BTC

$104,586.63

+

2.55%

ETH

$2,498.81

–

1.27%

USDT

$1.0006

+

0.03%

XRP

$2.1723

+

1.59%

BNB

$644.97

+

0.03%

SOL

$149.17

+

1.91%

USDC

$0.9997

–

0.03%

DOGE

$0.1799

+

3.16%

TRX

$0.2775

+

2.03%

ADA

$0.6635

+

3.14%

HYPE

$34.16

+

1.94%

SUI

$3.1633

+

5.35%

LINK

$13.46

+

1.87%

LEO

$8.9624

+

2.76%

XLM

$0.2631

+

1.32%

AVAX

$19.45

+

0.76%

BCH

$396.44

+

0.86%

TON

$3.1400

+

1.12%

SHIB

$0.0₄1249

+

1.57%

HBAR

$0.1645

+

1.31%

By Will Canny, AI Boost|Edited by Aoyon Ashraf

Jun 6, 2025, 6:23 p.m.

- Gemini is the latest crypto native company to file for an IPO.

- The crypto exchange has filed a draft registration statement with the SEC, signaling its intention to go public.

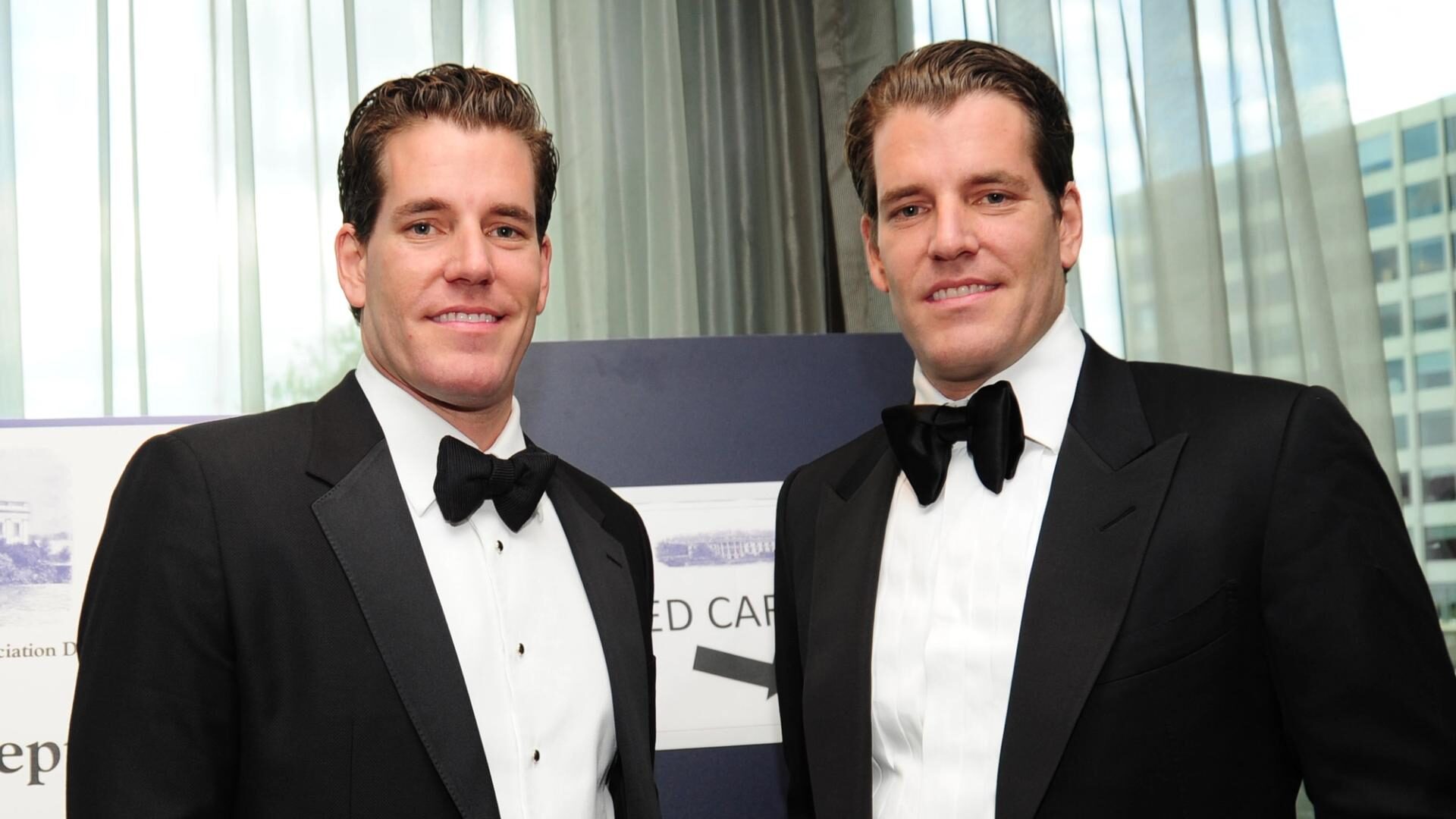

Gemini Space Station Inc., the crypto exchange and custody platform founded by Cameron and Tyler Winklevoss, has taken a significant step toward becoming a publicly traded company.

The firm announced Friday that it has confidentially submitted a draft registration statement on Form S-1 with the U.S. Securities and Exchange Commission (SEC), signaling its intent to pursue an initial public offering (IPO) of its Class A common stock.

STORY CONTINUES BELOW

While specific details around the size and valuation of the offering remain undisclosed, the move positions Gemini among a growing list of crypto-native firms seeking a foothold in traditional capital markets.

The crypto exchange has been taking major steps to go public in the U.S., including hiring Goldman Sachs and Citigroup as its financial advisors for the IPO. Gemini had also settled a $5 million lawsuit by the Commodity Futures Trading Commission, while the SEC ended its investigation into the exchange earlier this year.

The timing aligns with renewed interest in digital asset IPOs after stablecoin issuer Circle (CRCL) started trading on the New York Stock Exchange (NYSE) this week. Shares of Circle surged in its first day of trading Thursday, closing at $83 after going public at $31. The stock is currently trading around $113, almost 264% higher than its IPO price.

Gemini’s offering, if completed, would mark a major milestone not just for Gemini but for the crypto industry’s ongoing quest for mainstream financial legitimacy.

The company noted that the IPO will proceed after SEC review and pending market conditions, per standard disclosure protocols.

Read more: Circle Shares Surge on NYSE Debut, Signalling Strong Appetite for Stablecoin Issuers

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Will Canny is an experienced market reporter with a demonstrated history of working in the financial services industry. He’s now covering the crypto beat as a finance reporter at CoinDesk. He owns more than $1,000 of SOL.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.