BTC

$108,057.45

+

2.85%

ETH

$2,440.55

+

0.88%

USDT

$1.0005

–

0.00%

XRP

$2.2278

+

2.30%

BNB

$648.14

+

1.18%

SOL

$147.77

+

2.63%

USDC

$0.9998

+

0.00%

TRX

$0.2725

–

0.14%

DOGE

$0.1670

+

2.90%

ADA

$0.5853

+

0.61%

HYPE

$39.06

+

3.03%

WBT

$48.02

–

0.21%

SUI

$2.8417

+

2.48%

BCH

$480.78

+

4.37%

LINK

$13.29

+

0.90%

LEO

$9.0013

–

1.55%

XLM

$0.2458

–

0.90%

AVAX

$18.10

+

0.01%

TON

$2.9106

–

0.04%

SHIB

$0.0₄1177

+

1.13%

By Shaurya Malwa, CD Analytics

Jun 25, 2025, 12:57 p.m.

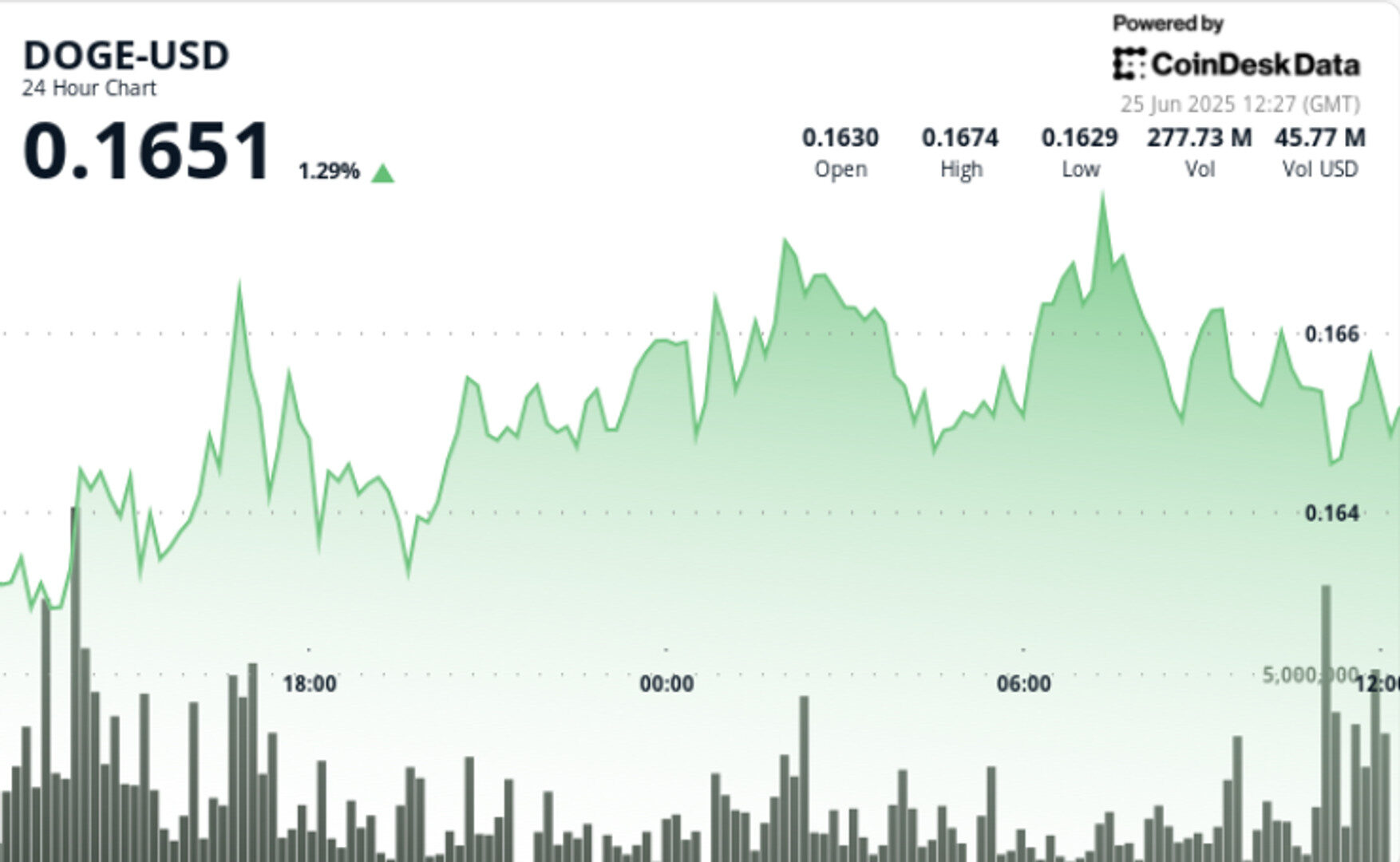

- Dogecoin rose by 1.67% to $0.167, breaking a key resistance level amid macroeconomic tensions.

- The cryptocurrency showed strength with higher lows and increased trader participation despite market volatility.

- Technical indicators suggest further gains are possible if Dogecoin maintains momentum above $0.165.

Dogecoin continued its upward trend over the past 24 hours, gaining 1.67% to close at $0.167 as bulls broke through a key resistance level.

STORY CONTINUES BELOW

The move comes amid ongoing macroeconomic tensions, including heightened trade disputes and geopolitical risk, which have injected volatility into broader crypto markets.

DOGE’s performance stands out as it climbs steadily off its weekly lows, forming a strong support base and flashing early signs of accumulation.

News Background

- Dogecoin’s breakout followed a surge in volume during the 16:00-17:00 UTC window on June 24, when the asset moved decisively above $0.166.

- The rally was backed by sustained buying interest and solidified earlier support established near $0.162–$0.163, where significant volume was recorded during the 13:00 hour.

- The price action unfolded against the backdrop of renewed market anxiety as global trade disputes and diplomatic tensions continue to weigh on investor sentiment.

- Risk assets have remained under pressure in recent weeks, though DOGE has demonstrated relative strength with consecutive higher lows and expanding participation from traders.

- Technical analysts note that the current price structure suggests further upside is possible if DOGE can maintain momentum above $0.165 and break beyond $0.168 resistance.

Price Action

DOGE traded within a healthy 3.4% range from $0.162 to $0.168.

The most dramatic movement occurred in the final 60 minutes of the session, when price jumped briefly to $0.168 at 07:26 UTC before entering a short-term retracement.

That surge was supported by a 0.28% price gain on heavy volume exceeding 11.7 million units. However, subsequent candles showed profit-taking and the formation of a descending channel, as DOGE dropped back to $0.166 by 08:04 UTC.

Notable selling spikes were seen at 07:51 and 08:03, where volume exceeded 4.9 million units.

Technical Analysis Recap

• DOGE posted a 1.67% gain over 24 hours, from $0.164 to $0.167

• Price broke above $0.166 resistance during the 16:00–17:00 window with above-average volume

• Key support established around $0.162–$0.163 with strong volume backing during 13:00 hour

• Highest price reached was $0.168; the session’s range was $0.0055 (3.4%)

• Late-session volatility saw a brief 0.28% surge followed by a 0.73% retracement into a descending channel

• RSI remains neutral; momentum indicators suggest potential continuation if $0.165 support holds.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.