BTC

$107,860.38

+

1.32%

ETH

$2,485.38

+

1.58%

USDT

$1.0004

+

0.00%

XRP

$2.1916

+

0.22%

BNB

$646.65

+

0.10%

SOL

$145.09

–

0.90%

USDC

$0.9999

+

0.00%

TRX

$0.2711

–

1.16%

DOGE

$0.1650

–

1.07%

ADA

$0.5718

–

2.05%

HYPE

$37.23

+

0.49%

WBT

$47.90

+

0.07%

BCH

$501.73

+

4.73%

SUI

$2.7249

–

2.72%

LINK

$13.34

–

0.53%

LEO

$8.9940

–

0.08%

XLM

$0.2421

–

1.42%

AVAX

$17.68

–

2.30%

TON

$2.8489

–

1.77%

SHIB

$0.0₄1165

–

0.32%

By Shaurya Malwa, CD Analytics

Updated Jun 26, 2025, 6:34 a.m. Published Jun 26, 2025, 6:33 a.m.

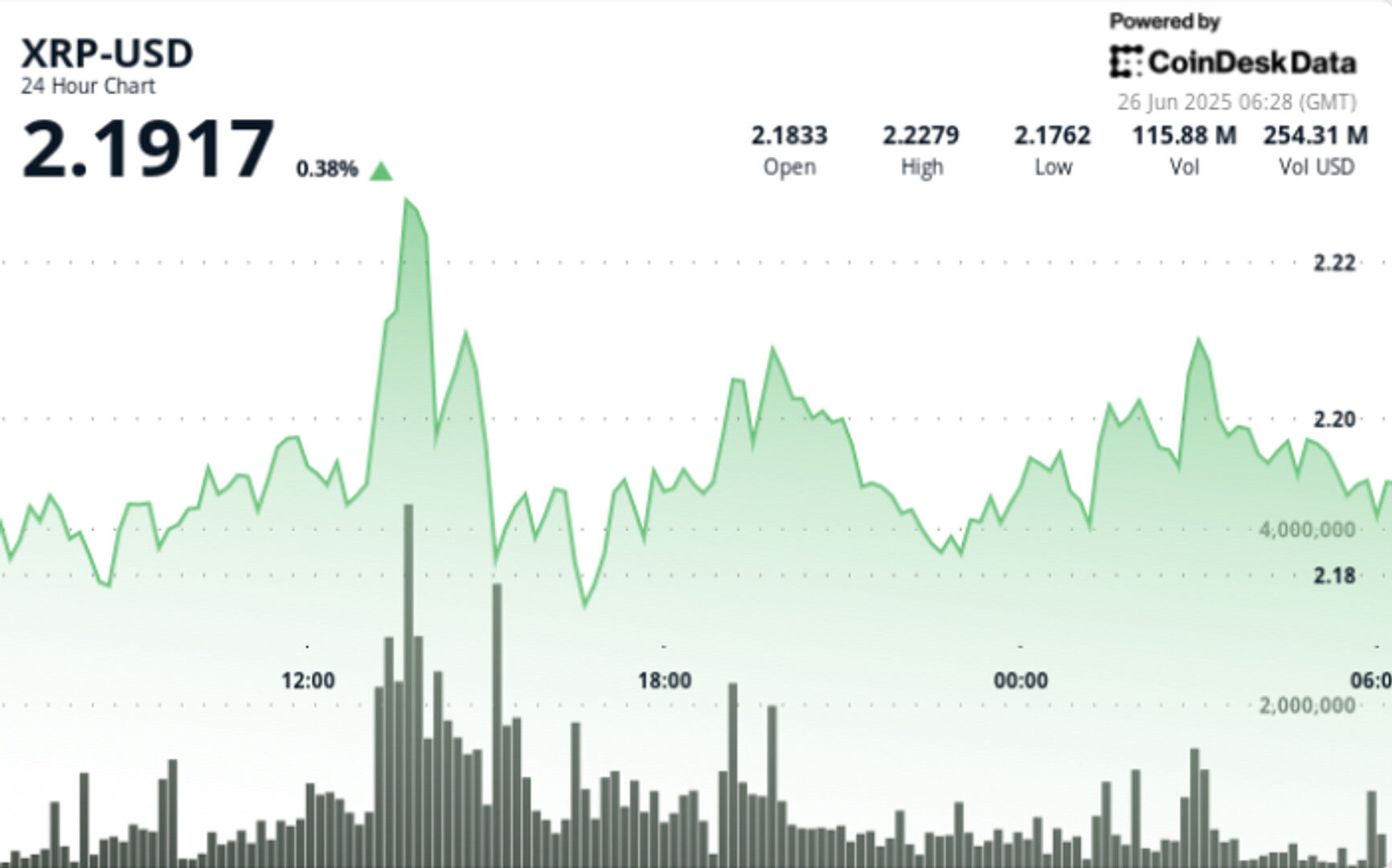

- XRP surged nearly 6% in a late-session breakout, driven by a volume spike that quadrupled its hourly average.

- Whale wallets moved hundreds of millions of dollars worth of XRP, yet the market maintained strong demand.

- The Ripple v. SEC case remains a key factor, with regulatory clarity potentially boosting XRP’s future.

XRP surged nearly 6% in a dramatic late-session breakout, powered by an explosive volume spike that quadrupled its hourly average and confirmed a fresh support zone above the $2.20 threshold.

The rally came as whale wallets moved hundreds of millions of dollars worth of XRP, yet the market shrugged off sell pressure, signaling strong underlying demand.

STORY CONTINUES BELOW

News Background

- The breakout unfolded as global risk sentiment stabilized slightly, with crypto markets rallying across the board.

- XRP led the charge, jumping from $2.19 to $2.20 in the final hour of the session.

- Volume during the breakout hour hit 108.12 million—nearly four times the average—establishing the move as a technically significant surge backed by real capital.

- On-chain data showed major XRP transfers in parallel with the rally. These included a $58 million whale transfer to Coinbase and a separate $439 million movement by Ripple to an unidentified wallet.

- Despite this typically bearish activity, XRP held firm, underscoring increasing confidence in the asset’s near-term prospects.

- The Ripple v. SEC case remains a key wildcard, with regulatory clarity seen as a potential catalyst for XRP’s next leg.

- Meanwhile, Google Trends data shows a fresh wave of retail interest, with searches for “XRP to $3” accelerating.

- Technical analysts are watching the July–September breakout window closely, with some models projecting upside targets between $3 and $5.

Price Action

XRP traded within a $0.056 range from $2.173 to $2.229 over 24 hours, with the most decisive move occurring during the final hour when the token surged nearly 6%. After peaking at $2.23, XRP pulled back slightly and consolidated between $2.19 and $2.20. Despite whale movement, support held firm at $2.17.

Intra-hour activity confirmed strength: the price began climbing at 01:28 UTC, breaking above $2.19 before volume exploded at 01:33–01:34, topping 2.7 million XRP per minute. The rally pushed XRP to $2.21 at 01:36, before settling into a tight consolidation range above $2.19.

Technical Analysis Recap

• XRP gained 5.87% from $2.19 to $2.20 in the final session hour

• Volume spiked to 108.12M XRP—nearly 4x the hourly average

• Price reached session high of $2.23 before consolidating above $2.20

• Support formed at $2.17–$2.19; resistance now sits at $2.23

• Breakout began at 01:28, followed by massive volume burst at 01:33

• Strong bid interest re-emerged at 02:00, signaling continuation potential

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.