BTC

105,389.60

+3.76%

ETH

3,392.09

+5.84%

XRP

3.20

+4.21%

USDT

1.00

+0.06%

SOL

265.19

+9.05%

BNB

687.80

+0.86%

DOGE

0.36192357

+4.08%

USDC

1.00

+0.01%

ADA

1.00

+4.46%

TRX

0.25834743

+5.35%

LINK

26.03

+6.86%

AVAX

36.29

+3.74%

WBTC

105,296.52

+3.68%

XLM

0.44203128

+6.24%

SUI

4.42

+3.06%

HBAR

0.34482112

+9.71%

TON

5.15

+1.22%

SHIB

0.0₄20493

+3.15%

LEO

9.64

+0.78%

LTC

117.42

+4.94%

By James Van Straten, Shaurya Malwa|Edited by Sheldon Reback

Updated Jan 24, 2025, 12:34 p.m. UTCPublished Jan 24, 2025, 12:00 p.m. UTC

What to know:

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what’s expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights. If you’re not already subscribed, click here. You won’t want to start your day without it.

By James Van Straten (All times ET unless indicated otherwise)

The past 24 hours have been among the most hectic in the crypto industry for years, and this was reflected in Thursday’s bitcoin (BTC) price, which whipsawed 2% to 3% multiple times in a matter of minutes. Still, it managed to stay above the psychological $100,000 level and is is currently around $105,000.

President Trump’s rhetoric is continuing to help weaken the dollar, which generally boosts risk assets such as cryptocurrencies. The DXY index, a measure of the U.S. currency against a basket of major trade partners, has dropped to the lowest since Dec. 17, so that should give risk-on assets a feel-good boost. U.S. bond yields and WTI crude oil are also heading down, with oil below $75 a barrel, the lowest in two weeks.

On the other side of the world, the Bank of Japan (BoJ) delivered on its promise with another interest-rate increase, taking the policy rate to 0.50%, the highest in more than 16 years. That followed a very hot inflation print, with headline inflation of 3.6% from the previous year, the fastest since January 2023. The question is whether we will get a second iteration of the yen carry trade unwind that occurred in August of last year. Time will tell. Stay alert!

- Crypto:

- Jan. 25: First deadline for SEC decisions on proposals for four spot solana ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF and VanEck Solana Trust, which are all sponsored by Cboe BZX Exchange.

- Jan. 29: Ice Open Network (ION) mainnet launch.

- Feb. 4: MicroStrategy Inc. (MSTR) Q4 FY 2024 earnings report.

- Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 pepecoin.

- Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

- Macro

- Jan. 24, 4:00 a.m.: S&P Global releases January 2025 eurozone HCOB Purchasing Managers’ Index (Flash) reports.

- Composite PMI Est. 49.7 vs. Prev. 49.6.

- Manufacturing PMI Est. 45.3 vs. Prev. 45.1.

- Services PMI Est. 51.5 vs. Prev. 51.6.

- Jan. 24, 4:30 a.m.: S&P Global releases January 2025’s U.K. Purchasing Managers’ Index (Flash) reports.

- Composite PMI Est. 50 vs. Prev. 50.4.

- Manufacturing PMI Est. 47 vs. Prev. 47.

- Services PMI Est. 50.9 vs. Prev. 51.1.

- Jan. 24, 9:45 a.m.: S&P Global releases January 2025’s U.S. Purchasing Managers’ Index (Flash) reports.

- Composite PMI Prev. 55.4.

- Manufacturing PMI Est. 49.6 vs. Prev. 49.4.

- Services PMI Est. 56.5 vs. Prev. 56.8.

- Jan. 24, 10:00 a.m.: The University of Michigan releases January U.S. consumer sentiment data.

- Index of Consumer Sentiment (Final) Est. 73.2 vs. Prev. 74.

- Jan. 24, 4:00 a.m.: S&P Global releases January 2025 eurozone HCOB Purchasing Managers’ Index (Flash) reports.

- Governance votes & calls

- Frax DAO is discussing a $5 million investment in World Liberty Financial (WLFI), the crypto project backed by the family of President Donald Trump.

- Jan. 24: Arbitrum BoLD’s activation vote deadline. BoLD allows anyone to participate in validation and defend against malicious claims to an Arbitrum chain’s state.

- Jan. 24: Hedera (HBAR) is hosting a community call at 11 a.m.

