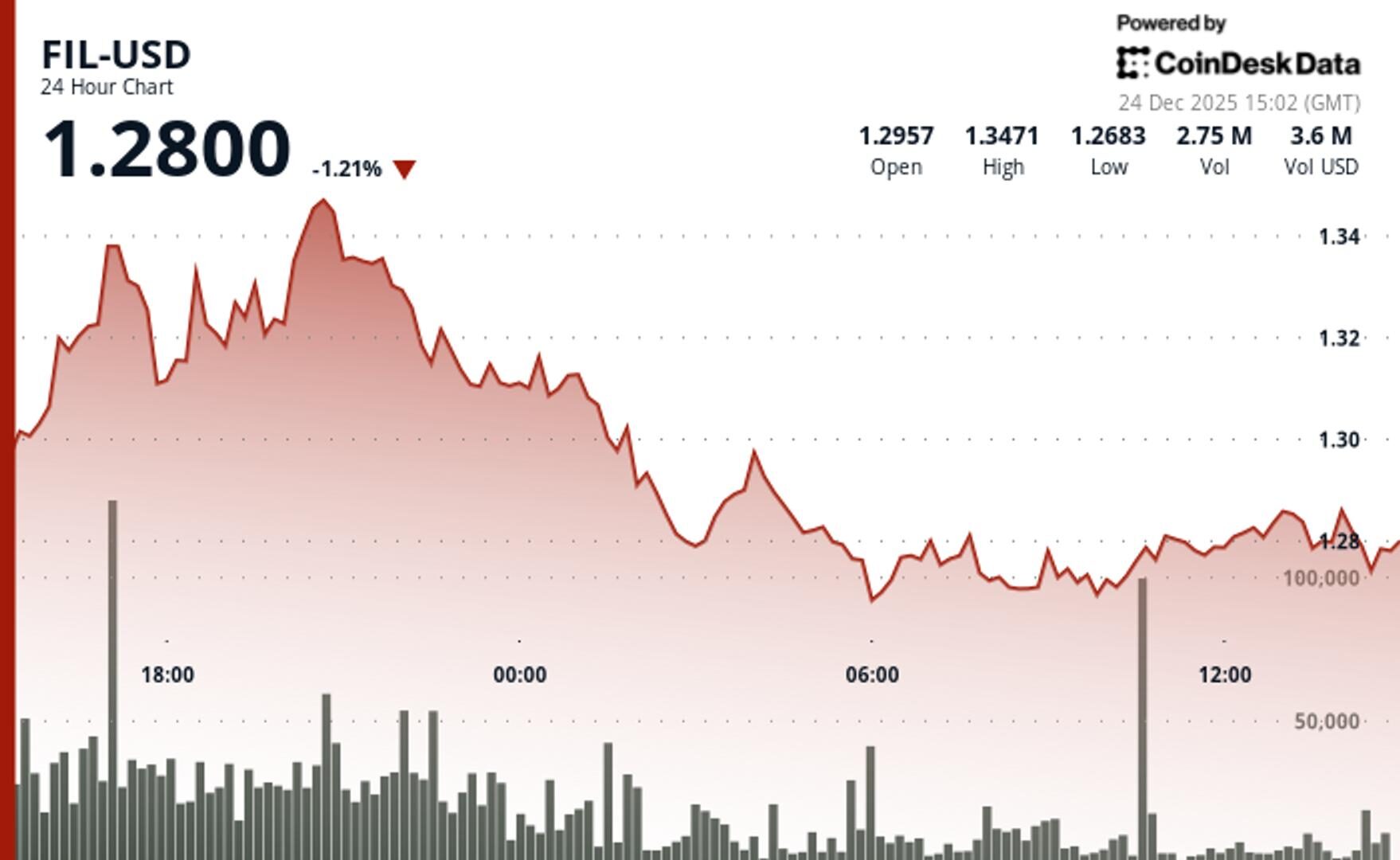

Filecoin (FIL) drops 2% as crypto markets weaken

Technical factors dominated as FIL maintained a tight correlation with broader crypto sentiment while establishing support above $1.27.

By Will Canny, CD Analytics|Edited by Aoyon Ashraf

Updated Dec 24, 2025, 3:53 p.m. Published Dec 24, 2025, 3:36 p.m.

- FIL slipped 2% in early trading hours on Wednesday.

- Trading volume rose 7% above weekly average on moderate activity.

- Price consolidated within a $0.09 range after testing $1.35 resistance.

Filecoin FIL$1.2776 slipped 2% to $1.28 during Tuesday’s session, tracking broader crypto market flows rather than responding to token-specific catalysts.

The token’s price action remains closely tied to the crypto market sentiment, according to CoinDesk Research’s technical analysis model. This tight correlation indicates large order flows are driving the price moves rather than fundamentals for Filecoin, according to the model.

STORY CONTINUES BELOW

The broader crypto market gauge, the CoinDesk 20 index, was 0.6% lower at the time of publication.

Trading volumes for Filecoin reinforce the consolidation theme, with 24-hour activity 7.3% above weekly averages signaling measured participation, the model said.

The model also showed that volume patterns support range-bound trading as participation falls short of breakout thresholds. The measured uptick suggests accumulation rather than aggressive positioning that typically precedes major directional moves.

- Primary support holds at $1.27, while resistance stays firm at $1.35 from volume-driven peaks.

- 24-hour activity 7% above the weekly average shows steady participation by large holders, with an 85% volume surge during $1.35 test, confirming key resistance.

- The formation of higher lows, from $1.266 to $1.276, within a $0.087 range, indicates an accumulation phase.

- The immediate upside target sits in the $1.285-$1.290 zone, based on range extension, with broader resistance at $1.35 requiring a volume surge to be breached.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Dec 19, 2025

L1 tokens broadly underperformed in 2025 despite a backdrop of regulatory and institutional wins. Explore the key trends defining ten major blockchains below.

What to know:

2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

More For You

By Will Canny, AI Boost|Edited by Stephen Alpher

1 hour ago

The analyst team said the first long-term co-location agreement at NC-1 validates WhiteFiber’s retrofit model.

What to know:

- B. Riley said WhiteFiber’s NC-1 Nscale deal backs the company’s timeline and execution.

- Lender talks for a construction facility are advanced, with potential credit enhancements.

- The bank’s analysts reiterated their buy rating on the stock while trimming their price target to $40 from $44 following the stock’s more than 50% decline from record highs.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language