This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 1,925.79 +5.55%

Bitcoin (BTC): $62,521.19 +4.22%

Ether (ETH): $2,428.37 +5.2%

S&P 500: 5,618.26 -0.29%

Gold: $2,585.66 +1.03%

Nikkei 225: 37,155.33 +2.13%

Bitcoin rose above $62,000, buoyed by the U.S. Federal Reserve’s 50 basis-point rate cut on Wednesday. Reductions in borrowing costs are traditionally a bullish indicator for risk assets such as cryptocurrencies, and easing cycles have historically coincided with surges in BTC’s price to all-time highs. Bitcoin has added about 4.35% in the last 24 hours while the digital asset market at large has risen over 5%, as measured by the CoinDesk 20 Index (CD20). Leading altcoins ETH and SOL lead the gains, up 5.8% and 7.4%, respectively.

Despite the long-awaited U.S. rate cut appearing to have the desired effect on crypto markets, traders are warning the rally could be short lived. They argue the bigger picture of economic slowdown and geopolitical uncertainty will hold back cryptocurrency price gains. Presto Research noted the mixed reaction across asset classes to the rate cut, which demonstrates that “growth concerns clearly exist.” Arthur Hayes, CIO of Maelstrom, argued that rate cuts will fuel inflation, which could see markets falter and then “they’re just going to do more of it and they’re going to make the problem even worse.”

Crypto Finance, a subsidiary of Germany’s largest stock exchange operator, signed a deal with Commerzbank to offer trading services to the lender’s corporate clients just two weeks after reaching a similar agreement with Zürcher Kantonalbank in Switzerland. Commerzbank will provide custody services, the companies said on Thursday. The trading service offered by the Deutsche Boerse unit will be available to clients based in Germany and initially focus on trading in the two largest cryptocurrencies, bitcoin and ether. Commerzbank obtained a crypto custody license in Germany in November 2023, allowing the financial services firm to offer a wide range of services related to digital assets.

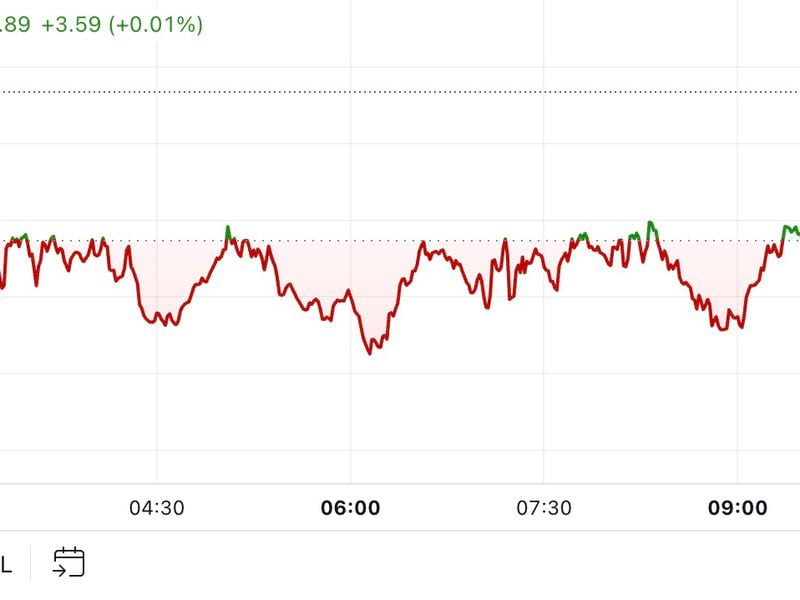

The chart shows bitcoin’s short-term holder (STH) realized price of $61,998.

The STH realized price reflects the average cost for coins moved within the last 155 days, which are the most likely to be spent.

Over the past six months, bitcoin has struggled to remain above this level. A sustained move above the STH realized price would suggest a more robust continuation of the bull market.

Source: Glassnode

– James Van Straten