This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 1,857.87 +0.73%

Bitcoin (BTC): $59.022 +0.84%

Ether (ETH): $2,506 −0.53%

S&P 500: 5,648.40 +1%

Gold: $2495.38 −0.07%

Nikkei 225: 38,686.31 −0.04%

Bitcoin rose above $59,000, though the rally was pared by suggestions of further interest-rate increases in Japan. Still, BTC remains 1% higher in the last 24 hours while the broader crypto market has risen around 0.9%, according to the CoinDesk20 Index. A slew of U.S. economic data is due this week, kicking off with the Institute of Supply Management’s manufacturing purchasing managers’ index for August later on Tuesday. A weak reading will strengthen the case for the Fed to cut interest rates, which would be expected to boost riskier assets like crypto.

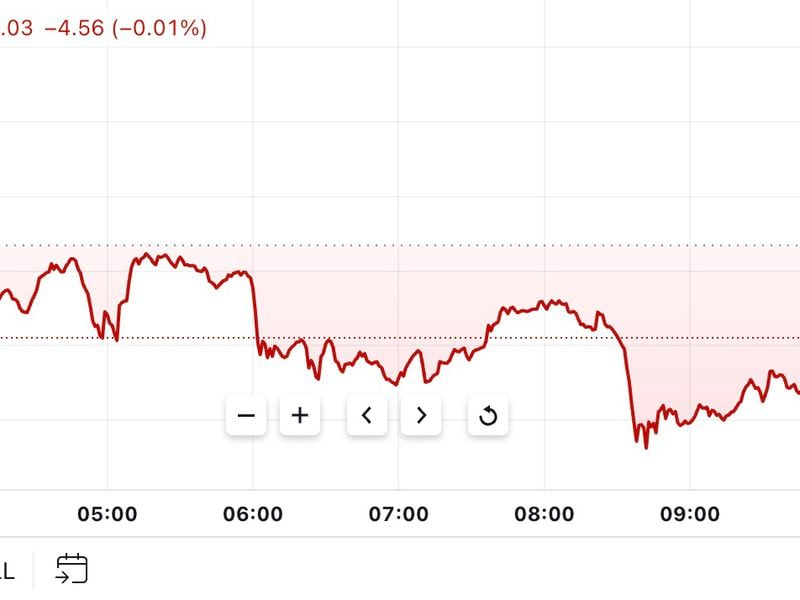

Bank of Japan Governor Kazuo Ueda reiterated that the central bank will raise interest rates further if the economy and inflation develop as expected. Ueda said the economic environment remains accommodative, with inflation-adjusted interest rates negative even after a late July increase in the benchmark borrowing cost. That was the first in decades and triggered an unwinding of yen carry trades, destabilizing risk assets. Ueda’s comments drew bids for the yen, pushing the USD/JPY pair to 145.85 from 147. Futures tied to the S&P 500 slipped by 0.5% and bitcoin by 0.4% to $58,920, according to CoinDesk data. The BOJ’s plan to tighten monetary policy poses a challenge for risk assets because the U.S. Federal Reserve is likely to start cutting rates in September.

Japanese investment adviser Metaplanet, which adopted bitcoin as a reserve asset earlier this year, tapped SBI VC Trade to provide custody services. Crypto exchange SBI VC Trade, a unit of Tokyo-based SBI Holdings, offers the potential to use BTC as collateral for financing, Metaplanet said on Monday. In May, Metaplanet said it was adopting bitcoin as a reserve asset to hedge against the volatility of the yen. As of Aug. 20, it held 360.4 BTC ($21 million). The reserve-asset strategy mimics software developer MicroStrategy, which has been buying bitcoin since 2020 and now holds over 226,000 BTC, more than 1% of all the bitcoin that will ever exist.

The chart shows weekly open-interest adjusted cumulative volume delta (CVD) in the top 25 cryptocurrencies by market value.

XMR and APT have positive CVDs, a sign of net inflows into the perpetual futures market tied to the two coins.

The remaining cryptocurrencies, including BTC, have faced net selling pressure.

Source: Velo Data

– Omkar Godbole