BTC

$117,710.89

+

6.40%

ETH

$2,976.26

+

7.39%

USDT

$1.0002

–

0.01%

XRP

$2.8220

+

8.03%

BNB

$690.71

+

2.57%

SOL

$164.99

+

3.99%

USDC

$0.9999

+

0.00%

DOGE

$0.2027

+

10.27%

TRX

$0.2983

+

1.84%

ADA

$0.7606

+

16.86%

HYPE

$45.38

+

10.41%

SUI

$3.5270

+

7.93%

LINK

$15.70

+

8.09%

BCH

$531.24

+

1.30%

WBT

$46.50

+

0.73%

XLM

$0.3568

+

10.53%

AVAX

$21.24

+

6.77%

HBAR

$0.2047

+

15.33%

LEO

$8.9771

+

0.23%

SHIB

$0.0₄1352

+

7.99%

By Francisco Rodrigues, CD Analytics|Edited by Parikshit Mishra

Jul 11, 2025, 11:29 a.m.

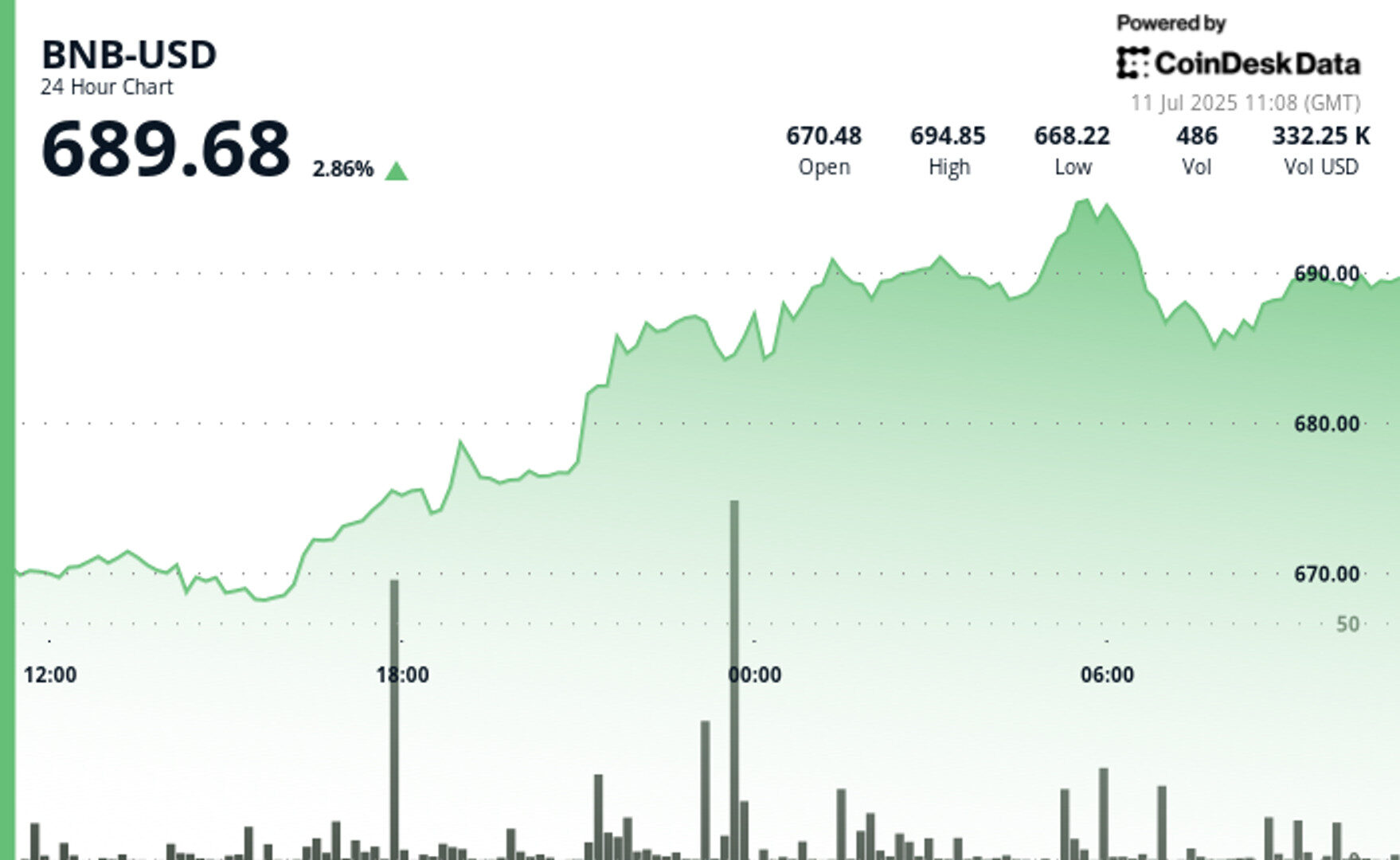

- BNB rose 2.8% to $688.7, driven by a combination of the broader cryptocurrency market rally and a fresh $1 billion token burn.

- The token burn is part of the token’s deflationary strategy to cut the total supply to 100 million tokens.

- Growing interest in using BNB as a corporate treasury reserve is also driving demand, with over 30 teams working on structuring public-company treasury reserves in BNB.

BNB is edging closer to the $700 mark as traders responded to a fresh $1 billion token burn and growing interest in using the asset as a corporate treasury reserve.

Over the last 24-hour period, BNB rose about 2.8%, from $670.40 to $688.7. Trading surged as the price moved up, amid a broader cryptocurrency market rally that saw bitcoin hit a new all-time high above $118,000.

STORY CONTINUES BELOW

The price briefly hit an intraday peak near $695 before settling into a tight range around $689.

The wally wasn’t just fueled by the rising crypto tide. Binance’s 32nd quarterly burn permanently removed about 1.59 million BNB from circulation, bringing the total value burned to 265,605 BNB according to a tracking website.

The burns are part of a deflationary strategy aiming to cut the total supply to 100 million tokens.

On top of this, over 30 teams are reportedly working on ways to structure public-company treasury reserves in BNB, with investment firm 10X Capital backing a plan for a $500 million U.S.-listed BNB treasury company.

Active addresses on BNB Chain have doubled since March, hovering around 2.5 million daily, according to Nansen data. Similarly, average daily transaction volumes have tripled.

Investors are watching to see if BNB can crack the psychological barrier at $700 in the days ahead.

Technical Analysis Overview:

- BNB gained 2.77% over the 24-hour period, signaling solid upward momentum, according to CoinDesk Research’s technical analysis model.

- Price ranged $27.51 (4.11%) between a low of $667.61 and a high of $695.12.

- Trading volume spiked to 155,426 tokens at the close of yesterday’s trading, more than double the 24-hour average of 64,169.

- Resistance is visible near $695.12, while support has emerged around $667.61.

- After the initial rally, prices consolidated within a narrow $1.51 band from $688.81 to $690.73.

- Strong support has settled near the $688.80-$689.00 zone.

- The market briefly tested resistance at $690.73 before easing back in a controlled pullback.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Francisco is a reporter for CoinDesk with a passion for cryptocurrencies and personal finance. Before joining CoinDesk he worked at major financial and crypto publications. He owns bitcoin, ether, solana, and PAXG above CoinDesk’s $1,000 disclosure threshold.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.