Bitcoin ETFs bled $54.2 million on Thursday.

Of 525 ETFs launched in 2024, 13 of the top 25 are either bitcoin or ether related.

The U.S.-listed bitcoin (BTC) and ether ETH spot exchange-traded funds (ETFs) are doing their part in contributing to the downward price pressures of crypto this week, with bitcoin down 6% and ether down 10%.

Investors drained $54.2 million from bitcoin ETFs on Oct. 3, the third consecutive day of net outflows, taking the three-day tally to $361.2 million, according to Farside Investors.

The main contributions on Thursday were Ark’s ARKB, at $58.0 million, and Fidelity’s FBTC, at $37.2 million. BlackRock’s IBIT saw an inflow of $36.0 million. Grayscale’s GBTC remains relatively muted, with just $5.9 million in outflows this week.

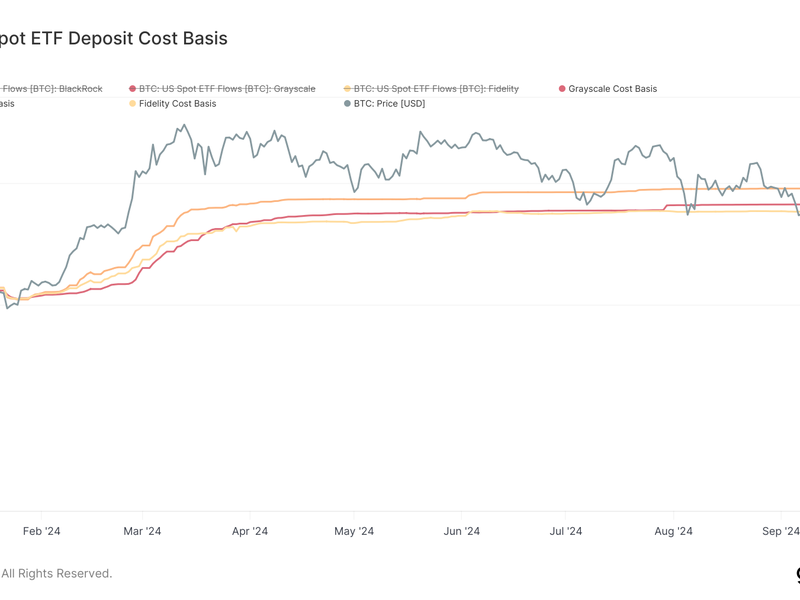

That said, the 11 ETFs have amassed a total of $18.5 billion in investor money since inception. Besides, investors are up on average on their investment around 3-10% with an average deposit cost basis between $54,911 and $59,120, according to Glassnode data.

The methodology used by Glassnode uses price stamping of bitcoin deposits to ETFs for the top three ETF issuers, which provides a rough break-even point for ETF investors. The data suggests, investors in Fidelity’s FBTC has a cost basis of $54,911, Grayscale at $55,943, and BlackRock $59,120.

In 2024, these cost basis have provided excellent price support for bitcoin, testing the lower bound multiple times during bull market corrections.

At the same time, ether ETFs experienced a net outflow of $3.2 million Thursday. Outflows came from Grayscale’s ETHE of $14.7 million, which has now seen a total of $2.9 billion in withdrawals. BlackRock ETHA saw a $12.1 million inflow. Ether ETFs now have a total outflow of $555.4 million, according to Farside Investors data.

Still, the performance of BTC and ETH ETFs is impressive compared to industry standards, according to Nate Geraci, President of the ETF store.

“Out of 525 ETFs launched in 2024, 13 of the top 25 are either bitcoin or ether related,” Geraci said.

As of press time, bitcoin was trading at $61,608, while ether was changing hands at $2,391, according to CoinDesk data.