BTC

$116,914.55

+

6.40%

ETH

$2,955.41

+

7.39%

USDT

$1.0002

–

0.01%

XRP

$2.7725

+

8.03%

BNB

$688.13

+

2.57%

SOL

$162.27

+

3.99%

USDC

$0.9999

+

0.00%

DOGE

$0.2014

+

10.27%

TRX

$0.2984

+

1.84%

ADA

$0.7377

+

16.86%

HYPE

$45.37

+

10.41%

SUI

$3.4831

+

7.93%

LINK

$15.53

+

8.09%

BCH

$529.97

+

1.30%

WBT

$46.43

+

0.73%

XLM

$0.3695

+

10.53%

AVAX

$21.02

+

6.77%

HBAR

$0.2011

+

15.33%

LEO

$8.9059

+

0.23%

SHIB

$0.0₄1340

+

7.99%

By Krisztian Sandor|Edited by Stephen Alpher

Jul 11, 2025, 3:34 p.m.

- Bitcoin has reached new all-time highs, with stablecoins like Tether’s USDT and Circle’s USDC also seeing record supply increases.

- USDC’s market cap has grown by $1.3 billion since July, while USDT added $1.4 billion, indicating a significant influx of capital into the crypto market.

- Analysts view the growth of stablecoins as a sign of fresh capital entering the crypto economy, often correlating with bitcoin rallies.

As bitcoin

pushed past all-time highs and other cryptocurrencies surged, the rise in stablecoin supply is offering a signal that this rally may have deeper roots.

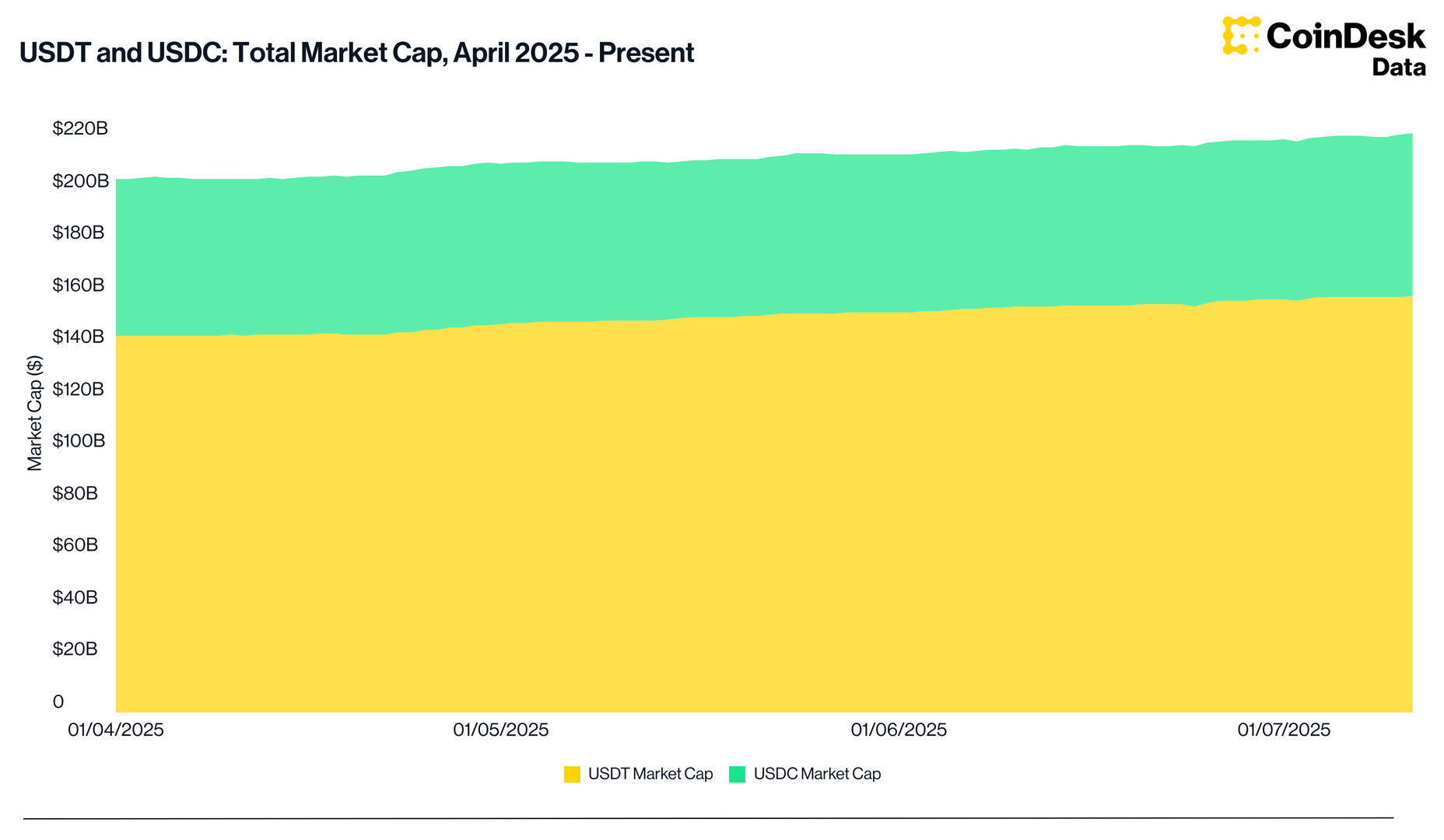

Tether’s USDT and Circle’s USDC, the two largest dollar-pegged stablecoins, each reached new record supplies this week, according to TradingView data. Since the start of July, USDC’s market cap has grown by $1.3 billion, reaching $62.8 billion, while USDT added $1.4 billion to hit nearly $160 billion.

STORY CONTINUES BELOW

Looking further back to April, when the market hit a short-term low, the growth is even more pronounced. USDT expanded by $15.2 billion—roughly 10.5%—and USDC added $2.7 billion, or 4.6%.

Stablecoins are cryptocurrencies with prices tied to an external asset, predominantly to the U.S. dollar. While they have been increasingly popular for payments, the asset class serves as a key source of liquidity and trading pairs on crypto exchanges.

Hence, analysts often treat their growth as a proxy for fresh capital entering the broader crypto economy.

Previously, periods of accelerating stablecoin growth coincided with sharp rallies in bitcoin, Caleb Franzen, founder of Cubic Analytics, pointed out in a chart shared on X.

Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University’s business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH.