BTC

$105,449.60

+

3.63%

ETH

$2,431.60

+

6.91%

USDT

$1.0005

–

0.03%

XRP

$2.1891

+

8.26%

BNB

$641.34

+

3.11%

SOL

$145.05

+

7.55%

USDC

$0.9999

–

0.03%

TRX

$0.2727

+

0.39%

DOGE

$0.1640

+

6.65%

ADA

$0.5853

+

6.80%

HYPE

$37.89

+

7.40%

WBT

$48.17

+

1.08%

SUI

$2.7914

+

11.13%

BCH

$459.79

+

2.32%

LINK

$13.34

+

12.18%

LEO

$9.1344

+

0.78%

XLM

$0.2485

+

7.40%

AVAX

$18.19

+

7.14%

TON

$2.9151

+

3.45%

SHIB

$0.0₄1169

+

6.62%

By Oliver Knight, CD Analytics

Updated Jun 24, 2025, 12:53 p.m. Published Jun 24, 2025, 12:53 p.m.

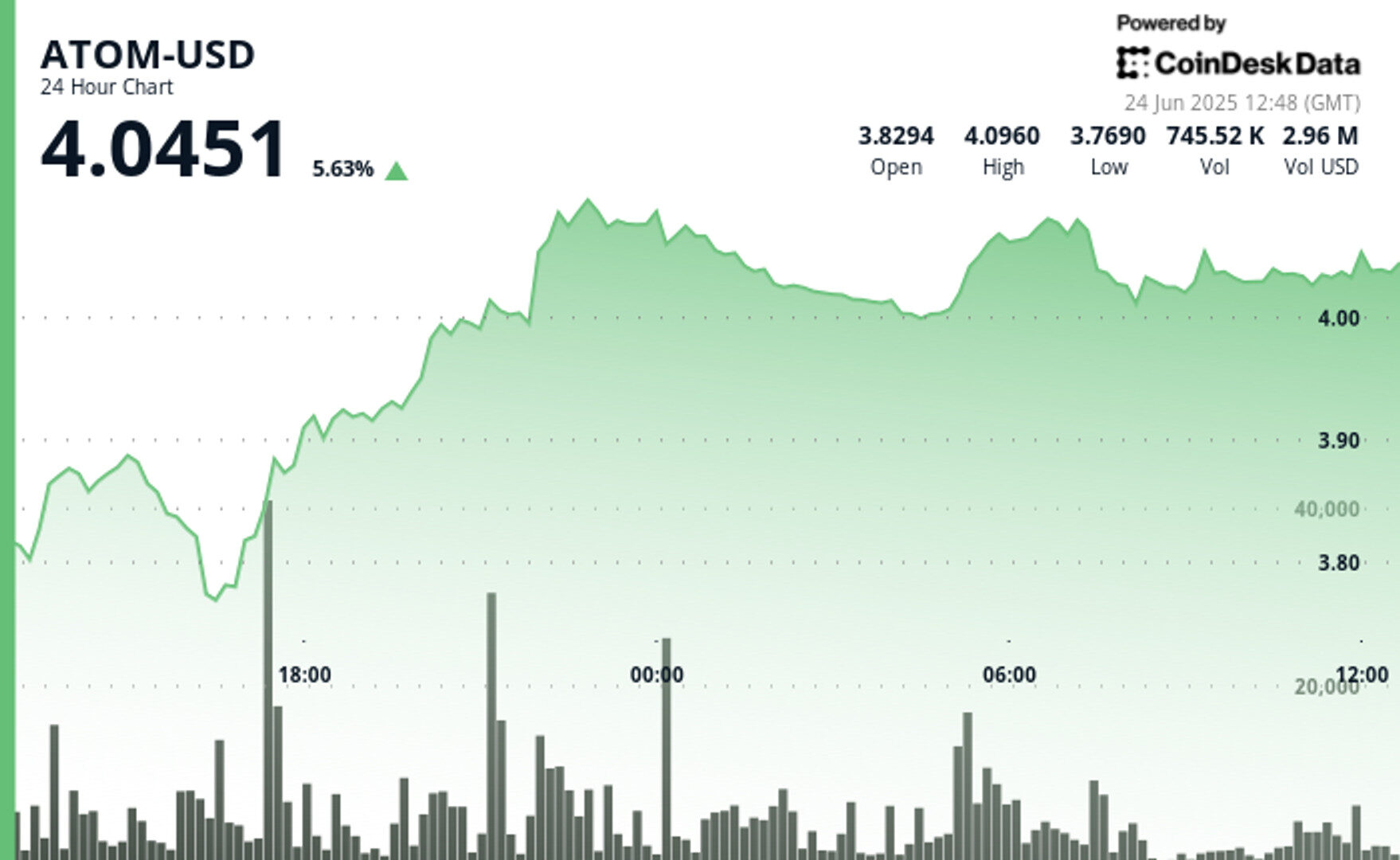

- ATOM-USD rallied 6.73% over 24 hours, breaking through the $4.00 resistance level with significantly above-average trading volume.

- Tension in the Middle East is creating volatility across cryptocurrency markets, with ATOM showing resilience amid broader market uncertainty.

- Cosmos recently hosted its Sovereign EVM Day featuring Ripple, potentially extending ATOM’s reach in DeFi and creating new cross-network opportunities.

Uncertainty in the Middle East between Iran and Israel continues to shape cryptocurrency performance as ATOM demonstrates remarkable strength with a decisive breakout.

The cryptocurrency surged from $3.787 to $4.042, establishing new support above the psychological $4.00 level with strong buyer conviction.

STORY CONTINUES BELOW

Technical Analysis

- ATOM-USD demonstrated a 6.73% gain over 24 hours, with a total price range of $0.359 (9.52%).

- The decisive breakout occurred at 22:00 on June 23rd, with price surging through the $4.00 resistance level.

- Trading volume during the breakout reached 2,027,234 units, nearly double the 24-hour SMA of 1,023,000.

- A new high-volume resistance level was established at $4.09. • Post-breakout, ATOM maintained support above $4.00 with decreasing volatility, suggesting consolidation.

- In the most recent hour, ATOM experienced a bullish breakout at 12:03, surging from $4.035 to $4.042.

- This mini-rally continued to $4.046 at 12:04, representing a 1.0% gain within just two minutes.

- The exceptionally high volume during this move (108,229 units at 12:03, followed by 91,550 units at 12:04) indicates strong buyer conviction.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.