- Unlocks

- Jan. 31: Optimism (OP) to unlock 2.32% of circulating supply worth $52.9 million.

- Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating supply worth $626 million.

- Day 12 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

- Day 5 of 5: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

- Day 1 of 2: Adopting Bitcoin (Cape Town, South Africa)

- Jan. 25-26: Catstanbul 2025 (Istanbul). The first community conference for Jupiter, a decentralized exchange (DEX) aggregator built on Solana.

- Jan. 30, 12:30 p.m. to 5:00 p.m.: International DeFi Day 2025 (online)

- Jan 30-31: Plan B Forum (San Salvador, El Salvador)

- Jan. 30 to Feb. 4: The Satoshi Roundtable (Dubai)

- Feb. 3: Digital Assets Forum (London)

- Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

- Feb. 6: Ondo Summit 2025 (New York).

- Feb. 7: Solana APEX (Mexico City)

- Feb. 13-14: The 4th Edition of NFT Paris.

- Feb. 18-20: Consensus Hong Kong

- Feb. 19: Sui Connect: Hong Kong

- Feb. 23 to March 2: ETHDenver 2025 (Denver)

- Feb. 25: HederaCon 2025 (Denver)

By Shaurya Malwa

- A humorous new decentralized autonomous organization, FartStrategy (FSTR) DAO, is investing user funds into FARTCOIN.

- The DAO is leveraging borrowed SOL to acquire the token, offering investors a chance to gain exposure to its price movements through FSTR.

- If FSTR trades below its FARTCOIN backing, token holders can vote to dissolve the DAO, redeeming their share of FARTCOIN proportionally after settling any outstanding debts.

- The VINE memecoin jumped to a $200 million market capitalization less than 48 hours after issuance.

- It was launched on the Solana blockchain by Rus Yusupov, one of the co-founders of the original Vine app, and introduced as a nostalgic tribute to the eponymous platform known for its six-second looping videos. Vine was a significant cultural phenomenon before closing in 2017.

- There have been recent discussions around potentially reviving the app, with Yusupov and technocrat Elon Musk expressing interest in its return.

- TRX leads growth in perpetual futures open interest in major coins.

- Funding rates for majors remain below an annualized 10%, a sign the market isn’t overly speculative despite BTC trading near record highs on optimism about Trump’s crypto policies.

- BTC and ETH call skews have firmed up, with block flows featuring outright longs in higher strike BTC calls and a bull call spread in ETH, involving calls at strikes $5K and $6K.

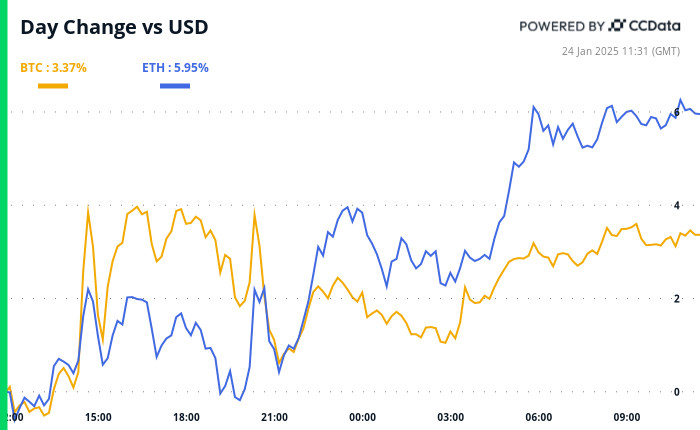

- BTC is up 2 % from 4 p.m. ET Thursday to $105,450.57 (24hrs: +3.43%)

- ETH is up 4.96% at $3,409.62 (24hrs: +6.18%)

- CoinDesk 20 is up 2.4% to 3,988.16 (24hrs: +4.79%)

- CESR Composite Staking Rate is up 1 bp to 3.16%

- BTC funding rate is at 0.0069% (7.58% annualized) on Binance

- DXY is down 0.48% at 107.53

- Gold is up 0.68% at $2,775.28/oz

- Silver is up 1.21% to $30.86/oz

- Nikkei 225 closed unchanged at 39,931.98

- Hang Seng closed +1.86% to 20,066.19

- FTSE is down 0.33% at 8,537.12

- Euro Stoxx 50 is up 0.73% at 5,255.47

- DJIA closed on Thursday +0.92% to 44,565.07

- S&P 500 closed +0.53 at 6,118.71

- Nasdaq closed +0.22% at 20,053.68

- S&P/TSX Composite Index closed +0.48% at 25,434.08

- S&P 40 Latin America closed +0.57% at 2,310.35

- U.S. 10-year Treasury was down 13 bps at 4.64%

- E-mini S&P 500 futures are down 0.13% at 6,143.75

- E-mini Nasdaq-100 futures are down 0.56% at 22,005.50

- E-mini Dow Jones Industrial Average Index futures are unchanged at 44,709.00

- BTC Dominance: 58.51 (-0.11%)

