By Oliver Knight, CD Analytics

Updated Jul 3, 2025, 4:17 p.m. Published Jul 3, 2025, 4:17 p.m.

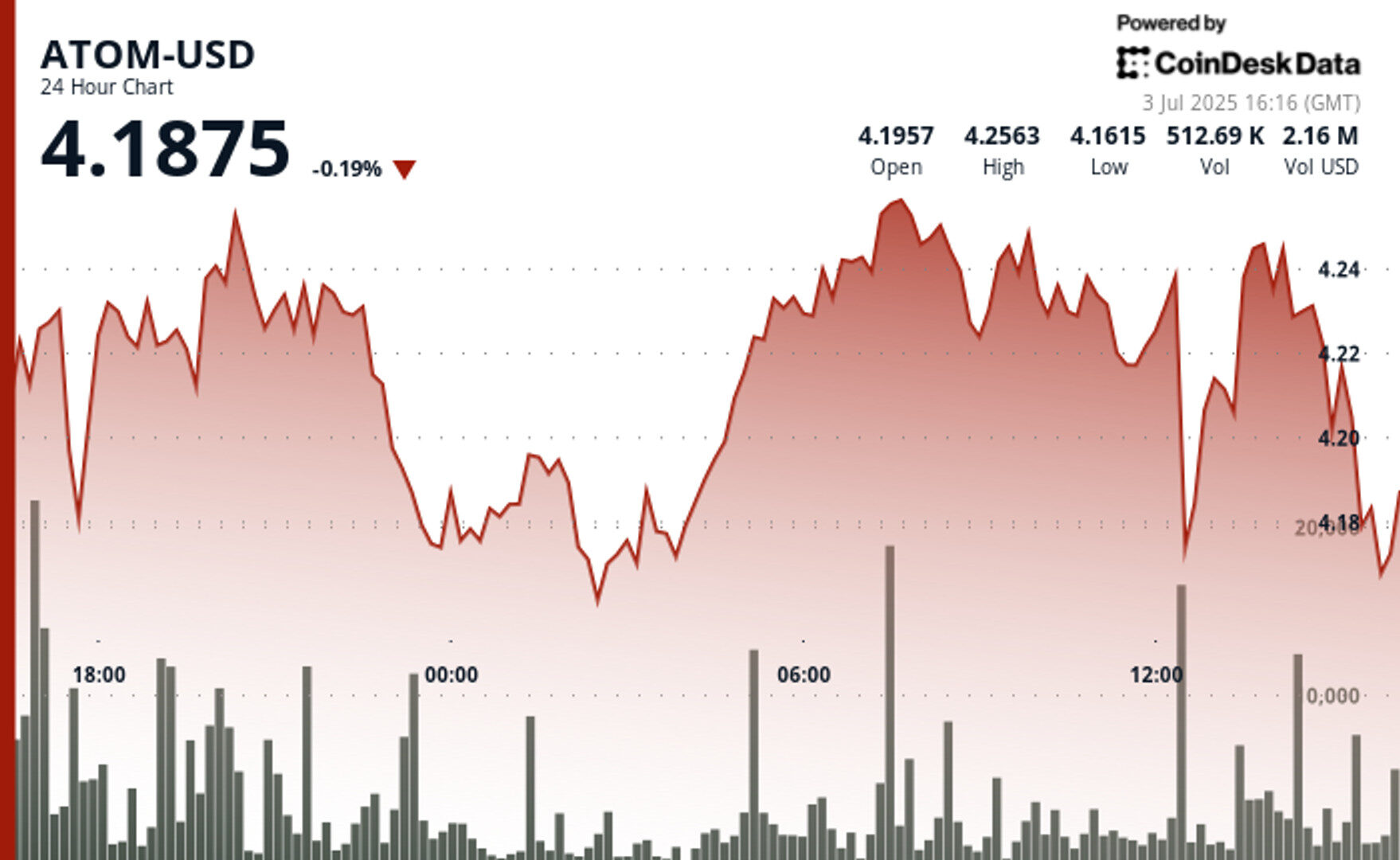

- While Bitcoin neared record highs, altcoins like ATOM consolidated, finding key support at $4.20 as broader attention stayed on major crypto assets.

- ATOM traded in a tight 4% range, showing signs of stabilization near $4.21 after a sharp intraday selloff, potentially setting up for a move if Bitcoin cools.

- The CD20 Index surged 2% to a peak of $1,811.11 before pulling back on profit-taking, reflecting strong but temporary altcoin momentum.

The altcoin market took a backseat on Thursday as crypto majors bitcoin and ether attempted to rally to new highs.

As billions of dollars worth of liquidity flowed into shorting bitcoin on the brink of record highs, altcoins like ATOM consolidated, finding support at the $4.20 level.

STORY CONTINUES BELOW

Typically when bitcoin rallies altcoin price action is muted and the inverse is true when bitcoin consolidates, so ATOM could be primed for a rally once bitcoin begins to cool off.

Technical analysis

- ATOM-USD traded within a range of $4.09 to $4.26 during the 24-hour period from 2 July 16:00 to 3 July 15:00, representing a 4% swing.

- Key support established at $4.16-$4.17 with high volume buying emerging at the $4.20 level during the 13:00 hour session on July 3rd.

- Despite reaching a peak of $4.26 during the 07:00 hour, ATOM failed to sustain momentum above the $4.25 resistance level.

- In the last 60 minutes from 3 July 14:24 to 15:23, ATOM-USD declined from $4.24 to $4.21, representing a 0.73% decrease.

- Sharp selloff occurred between 15:03-15:07, dropping to a session low of $4.19, before staging a recovery.

- Final 15 minutes showed stabilization with price consolidation around $4.21, suggesting potential short-term equilibrium.

CD20 Index Surges 2% Before Profit-Taking Emerges

- The CD20 demonstrated significant volatility in the last 24 hours from 2 July 16:00 to 3 July 15:00, reaching a peak of $1,811.11 before retracing to $1,793.55, with an overall range of $37.27 (2%).

- After establishing support around $1,780 during early hours, the index staged an impressive rally through the morning session of 3 July, gaining momentum particularly between 09:00-14:00 before profit-taking emerged in the final hour.

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.