’s a balance sheet that would slot it roughly into the ranks of the top 50 U.S. banks by assets if it were a traditional institution.

STORY CONTINUES BELOW

Stani Kulechov, founder of Aave and developer Aave Labs, has a straightforward version of what he’s building: “Aave will be the backbone of all credit,” he said. Not just leverage for crypto traders, but mortgages, credit cards, consumer and business loans, even sovereign debt — with DeFi running quietly in the background.

The path there runs on two rails. On the consumer side, the upcoming Aave App, now listed on Apple’s App Store, aims to become a savings account for average investors. Users see an interface closer to a neobank; under the hood, deposits are funneled into Aave’s onchain lending markets — a textbook “DeFi mullet” play where a familiar, Web2 front end masks the complex blockchain and DeFi engine in the back end.

Then, there’s the institutional side and the booming tokenized real-world asset space. Aave’s Horizon, which debuted this August, is offering regulated players a marketplace to borrow stablecoins on their tokenized assets 24/7 while staying inside compliance lines. It has grown into a roughly $600 million pool despite the past months’ crypto headwinds.

As the world is migrating onchain and traditional financial rails and blockchain rails are becoming increasingly intertwined, Aave is positioned to sit close to the center of that flow.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Margaux Nijkerk|Edited by Cheyenne Ligon

23 minutes ago

The Ethereum Foundation’s new leaders hope to bring in a new era for the second-largest cryptocurrency.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language