BTC

$108,723.91

+

0.39%

ETH

$2,621.33

+

2.41%

FDUSD

$0.9983

+

0.02%

USDT

$1.0001

+

0.01%

XRP

$2.3276

+

2.71%

BNB

$664.17

+

0.63%

SOL

$152.58

+

2.16%

USDC

$0.9999

–

0.00%

TRX

$0.2866

–

0.19%

DOGE

$0.1719

+

2.17%

ADA

$0.5943

+

2.95%

HYPE

$39.24

+

4.05%

BCH

$508.56

+

2.22%

SUI

$2.9249

+

1.96%

WBT

$44.72

–

0.41%

LINK

$14.05

+

5.28%

LEO

$9.0202

–

0.25%

XLM

$0.2653

+

6.69%

AVAX

$18.40

+

2.97%

SHIB

$0.0₄1186

+

0.63%

By Shaurya Malwa, CD Analytics

Updated Jul 9, 2025, 4:55 a.m. Published Jul 9, 2025, 4:45 a.m.

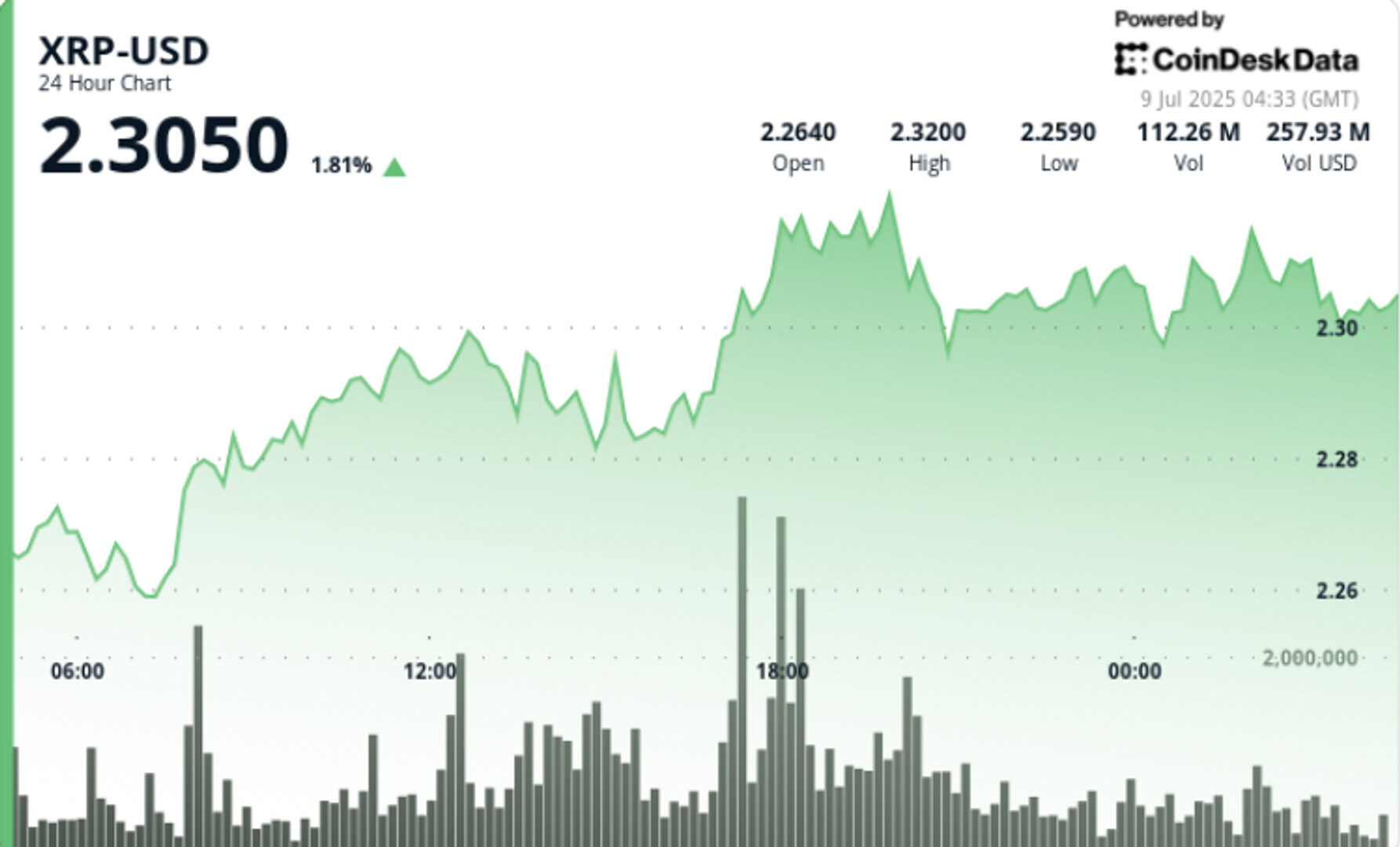

- Ripple’s application for a U.S. banking license has sparked renewed interest in XRP, leading to a significant price breakout.

- XRP’s price surged past the $2.28 resistance level, with technical analysts eyeing $2.38 as the next major target.

- The asset remains structurally bullish due to Ripple’s regulatory progress and increasing institutional interest.

Ripple’s push for a U.S. banking license has reignited bullish momentum for XRP, fueling a high-volume breakout above the $2.28 resistance level and setting up a potential test of $2.38 — a level that, if breached, could trigger a larger upside move.

- Ripple’s application for a national trust bank charter with the U.S. Office of the Comptroller of the Currency

has provided a fundamental catalyst for XRP.

- The move signals deeper integration into the regulated financial system and is widely seen as a bullish step toward institutional adoption.

- As the regulatory narrative shifts, XRP has emerged as one of the few altcoins with both legal clarity and rising institutional interest.

- XRP rallied 2.36% over the 24-hour period from 6 July 03:00 to 7 July 02:00, climbing from $2.21 to $2.26 with high conviction buying.

- The breakout was defined by a surge in trading volume, peaking at over 67 million units during the 10:00 hour as price pushed through $2.28.

- Price action printed a daily high of $2.29, before pulling back and consolidating above support at $2.24–$2.25.

- The intraday range spanned $0.08 (3.62%), with key breakout points at 08:00, 10:00, and 13:00 — each confirmed by above-average volume.

- $2.24–$2.25 has established itself as strong support after bulls defended this zone during an 18:00 dip.

- The $2.28–$2.29 area now acts as immediate resistance. A decisive flip of this zone could open room for a run toward $2.38 — a level technical analysts are closely watching as the next major breakout trigger.

- In the final 60 minutes of the session (7 July 01:05–02:04), XRP surged from $2.26 to $2.27, a 2.29% jump, with momentum building at 01:30 and 02:01 — both marked by sharp volume spikes.

- A sustained close above $2.28 with volume confirmation could push XRP toward the next upside targets of $2.38, then $2.60–$3.40 in extension.

- Failure to hold $2.25 support would likely trigger a retest of $2.21–$2.22 demand zone.

- With a rising narrative around Ripple’s regulatory progress and XRP’s legal clarity, the asset remains one of the most structurally bullish large-cap tokens in the current macro environment.

(Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.)

STORY CONTINUES BELOW

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.