BTC

$95,908.99

0.20%

ETH

$2,651.80

1.05%

USDT

$1.0002

0.00%

XRP

$2.4647

0.91%

BNB

$707.70

9.88%

SOL

$191.67

2.85%

USDC

$0.9999

0.01%

DOGE

$0.2575

0.45%

ADA

$0.7824

0.55%

TRX

$0.2362

2.73%

WBTC

$95,933.08

0.16%

LINK

$18.65

0.64%

SUI

$3.5050

6.47%

AVAX

$25.57

1.39%

XLM

$0.3298

2.75%

SHIB

$0.0₄1627

1.46%

LTC

$121.21

4.19%

TON

$3.6650

1.72%

LEO

$9.6416

0.54%

HBAR

$0.2253

0.23%

By James Van Straten|Edited by Oliver Knight

Updated Feb 13, 2025, 11:59 a.m. UTCPublished Feb 13, 2025, 11:52 a.m. UTC

What to know:

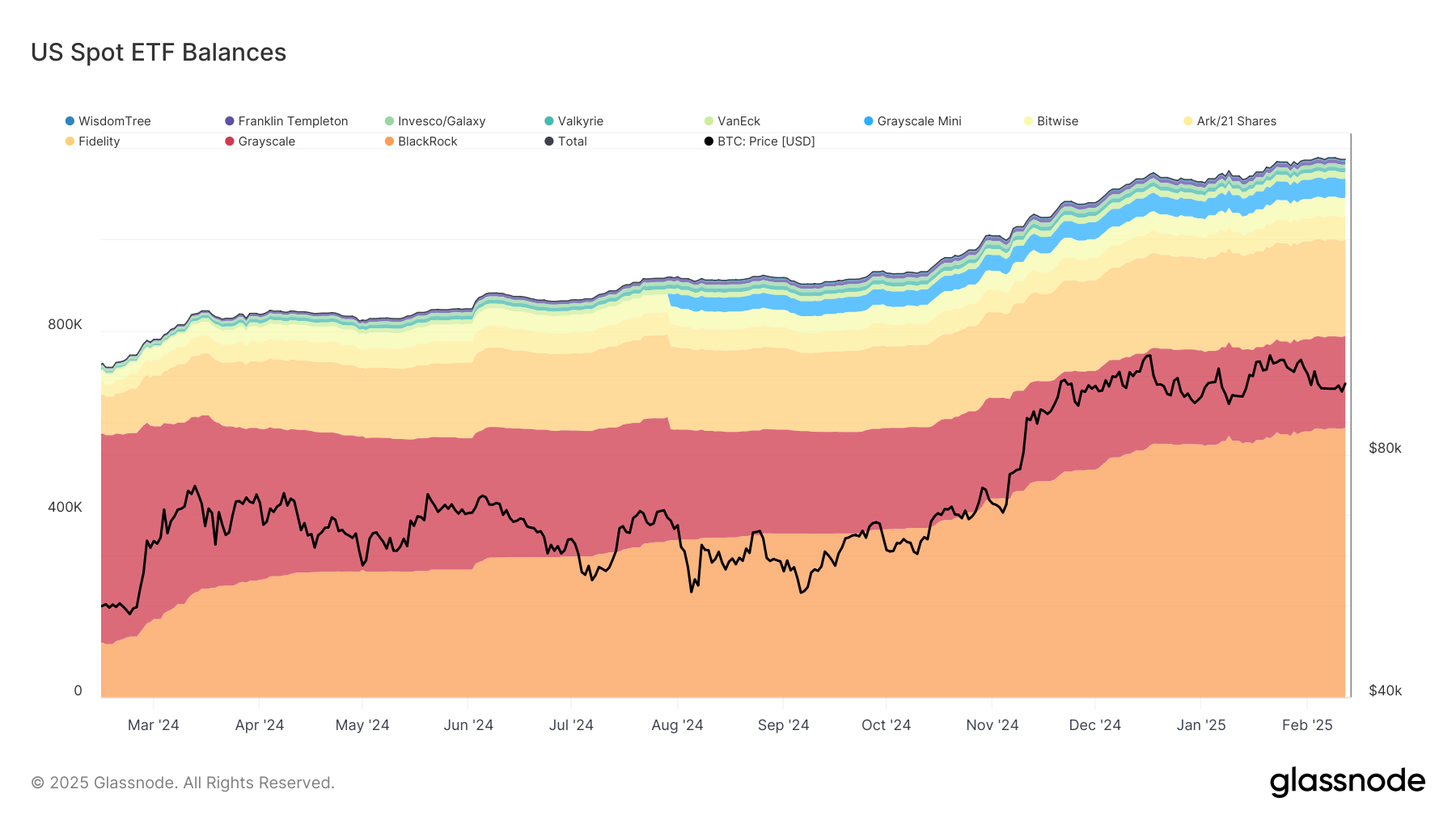

- U.S. spot listed bitcoin ETFs witness three consecutive days of outflows totaling $494 million.

- Bitcoin price continues to stall out hovering around $96,000, stuck in a trading range since mid-November.

U.S. spot-listed bitcoin (BTC) exchange-traded funds (ETFs) have seen three consecutive days of outflows totaling $494 million. Wednesday’s outflows were the largest of the three, with $251 million, which saw BlackRock’s iShares Trust (IBIT) register a $22.1 million outflow, with Fidelity Wise Origin Bitcoin Fund (FBTC) registering the largest outflow of $102 million, according to Farside data.

The outflows coincided with low volume in the ETFs, and Wednesday saw a total of just $2.58 billion in volume. IBIT registered less than $2 billion in volume, which put it as the tenth most traded U.S. ETF, according to Coinglass data. IBIT typically falls into the top 5 most traded ETFs when bitcoin surges or gains momentum.

STORY CONTINUES BELOW

The lack of demand shown in the recent Goldman Sachs filing of the bitcoin ETFs shows the lackluster demand for new net long positions in these ETFs, which are primarily used as trading vehicles.

Bitcoin is currently at $96,000, in the middle of a trading range between $90,000 and its all-time high of $109,000, which began in mid-November.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).