- Ethereum to bitcoin ratio: 0.032 (0.68%)

- Hashrate (seven-day moving average): 784 EH/s

- Hashprice (spot): $61.0

- Total Fees: 6.8 BTC/ $104,070

- CME Futures Open Interest: 191,645

- BTC priced in gold: 38.1 oz

- BTC vs gold market cap: 10.83%

- Ether seems have chalked out a falling wedge pattern, characterized by two converging trendlines, representing a series of lower highs and lower lows.

- The converging nature of trendlines indicates that sellers are slowly losing grip.

- A breakout is said to represent a bullish trend reversal.

- MicroStrategy (MSTR): closed on Thursday at $373.12 (-1.11%), up 2.55% at $382.62 in pre-market.

- Coinbase Global (COIN): closed at $296.01 (+0.05%), up 2.16% at $302.39 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$33.94 (+3.44%)

- MARA Holdings (MARA): closed at $19.95 (+1.32%), up 1.8% at $20.31 in pre-market.

- Riot Platforms (RIOT): closed at $12.99 (-1.14%), up 2.62% at $13.33 in pre-market.

- Core Scientific (CORZ): closed at $16.34 (+2.32%), up 1.04% at $16.51 in pre-market.

- CleanSpark (CLSK): closed at $11.41 (+2.42%), up 2.19% at $11.67 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.65 (+0.47%), up 1.75% at $26.10 in pre-market.

- Semler Scientific (SMLR): closed at $61.15 (-1.55%), down 10.89% at $54.49 in pre-market.

- Exodus Movement (EXOD): closed at $44 (+7.32%), up 0.75% at $44.33 in pre-market.

Spot BTC ETFs:

- Daily net flow: $188.7 million

- Cumulative net flows: $39.42 billion

- Total BTC holdings ~ 1.169 million.

Spot ETH ETFs

- Daily net flow: -$14.9 million

- Cumulative net flows: $2.79 billion

- Total ETH holdings ~ 3.663 million.

Source: Farside Investors

- The market capitalization of Tether’s USDT, the world’s largest dollar-pegged stablecoin, has flattened near $138 billion.

- The USDC supply continues to increase and has risen to nearly $52 billion this week, the highest since September 2022.

- Bitcoin Steady Near $104K After Bank of Japan Delivers Hawkish Rate Hike (CoinDesk): Bitcoin held steady above $104,000 in early Asian hours Friday despite the Bank of Japan’s rate hike as markets eyed President Trump’s Thursday executive order on crypto and potential U.S. policy changes.

- Trump Issues Crypto Executive Order to Pave U.S. Digital Assets Path (CoinDesk): President Trump issued a pro-crypto executive order, directing the creation of a digital asset framework, banning CBDC development and considering a national digital asset reserve.

- Vitalik Buterin Calls for Added Focus on Ether as Part of the Network’s Scaling Plans (CoinDesk): In a Thursday post, Ethereum co-founder Vitalik Buterin outlined strategies to boost the value of ether including using it as collateral, implementing fee-burning incentives and increasing temporary transaction data called blobs.

- Japan Hikes Rates, Solidifying Exit From Rock-Bottom Borrowing Costs (Bloomberg): The Bank of Japan raised its key rate by 25 basis points to 0.5% on Friday, the highest in 17 years, strengthening the yen and lifting 10-year bond yields to 1.23%.

- U.S. Stocks at Most Expensive Relative to Bonds Since Dotcom Era (Financial Times): Stocks in the S&P 500 hit record valuations, with the equity risk premium turning negative for the first time since 2002 driven by soaring demand for dominant tech companies.

- Trump 2.0 Is Going Well for China So Far. Can the Honeymoon Last? (CNN): In a Thursday interview, President Trump called tariffs a “tremendous power” but suggested deals could avert tougher measures. Beijing cautiously welcomed the reprieve, eyeing negotiations while bracing for future tensions.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM,

BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.