Crypto investment products lost about $726 million last week, with bitcoin funds registering losses of $643 million, CoinShares said.

Spot bitcoin ETFs in the U.S. extended their losing streak to eight days for the first time since they listed in January, according to Bloomberg.

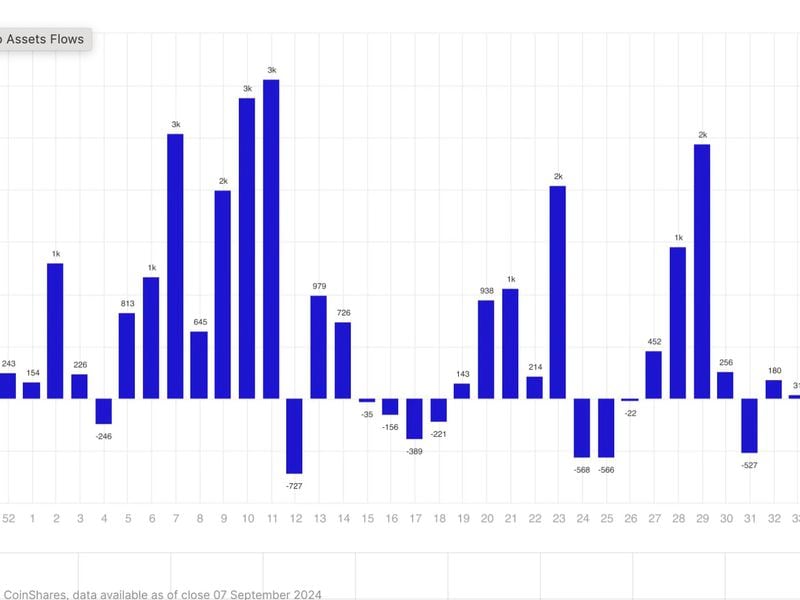

Digital asset investment products suffered their highest net outflows since March last week, losing $725.7 million. Most of the money fled bitcoin (BTC) products as investors withdrew from spot U.S. exchange-traded funds (ETFs) for the largest cryptocurrency for a record eight straight days.

Bitcoin products registered outflows of $643 million, while their ether (ETH) equivalents lost $98 million, according to digital asset manager CoinShares. The outflows were almost entirely concentrated in U.S., with $721 million leaving the market, CoinShares said.

Bitcoin fell more than 8% during the week, closing out Friday at $54,000 having traded around $59,000 on Sept. 2. The period was a busy one for economic data out of the U.S., with all of the readings – including the widely watched nonfarm payrolls report – coming in weak. While that raised the prospects of a 50 basis-point rate cut by the Fed this month, it did little to stir bitcoin bulls.

Spot bitcoin ETFs in the U.S. experienced net outflows every day, part of an eight-day losing streak. That’s the first time this has occurred since the funds started trading in January, according to Bloomberg.

This week, traders will be eyeing the U.S. release of August’s Consumer Price Index (CPI) on Wednesday and Producer Price Index (PPI) on Thursday. Before then, on Tuesday, Donald Trump goes head to head with Kamala Harris in the first debate between the presidential candidates ahead of November’s election.