BTC

$107,676.99

–

1.59%

ETH

$2,493.08

–

3.16%

USDT

$1.0003

–

0.01%

XRP

$2.2150

–

1.97%

BNB

$652.27

–

1.00%

SOL

$146.67

–

2.71%

USDC

$0.9999

–

0.00%

TRX

$0.2820

–

1.31%

DOGE

$0.1629

–

4.53%

ADA

$0.5700

–

3.65%

HYPE

$37.87

–

5.99%

SUI

$2.8608

–

4.59%

WBT

$44.89

+

2.70%

BCH

$480.01

–

2.91%

LINK

$13.07

–

4.52%

LEO

$9.0301

+

0.17%

AVAX

$17.68

–

4.49%

XLM

$0.2357

–

2.38%

TON

$2.7791

–

2.99%

SHIB

$0.0₄1134

–

4.10%

By Jamie Crawley, CD Analytics|Edited by Sheldon Reback

Jul 4, 2025, 3:43 p.m.

- BONK soared 21% in 24 hours, outpacing the top 100 coins by market cap amid ETF and token burn momentum.

- A potential 2x BONK ETF from Tuttle Capital and an approaching 1 million holder milestone have energized investor sentiment.

- Price action remains bullish, with technicals signaling breakout potential beyond current resistance levels.

Solana-based memecoin BONK dropped back after jumping in excess of 20% earlier this week, but remains in bullish mode amid increased trader activity.

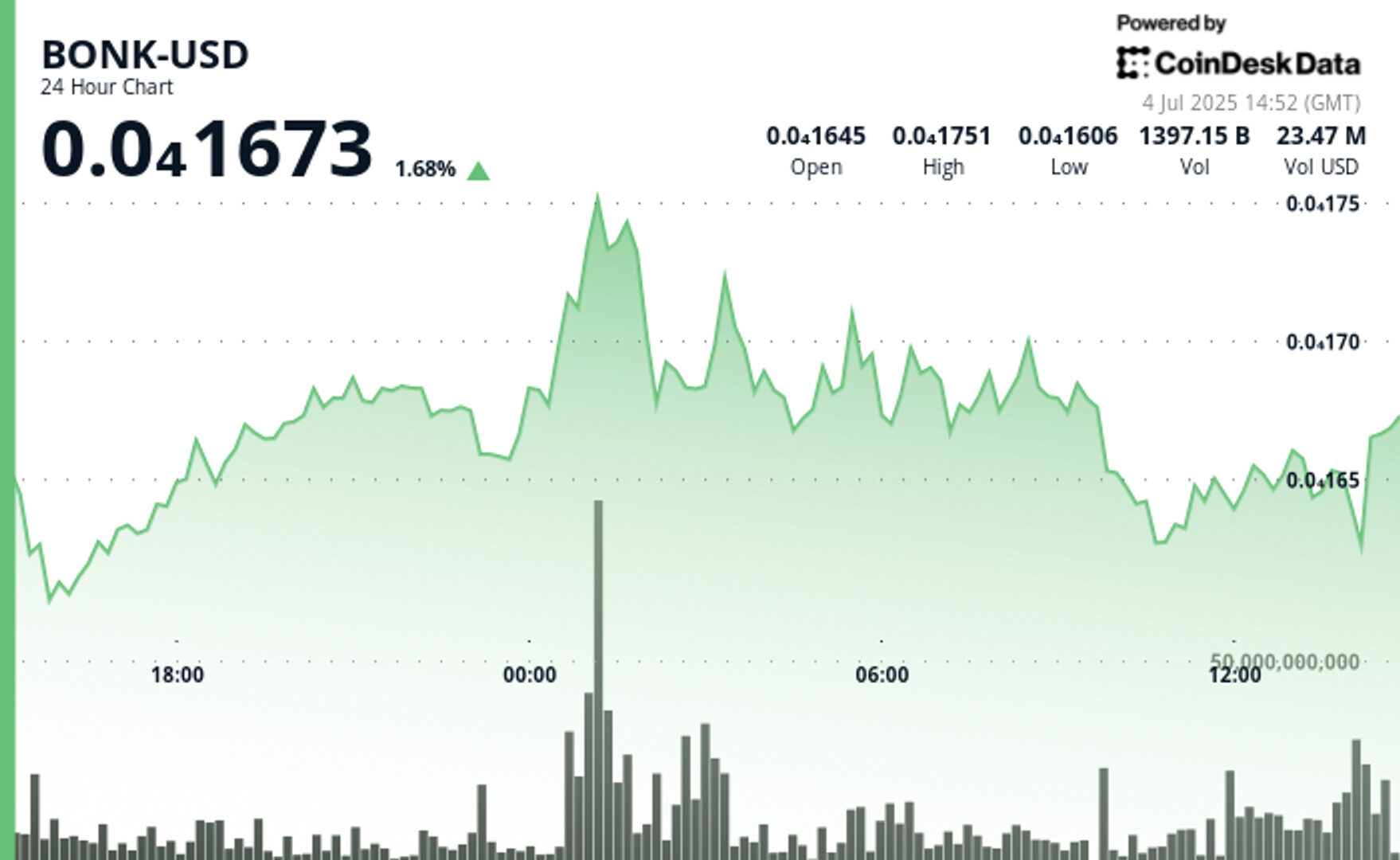

BONK surged 21% in a 24-hour period into Thursday and positioned itself as the strongest performer among major cryptocurrencies. It was recently trading at $0.00001673, a 1.68% gain, with price action ranging from $0.00001606 to $0.00001751, a 9.4% intraday swing.

STORY CONTINUES BELOW

Fueling tge momentum is mounting speculation around a 2x leveraged BONK ETF, with Tuttle Capital Management confirming July 16 as the earliest potential launch date pending regulatory approval.

Adding to the bullish sentiment, BONK is on the cusp of reaching 1 million holders, a milestone that will trigger a 1 trillion token burn, potentially slashing supply and amplifying upside pressure. It currently boasts over 943,000 holders.

Technically, BONK has broken free from both falling wedge and symmetrical triangle patterns, indicating a transition from consolidation to potential expansion, according to CoinDesk Research’s analytical model.

Analysts point to firm support at $0.000013 and resistance near $0.000018. A successful breach above this resistance could unlock a potential path toward $0.00003372, representing a possible 100% upside if momentum holds.

This rally coincides with broader growth in the Solana ecosystem, including increased validator participation and infrastructure investment. With strong fundamentals, technical support, and speculative catalysts aligned, BONK could be poised for an extended breakout in the near term.

- BONK peaked at $0.00001751 around 01:00 UTC with a notable 1.66B volume spike, establishing a high-volume resistance zone.

- Price traded in a tight band from 03:00 to 12:00 UTC, signaling consolidation post-rally.

- Key support at $0.00001627 held firm throughout the trading session despite intraday pullbacks.

- BONK experienced a sharp 1.5% reversal at 13:52 UTC on heavy volume (31.9B), validating $0.0000164 as near-term support.

- Resistance is forming near $0.000017, tested multiple times between 02:00 and 06:00 UTC.

- Broader support zone remains around $0.000013, per macro-level chart patterns.

- BONK has broken out of both falling wedge and symmetrical triangle formations, typically bullish setups.

- RSI suggests room for further upside, with no overbought signals evident at current levels.`

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Jamie has been part of CoinDesk’s news team since February 2021, focusing on breaking news, Bitcoin tech and protocols and crypto VC. He holds BTC, ETH and DOGE.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.