BTC

$117,715.18

+

0.16%

ETH

$2,964.03

–

0.23%

XRP

$2.7608

+

7.22%

USDT

$1.0002

–

0.00%

BNB

$693.00

+

1.15%

SOL

$162.86

–

0.27%

USDC

$0.9998

+

0.00%

DOGE

$0.2006

+

2.20%

TRX

$0.3043

+

3.18%

ADA

$0.7121

+

1.89%

HYPE

$46.82

+

3.42%

SUI

$3.4236

–

1.68%

XLM

$0.3735

+

23.06%

LINK

$15.22

–

0.33%

BCH

$516.60

–

0.46%

WBT

$46.45

–

0.23%

AVAX

$20.82

+

0.33%

LEO

$9.0799

+

1.01%

HBAR

$0.1971

–

1.26%

SHIB

$0.0₄1329

+

0.48%

By Shaurya Malwa, CD Analytics

Updated Jul 12, 2025, 6:51 a.m. Published Jul 12, 2025, 6:51 a.m.

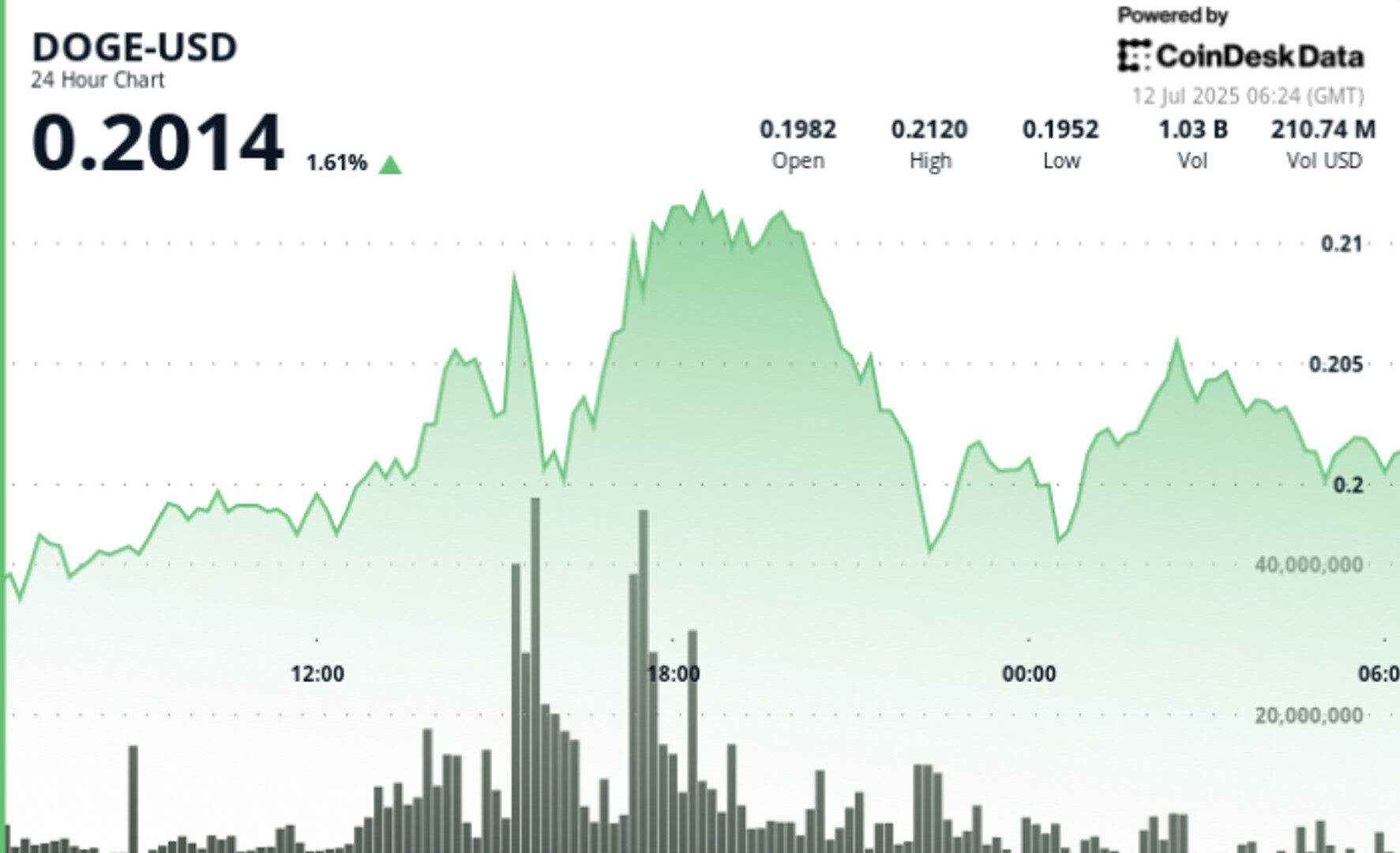

- Dogecoin advanced 8.6% intraday but closed at $0.202, retracing its gains.

- Trading volumes peaked at 1.1 billion, establishing resistance between $0.208 and $0.213.

- Analysts noted systematic profit-taking at $0.211, indicating larger holders’ influence.

What to know:

- DOGE advanced 8.6% from $0.198 to $0.213 between July 11 06:00 and July 12 05:00 before closing at $0.202 — a full retracement of its intraday gains.

- Trading volumes surged past 1.1B during the 13:00–15:00 session, establishing resistance between $0.208–$0.213.

- Support held at $0.200–$0.201 through late-session volatility, with final hour price action stabilizing around $0.202.

- Analysts flagged the rejection at $0.211 (20:00) as evidence of systematic profit-taking by larger holders.

News Background: BTC Record, Risk-On Flows Drive Meme Coin Rally

Bitcoin touched an all-time high of $118,000 during the session, as crypto markets benefited from a surge in institutional inflows — estimated at $50B this week alone.

Easing geopolitical tensions, improving trade relations, and dovish signals from central banks have boosted risk assets across the board. Dogecoin, typically a high-beta play during crypto rallies, surged alongside altcoins in response.

STORY CONTINUES BELOW

Price Action Summary

- Range: $0.198 → $0.213 → $0.202 | Total swing: 8.6%

- Breakout Zone: $0.200–$0.208 cleared on strong volume

- Resistance: $0.208–$0.213, with reversal from $0.211

- Support: $0.200–$0.201 tested and held multiple times

- Final Hour (04:55–05:54): Price rose from $0.200 → $0.202 (+0.5%)

- Volume Peak: 1.1B between 13:00–15:00; 19M during 05:00–05:10 late surge

Technical Analysis

- Mid-session momentum broke above key resistance zones but failed to sustain above $0.213

- Volume-backed reversal near session high suggests strategic exits by institutions

- Final-hour recovery shows $0.200 remains psychologically significant

- Momentum cooling; near-term consolidation expected in $0.200–$0.204 band

What Traders Are Watching

- Can DOGE reclaim and hold above $0.208–$0.210 to retest highs?

- Breakdown below $0.198–$0.200 would signal trend exhaustion

- Consolidation above $0.202 would support a bullish continuation setup into next week

- Broader BTC and macro risk sentiment will continue to dictate altcoin flows

Takeaway

DOGE followed broader crypto markets higher with a clean intraday breakout — but its rejection at $0.213 and sharp pullback highlight the fragile nature of meme coin rallies during high volatility sessions.

Institutional flows remain, but traders should watch for volume confirmation before chasing upside. $0.200 is now the line in the sand.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.