BTC

$86,600.28

–

3.76%

ETH

$2,136.01

–

3.07%

USDT

$0.9998

–

0.04%

XRP

$2.3825

–

8.70%

BNB

$592.45

–

0.66%

SOL

$138.69

–

3.33%

USDC

$1.0001

+

0.00%

ADA

$0.8169

–

10.12%

DOGE

$0.1978

–

2.09%

TRX

$0.2437

+

1.43%

WBTC

$86,456.74

–

3.72%

LINK

$15.92

–

6.89%

HBAR

$0.2340

–

1.77%

LEO

$9.9233

+

0.01%

XLM

$0.2834

–

4.58%

AVAX

$20.07

–

4.54%

SUI

$2.5891

–

5.63%

LTC

$103.16

–

0.28%

BCH

$390.95

–

1.26%

SHIB

$0.0₄1312

–

2.45%

By Aoyon Ashraf

Updated Mar 7, 2025, 11:32 p.m. UTCPublished Mar 7, 2025, 11:29 p.m. UTC

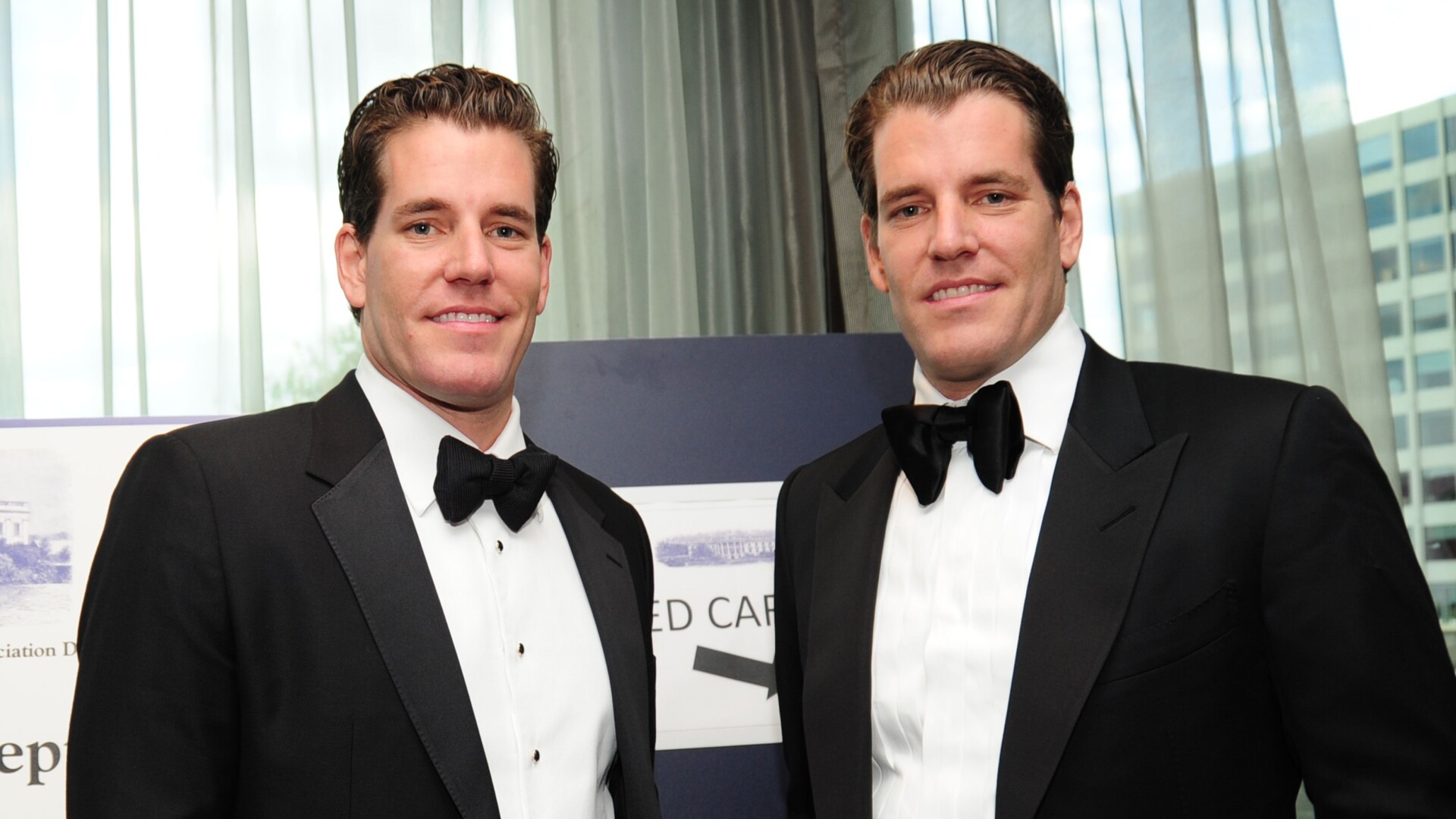

- Crypto exchange Gemini, founded by the Winklevoss twins, has confidentially filed for an IPO, with Goldman Sachs and Citigroup involved in the process.

- The potential IPO follows the SEC’s decision to end its investigation into Gemini without taking action, and a $5 million settlement of a separate lawsuit by the Commodity Futures Trading Commission.

- Gemini joins several other crypto firms, including Kraken, Circle, Bullish, and Blockchain.com, that are considering U.S. public listings amid a retreat from full-scale litigation by the SEC.

Crypto exchange and custodian Gemini has confidentially filed for an initial public offering (IPO), Bloomberg reported, citing people familiar with the matter.

The firm, founded by billionaire Cameron and Tyler Winklevoss, is working with Goldman Sachs and Citigroup, the report said, noting that no final decision has been made on the listing.

STORY CONTINUES BELOW

The potential IPO comes after the U.S. Securities and Exchange Commission (SEC) ended its investigation into Gemini without taking action, according to a February post by Cameron Winklevoss. The company also settled a separate Commodity Futures Trading Commission lawsuit in January for $5 million.

Gemini is among several crypto firms lining up to list their companies in the U.S. public market after the SEC has been in a full-scale litigation retreat in the first months of the Trump administration.

Just today, Bloomberg reported that Crypto exchange Kraken is considering an IPO by the first quarter of 2026, adding to the reports that firms such as Circle, Bullish (parent company of CoinDesk) and Blockchain.com are also queueing up for a U.S. listing.

Aoyon Ashraf is CoinDesk’s managing editor for Breaking News. He spent almost a decade at Bloomberg covering equities, commodities and tech. Prior to that, he spent several years on the sellside, financing small-cap companies. Aoyon graduated from University of Toronto with a degree in mining engineering. He holds ETH and BTC, as well as ALGO, ADA, SOL, OP and some other altcoins which are below CoinDesk’s disclosure threshold of $1,000.