This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 2,081.93 +0.82% Bitcoin (BTC): $67,929.41 +1.33% Ether (ETH): $2,539.37 +0.56% S&P 500: 5,809.86 +0.21% Gold: $2,723.02 -0.42% Nikkei 225: 37,913.92 -0.6%

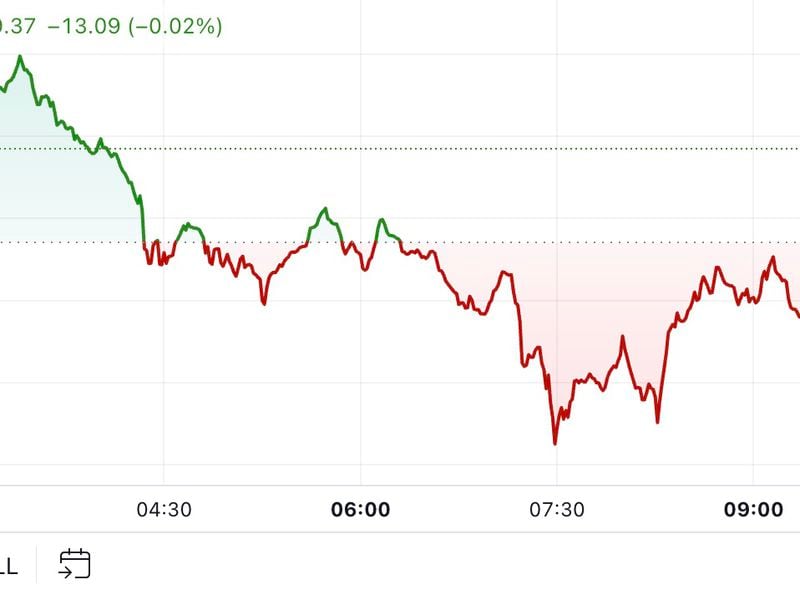

Bitcoin traded between $67,500-$67,900 during the European morning following a retreat from above $68,000. BTC remains over 1.2% higher in the last 24 hours, outperforming other major tokens, which have posted more modest gains. ETH and SOL have risen around 0.75%, while DOGE is up nearly 1%. The broader digital asset market, as measured by the CoinDesk 20 Index, has risen just under 0.8%. Bitcoin looks on course to close the week over 1% lower, according to CoinDesk Indices data, having failed to sustain any of its ascents north of $68,000.

The board of Microsoft has recommended shareholders vote against a proposal for the company to assess bitcoin as an inflationary hedge. In a filing with the SEC on Thursday, Microsoft laid out issues to discuss at the company’s next shareholder meeting. One of the proposals suggests that the tech firm should look into bitcoin to hedge against inflation and other macroeconomic influences. “As the proposal itself notes, volatility is a factor to consider in evaluating cryptocurrency investments for corporate treasury applications that require stable and predictable investments to ensure liquidity and operational funding. Microsoft has strong and appropriate processes in place to manage and diversify its corporate treasury for the long-term benefit of shareholders and this requested public assessment is unwarranted,” it said.

Balance, Canada’s long-standing crypto custodian, finally attained qualified custodian status this week, prompting the firm’s CEO, George Bordianu, to say it’s time to start bringing the country’s ETF digital assets “back home.” Bordianu is alluding to the fact that the safekeeping of crypto assets underlying funds issued by ETF providers 3iQ, Purpose Investments and Evolve, end up in sub-custody arrangements and held by blue chip U.S. exchanges like Coinbase and Gemini, rather than remaining on Canadian soil. “We have billions worth of retail assets in Canada’s crypto ETFs that sit in the United States,” Bordianu said in an interview. “We’re trying to simplify the picture, to make it cheaper and a little bit easier for new asset managers to do a few more ETF and mutual funds in Canada.”

The chart shows bitcoin’s options-based implied volatility and forward implied volatility, which is the projected volatility of the cryptocurrency over the coming months.

The higher forward IV for the Nov. 8 expiry indicates expectations for price turbulence likely stemming from the U.S. election result.

The 72% annualized forward IV figure means traders expect a price swing of around 3.8% on that day.

Source: Amberdata

– Omkar Godbole