BTC

$107,453.67

+

0.62%

ETH

$2,452.01

–

0.15%

USDT

$1.0004

–

0.01%

XRP

$2.1970

–

0.69%

BNB

$658.78

+

0.80%

SOL

$149.55

+

0.11%

USDC

$1.0001

–

0.00%

TRX

$0.2811

+

0.76%

DOGE

$0.1613

+

0.10%

ADA

$0.5576

–

0.83%

HYPE

$38.30

–

1.20%

BCH

$506.97

–

3.09%

WBT

$43.99

+

4.74%

SUI

$2.7334

–

1.54%

LINK

$13.07

–

0.85%

LEO

$8.9292

–

1.07%

AVAX

$17.64

+

0.30%

XLM

$0.2325

–

1.71%

TON

$2.8143

–

1.08%

SHIB

$0.0₄1139

+

1.02%

By Omkar Godbole, CD Analytics|Edited by Parikshit Mishra

Jul 2, 2025, 7:19 a.m.

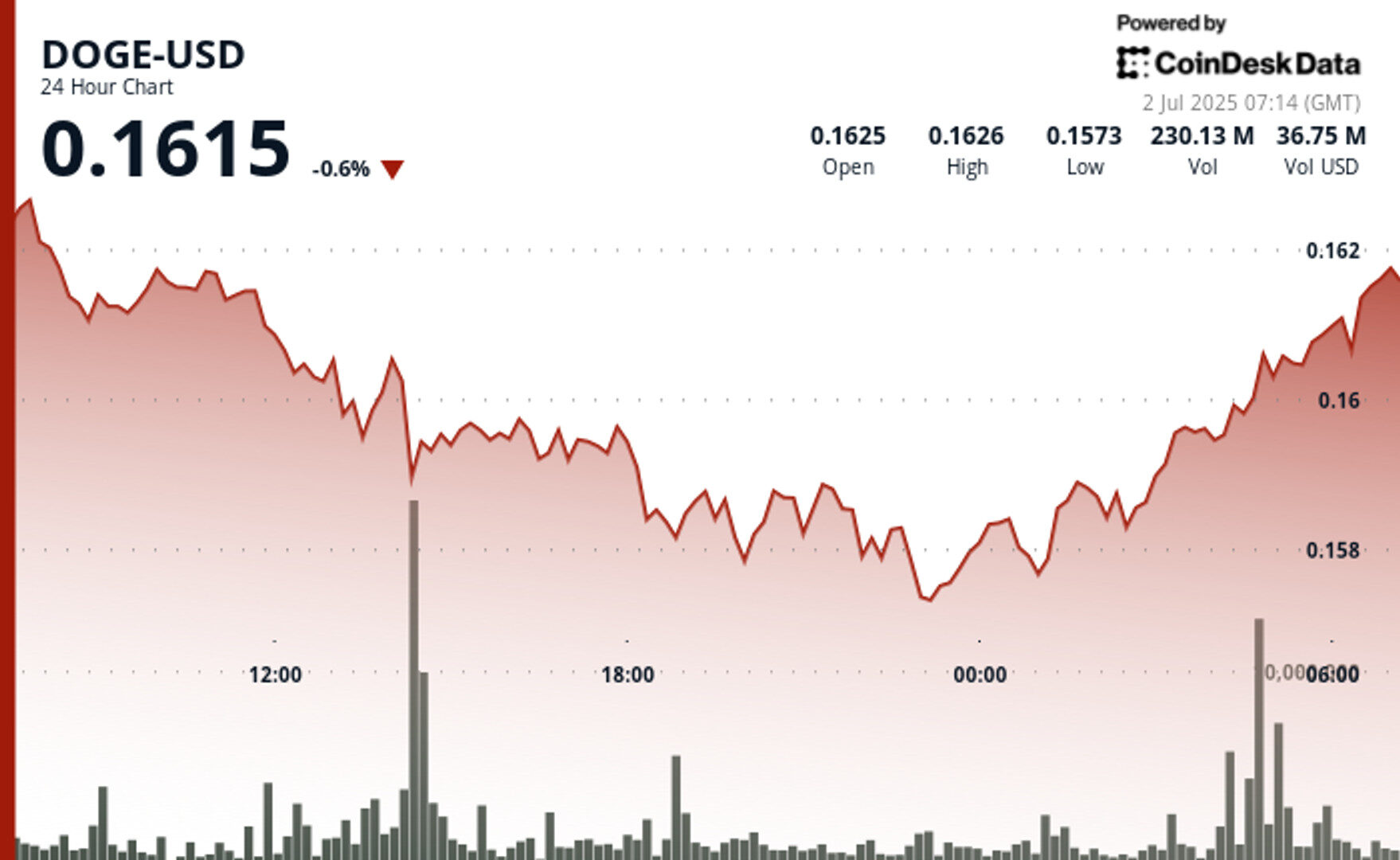

- Dogecoin formed a bullish double bottom pattern, gaining over 2% to more than 16 cents.

- The cryptocurrency’s recovery aligns with a bounce in bitcoin, which rose from $105,200 to $107,000.

- A move above 17 cents is needed to invalidate the broader bearish trend in dogecoin.

Dogecoin

, the world’s largest meme cryptocurrency by market value, has regained some poise, having formed a bullish double bottom pattern during the overnight trade.

DOGE has gained over 2% to over 16 cents since early Asian hours, reversing part of Monday’s slide from 16.63 cents to 15.67 cents, according to data source CoinDesk.

STORY CONTINUES BELOW

Per CoinDesk’s AI research, the cryptocurrency formed a “double bottom pattern” around the 15.7-15.8 cents zone with above-average volume. The bounce is consistent with the recovery in market leader bitcoin

, which has bounced to $107,000 from the overnight low of around $105,200.

The double bottom forms after a notable sell-off and is characterized by two bottoms at approximately the same level, separated by a brief recovery. An eventual move above the high logged during the interim recovery, as seen in DOGE’s case, is said to confirm a bearish-to-bullish trend change.

While the intraday momentum has shifted bearish, the broader bearish lower highs pattern, representing a consistent downtrend since the second half of May, remains intact.

The daily price chart indicates that a convincing move above the lower high of 17 cents, established over the weekend, is required to invalidate the broader bearish setup.

- DOGE formed a clear double bottom pattern around the $0.157-$0.158 zone, with above-average volume, particularly during the 13:00-14:00 hours on July 1.

- The cryptocurrency experienced a steady climb culminating in a bullish close at $0.161, with increasing volume confirming buyer interest.

- In the last 60 minutes from July 2, 05:37 to 06:36, DOGE demonstrated a clear bullish trend, rising from $0.1605 to $0.1611, representing a 0.36% gain.

- Price action formed an ascending channel, with notable volume spikes at 06:06 and 06:07 (over 4.4M and 6.0M respectively), confirming strong buyer interest.

- After reaching a local high of $0.1611 at 06:14, DOGE experienced a brief pullback to $0.1606 at 06:27 before recovering to close the hour at $0.1611.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.