Bitcoin ETFs recorded $136 million in inflows, with BlackRock’s IBIT contributing $98.9 million, equivalent to 1,548 BTC.

Ether ETFs saw $62.5 million in inflows, led by BlackRock’s ETHA with $59.3 million, third-largest day for Ether ETF inflows since launch.

Bitcoin (BTC) exchange-traded funds (ETFs) listed in the U.S. are doing their bit to boost supply scarcity in the crypto market.

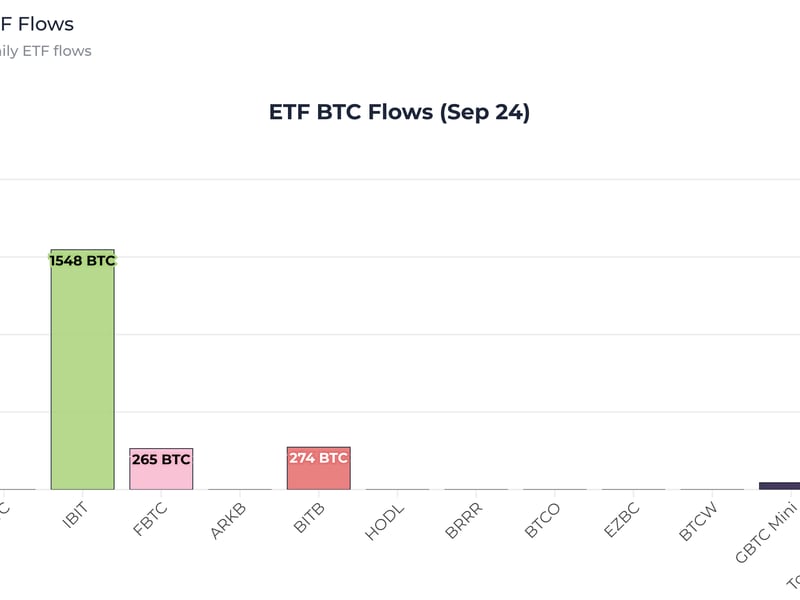

According to the latest data from Farside Investors, bitcoin btc exchange-traded funds (ETFs) saw an inflow of $136.0 million on Sept. 24. Leading this surge was BlackRock’s IBIT ETF, which experienced a significant inflow of $98.9 million, marking its largest inflow since Aug. 26. This brings IBIT’s total net inflows to over $21 billion, reinforcing its number one position in the market. Other notable contributors included Fidelity’s FBTC, with $16.8 million in net inflows, and Bitwise’s BITB, which attracted $17.4 million.

More importantly, the inflows on Sept. 24 were equivalent to 2,132 BTC, with IBIT accounting for 1,548 BTC, per HeyApollo data. Given that the current daily issuance of Bitcoin is around 450 BTC, these inflows represent nearly five times the daily mined supply being removed from the market.

Overall, bitcoin ETF inflows have reached $17.8 billion, underscoring continued investor interest in these investment vehicles.

Ether <a href="https://coindesk.com/price/ethereum/" data-position="autolink" title="Ethereum Price