BTC

$107,510.74

+

1.36%

ETH

$2,427.17

–

0.63%

USDT

$1.0005

+

0.01%

XRP

$2.1872

–

0.17%

BNB

$646.97

+

0.57%

SOL

$144.12

–

0.64%

USDC

$0.9999

–

0.00%

TRX

$0.2732

–

0.51%

DOGE

$0.1653

+

0.07%

ADA

$0.5678

–

3.27%

WBT

$47.90

–

0.15%

BCH

$484.87

+

7.04%

SUI

$2.7541

–

1.26%

LINK

$13.16

–

1.66%

LEO

$8.9922

+

0.01%

XLM

$0.2414

–

2.83%

AVAX

$17.60

–

3.19%

TON

$2.8354

–

2.18%

SHIB

$0.0₄1164

–

0.25%

LTC

$84.49

–

0.49%

By Tom Carreras, AI Boost|Edited by Aoyon Ashraf

Jun 25, 2025, 9:23 p.m.

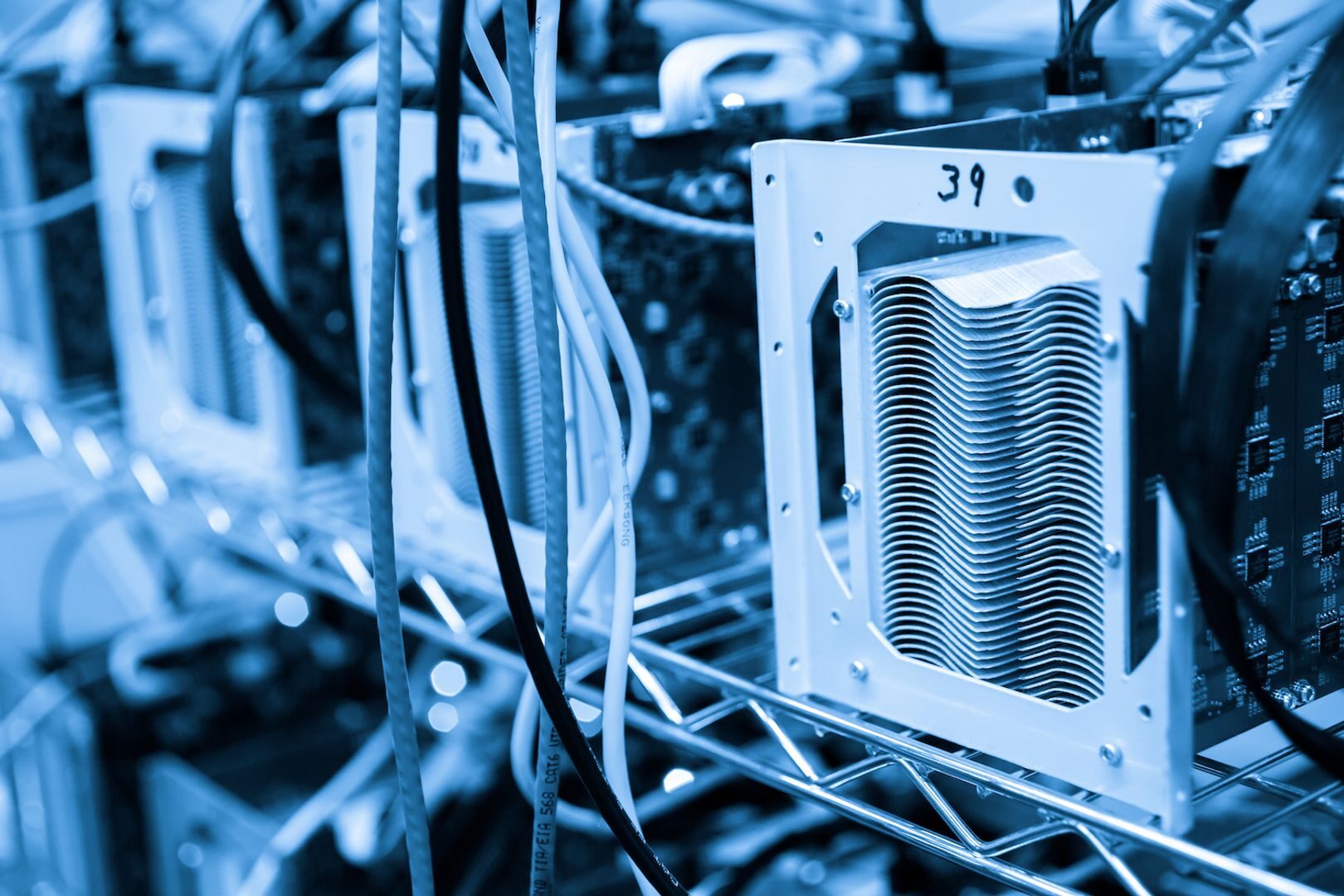

- Bit Digital is shifting its focus from bitcoin mining to ether staking and treasury operations.

- The company plans to sell its bitcoin mining assets and reinvest the proceeds into ether.

- Bit Digital will also sell shares to fund additional ether purchases, and its subsidiary WhiteFiber is preparing to go public.

Bit Digital (BTBT) is changing course to become a dedicated ether

staking and treasury operation, the companysaidWednesday.

The New York-based firm will exit the bitcoin

mining business entirely, repurposing its assets and capital into its growing ETH strategy.

STORY CONTINUES BELOW

The company began building its ether position and Ethereum staking infrastructure in 2022. As of March 31, Bit Digital held 24,434.2 ETH, valued at $44.6 million, and 417.6 BTC worth $34.5 million. It plans to convert the remaining bitcoin into ether over time.

To fund the transition, Bit Digital has started a process to sell or wind down its bitcoin mining operations. Net proceeds from the divestiture will be reinvested in ether. No specific timeline was given for the sale or conversion of assets.

The announcement marks a significant pivot for a company once rooted in bitcoin mining, especially considering the incredible run BTC has been on compared to ETH. The ETH/BTC ratio is down 75% since December 2021.

However, the move isn’t a big surprise given how tough the mining industry has become since last year’s halving cut the BTC rewards for miners to half, squeezing profit margins, despite rally in bitcoin prices.

The firm has also announced that it will be selling shares to fund the purchase of more ether, and that its high-performance computing (HPC) subsidiary, WhiteFiber, has submitted a draft registration letter with the Securities and Exchange Commission with regards to going public.

BTBT is down 3.41% in after hours trading.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Tom writes about markets, bitcoin mining and crypto adoption in Latin America. He has a bachelor’s degree in English literature from McGill University, and can usually be found in Costa Rica. He holds BTC above CoinDesk’s disclosure threshold of $1,000.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.