BTC

$96,250.18

2.22%

ETH

$2,628.68

3.58%

USDT

$1.0001

0.02%

XRP

$2.4285

3.87%

SOL

$196.28

4.70%

BNB

$637.59

0.66%

USDC

$1.0001

0.02%

DOGE

$0.2554

5.13%

ADA

$0.7782

4.53%

TRX

$0.2408

2.96%

WBTC

$96,170.84

2.11%

LINK

$18.75

5.20%

AVAX

$25.27

6.78%

SUI

$3.2967

7.93%

XLM

$0.3193

6.35%

SHIB

$0.0₄1589

4.16%

TON

$3.7422

4.30%

LEO

$9.6062

0.15%

LTC

$118.15

9.87%

HBAR

$0.2261

8.38%

By Omkar Godbole|Edited by Parikshit Mishra

Updated Feb 12, 2025, 8:07 a.m. UTCPublished Feb 12, 2025, 8:04 a.m. UTC

What to know:

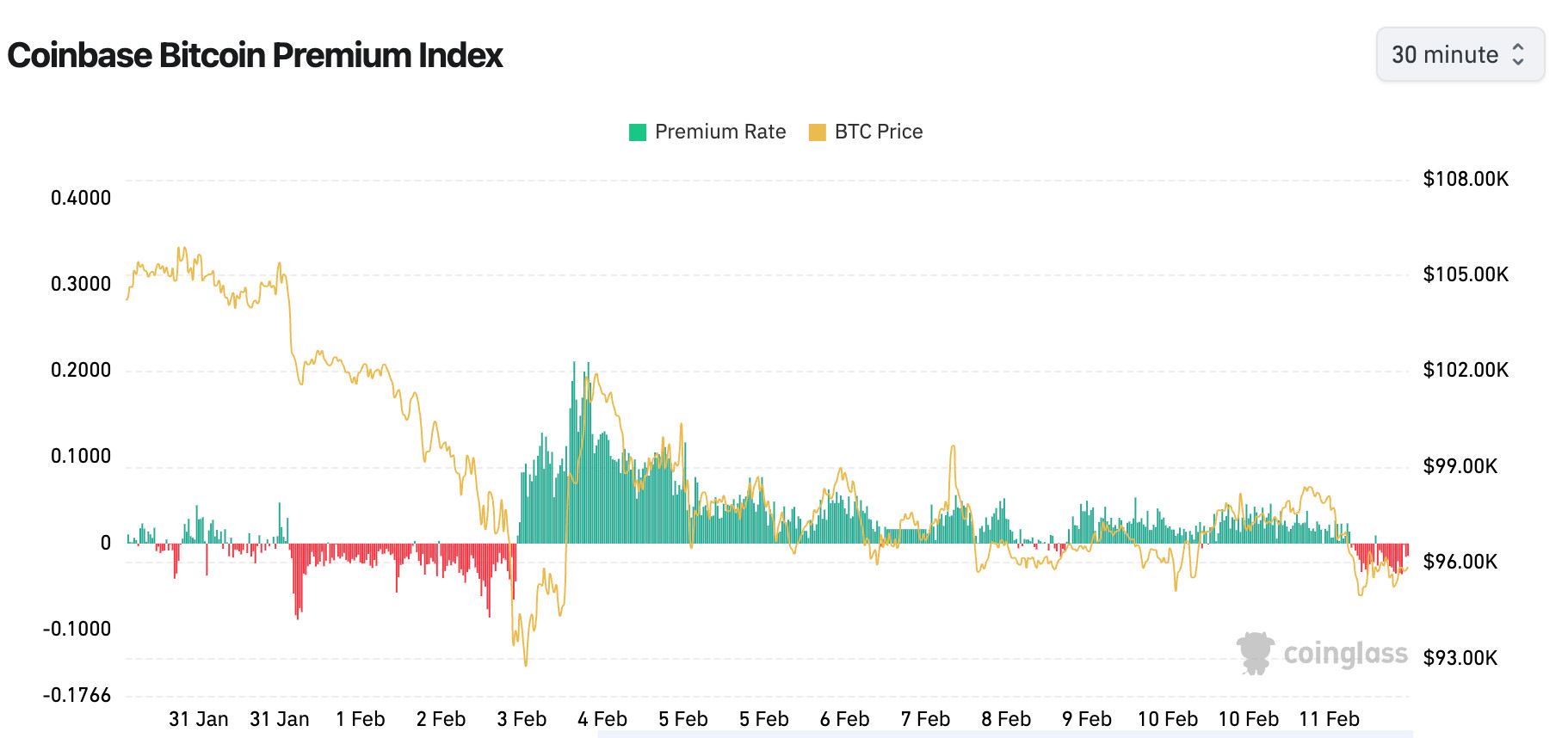

- BTC’s Coinbase premium indicator tracked by Coinglass has flipped negative for the first time since the Aug. 3 price crash.

- It’s a sign that traders over the Nasdaq-listed exchange have turned cautious ahead fo the CPI release.

Bitcoin’s (BTC) Coinbase premium indicator, which measures the spread between BTC’s dollar-denominated price on the Coinbase exchange and tether-denominated price on Binance, has flipped negative for the first time since the Feb. 3 crash, according to data source Coinglass.

It’s a sign that traders over the Nasdaq-listed exchange have turned cautious ahead of Wednesday’s U.S. CPI release, and their offshore counterparts have led the price recovery from overnight lows near $94,900 to $96,000.

Story continues

Historically, bull runs have been marked by prices trading at a premium on Coinbase, indicating strong leadership from U.S. investors. The premium soared to two-month highs in early November as BTC rose into its the-then uncharted territory above $70,000.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.