BTC

$104,418.50

–

1.01%

ETH

$2,502.48

–

1.85%

USDT

$1.0004

+

0.01%

XRP

$2.1217

–

1.28%

BNB

$640.01

–

2.02%

SOL

$142.33

–

3.49%

USDC

$0.9999

+

0.01%

DOGE

$0.1758

–

1.40%

TRX

$0.2703

–

0.29%

ADA

$0.6152

–

3.58%

HYPE

$39.00

–

6.17%

SUI

$2.8580

–

6.17%

LINK

$12.95

–

2.19%

WBT

$38.87

+

4.26%

BCH

$422.36

–

4.04%

LEO

$9.0801

+

0.53%

AVAX

$18.80

–

2.19%

XLM

$0.2537

–

2.36%

TON

$2.9227

–

2.70%

SHIB

$0.0₄1194

–

0.90%

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

Jun 14, 2025, 7:47 p.m.

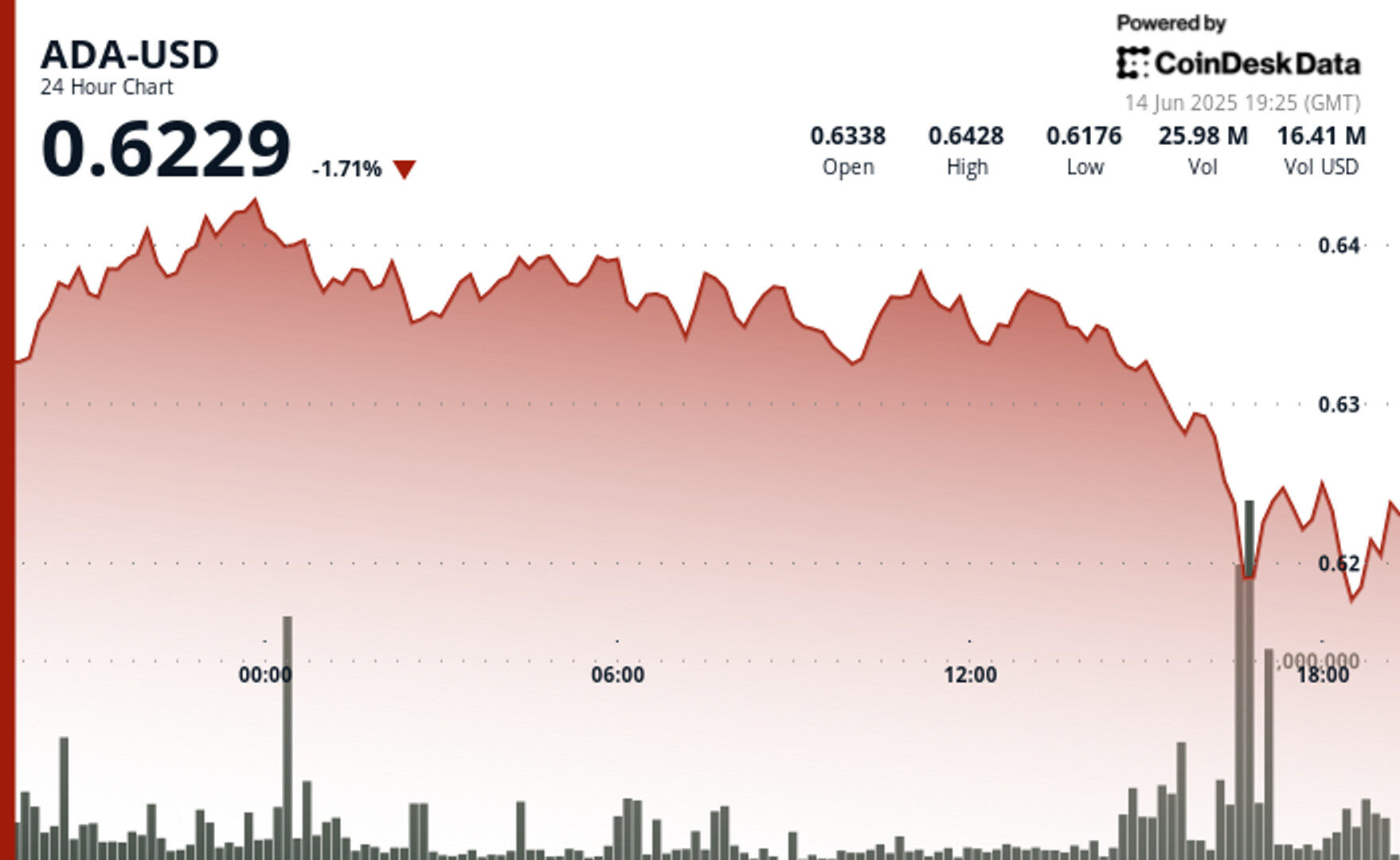

- ADA is trading at $0.6229, down 1.71% over the past 24 hours after briefly dipping to $0.6176, to CoinDesk Research’s technical analysis model.

- Cardano Foundation launched Originate, a blockchain tool to verify product origin and boost enterprise adoption.

- Whales reportedly sold 270 million ADA this week, adding pressure amid ongoing Middle East conflict.

Cardano’s ADA

was down 1.71% over the past 24 hours, trading at $0.6229 as of June 14. The asset briefly slipped to $0.6176 before stabilizing, holding its footing despite a sharp wave of selling from large holders.

According to recent market data, whales have offloaded over 270 million ADA —worth roughly $170 million — in a move that has added significant pressure to the token’s price action during a week marked by geopolitical volatility.

STORY CONTINUES BELOW

Yet, amid the sell-off, the Cardano Foundation unveiled a new product aimed at enterprise adoption. On Thursday, the organization launched Originate, a blockchain-based solution for verifying product origin and authenticity. Designed to help businesses streamline compliance and protect against counterfeits, Originate allows companies to digitize and track critical product data on-chain, enabling instant verification by consumers and regulators.

On its website, the Foundation emphasized that Originate is built to strengthen brand trust in industries where supply chain transparency is critical. By positioning itself as a tool for regulatory compliance and consumer assurance, the product may help bolster Cardano’s reputation in enterprise circles —especially at a time when investors are searching for real-world use cases beyond DeFi and staking.

The announcement comes just days after ADA was added to the Nasdaq Crypto Index, joining Bitcoin and Ethereum. While short-term sentiment remains fragile due to whale behavior and broader risk-off macro trends, Cardano’s expanding institutional profile could provide longer-term support.

Technical Analysis Highlights

- ADA ranged between $0.6176 and $0.6428, closing near $0.6229, a 1.71% daily loss.

- Resistance remains strong near $0.642–$0.645, while price broke below support at $0.636.

- Heaviest volume spikes occurred after 18:00 GMT as price dipped below $0.62, triggering brief sell-off followed by consolidation.

- Trend remains bearish with lower highs forming throughout the day, and rejection at $0.635.

- Price action suggests near-term stabilization, but whales remain dominant in setting market direction

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.