BTC

$102,593.84

+

3.10%

ETH

$2,283.44

+

4.26%

USDT

$1.0008

+

0.01%

XRP

$2.0373

+

3.43%

BNB

$628.28

+

3.25%

SOL

$137.77

+

5.80%

USDC

$1.0002

–

0.03%

TRX

$0.2723

+

2.93%

DOGE

$0.1560

+

4.71%

ADA

$0.5509

+

3.91%

HYPE

$36.27

+

6.37%

WBT

$47.73

–

0.44%

BCH

$453.15

+

1.14%

SUI

$2.5516

+

6.89%

LEO

$9.0466

+

1.25%

LINK

$11.95

+

4.65%

XLM

$0.2327

+

4.17%

AVAX

$17.06

+

5.76%

TON

$2.8273

+

3.46%

SHIB

$0.0₄1110

+

7.00%

By Tom Carreras, Krisztian Sandor|Edited by Cheyenne Ligon

Updated Jun 23, 2025, 5:41 p.m. Published Jun 23, 2025, 5:39 p.m.

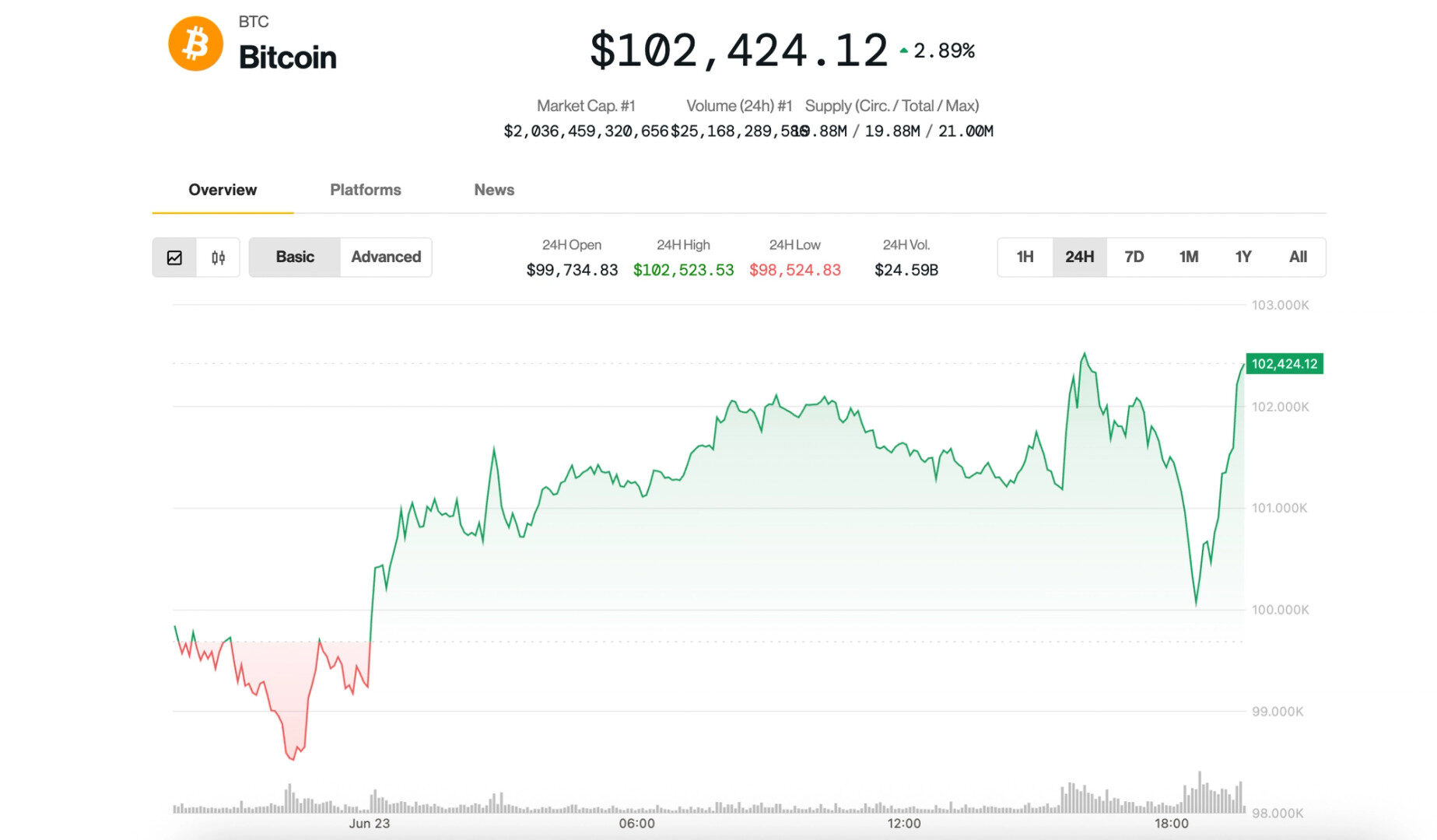

- Bitcoin briefly dropped to $99,500 but quickly rebounded by 2.9% to $102,400 following developments in the Middle East.

- Iran’s missile strikes on American bases in the Gulf region, including Qatar, led to no casualties, but influenced market reactions.

- Traditional haven assets like gold saw minimal movement, while crude oil prices fell 4%.

Bitcoin

is quickly responding to developments in the Middle East.

After briefly sinking to $99,500, bitcoin has bounced back 2.9% in the last hour and is now trading at $102,400. The digital asset is still up 2.5% in the last 24 hours, while the CoinDesk 20 (an index of the top 20 cryptocurrencies by market capitalization, excluding stablecoins, memecoins and exchange coins) has risen 2.1% in the same period of time.

STORY CONTINUES BELOW

Bitcoin’s drop occurred as Iran retaliated against U.S. President Donald Trump’s administration’s weekend bombardment of three of its nuclear sites. The Middle Eastern nation carried out missile strikes against American bases in multiple Gulf countries, including Qatar, Kuwait, Bahrain and the United Arab Emirates. The attack on Qatar resulted in no casualties or injuries, according to a Qatari official.

Investors appeared to be unfazed by the military action. Gold, a traditional haven assets, barely inched higher at around $3,380, while crude oil prices plummeted 4% during the day.

“Crude getting crushed. Good sign,” Sean Farrell, head of digital asset strategy at Fundstrat, noted in an X post.

“Generally when it comes to war and other external factors that disrupt things globally, there tends to be heavy short-term dips which later rebound depending on the severity as well as how things are communicated,” said Nicolai Søndergaard, research analyst at blockchain analytics firm Nansen. “So far I’d say we are seeing the situation play out similarly here.”

“Smart money still seems to be going a bit more risk off,” he said, adding that exchanges saw some notable outflows, suggesting opportunistic investors bought the dip in prices.

Tom writes about markets, bitcoin mining and crypto adoption in Latin America. He has a bachelor’s degree in English literature from McGill University, and can usually be found in Costa Rica. He holds BTC above CoinDesk’s disclosure threshold of $1,000.

Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University’s business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH.