BTC

$105,265.01

+

3.76%

ETH

$2,438.54

+

8.44%

USDT

$1.0004

–

0.03%

XRP

$2.1900

+

9.45%

BNB

$639.84

+

2.69%

SOL

$144.21

+

8.15%

USDC

$0.9998

–

0.03%

TRX

$0.2726

+

0.65%

DOGE

$0.1637

+

7.37%

ADA

$0.5836

+

7.71%

HYPE

$37.70

+

9.52%

WBT

$47.78

+

0.27%

SUI

$2.7685

+

12.01%

LINK

$13.36

+

13.74%

BCH

$451.15

+

1.43%

LEO

$9.1262

+

0.93%

XLM

$0.2474

+

7.63%

AVAX

$18.18

+

8.50%

TON

$2.9051

+

3.57%

SHIB

$0.0₄1165

+

6.93%

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

Jun 24, 2025, 3:41 p.m.

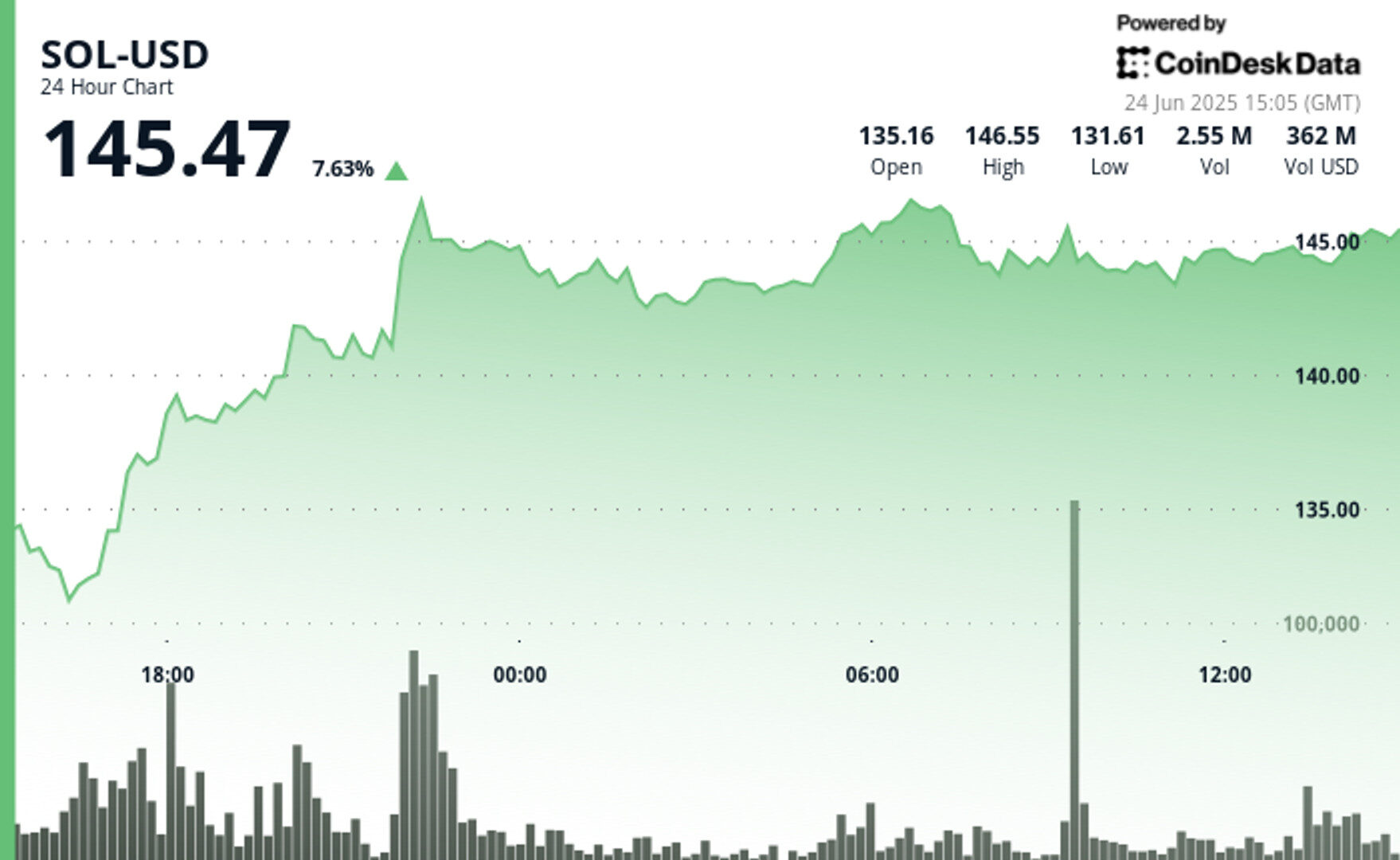

- SOL rose 7.63% to $145.47 as futures trading hit record levels.

- CME futures volume reached 1.75 million contracts, signaling institutional demand.

- Strong intraday support emerged around $132.43 during the early stages of the rally.

Solana’s SOL token

is trading at $145.47, up 7.63% in the past 24 hours, as traders responded to a breakout surge backed by strong futures activity. The rally gained traction after a sharp bounce from $133.55 to $144.10, supported by above-average trading volumes during the 17:00 and 22:00 hours, according to CoinDesk Research’s technical analysis model.

Per a post on X earlier today by crypto analytics firm Glassnode, CME futures volume for SOL hit an all-time high of 1.75 million contracts, reflecting an increase in institutional interest. This marked the highest volume level since the exchange introduced SOL futures in March, signaling aggressive positioning by sophisticated market participants as price approached the $145 zone.

STORY CONTINUES BELOW

In a separate development with longer-term significance, Kazakhstan’s government issued a press release on May 30 announcing the creation of the Solana Economic Zone Kazakhstan (SEZ KZ), the first such initiative in Central Asia built on Solana’s blockchain. The launch event took place in Astana with support from the Solana Foundation and government agencies. According to the Ministry of Digital Development, Innovation and Aerospace Industry, the SEZ will serve as a testbed for asset tokenization, blockchain engineering education, and foreign startup onboarding.

The SEZ initiative includes three strategic pillars:

- Tokenized Capital Markets: A pilot program with AIX, Solana Foundation, Jupiter, and Intebix aims to introduce tokenized financial instruments into Kazakhstan’s infrastructure.

- Web3 Talent Development: A nationwide blockchain education initiative will be launched in partnership with universities and Astana Hub.

- Startup Onboarding: With support from Forma, the country plans to attract international Web3 firms through infrastructure access, regulatory clarity, and business incentives.

Technical Analysis Highlights

- SOL gained 7.63%, climbing from $133.55 to $145.47 within a $15.94 range.

- The sharpest rally occurred at 22:00, when price spiked to $146.90 on 3.92M volume.

- A high-volume support level was established at $132.43 during the 17:00 hour.

- SOL entered a consolidation zone between $143 and $146 with resistance at $146.55.

- A V-shaped recovery followed a dip from $144.88 to $143.59.

- Strong support emerged at $143.60 with 38,097 SOL volume at 13:53.

- A short-term support band formed between $143.60 and $143.80.

- Immediate resistance was observed at $144.30.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.