BTC

$117,715.18

+

0.16%

ETH

$2,964.03

–

0.23%

XRP

$2.7608

+

7.22%

USDT

$1.0002

–

0.00%

BNB

$693.00

+

1.15%

SOL

$162.86

–

0.27%

USDC

$0.9998

+

0.00%

DOGE

$0.2006

+

2.20%

TRX

$0.3043

+

3.18%

ADA

$0.7121

+

1.89%

HYPE

$46.82

+

3.42%

SUI

$3.4236

–

1.68%

XLM

$0.3735

+

23.06%

LINK

$15.22

–

0.33%

BCH

$516.60

–

0.46%

WBT

$46.45

–

0.23%

AVAX

$20.82

+

0.33%

LEO

$9.0799

+

1.01%

HBAR

$0.1971

–

1.26%

SHIB

$0.0₄1329

+

0.48%

By Shaurya Malwa, CD Analytics

Updated Jul 12, 2025, 6:33 a.m. Published Jul 12, 2025, 6:32 a.m.

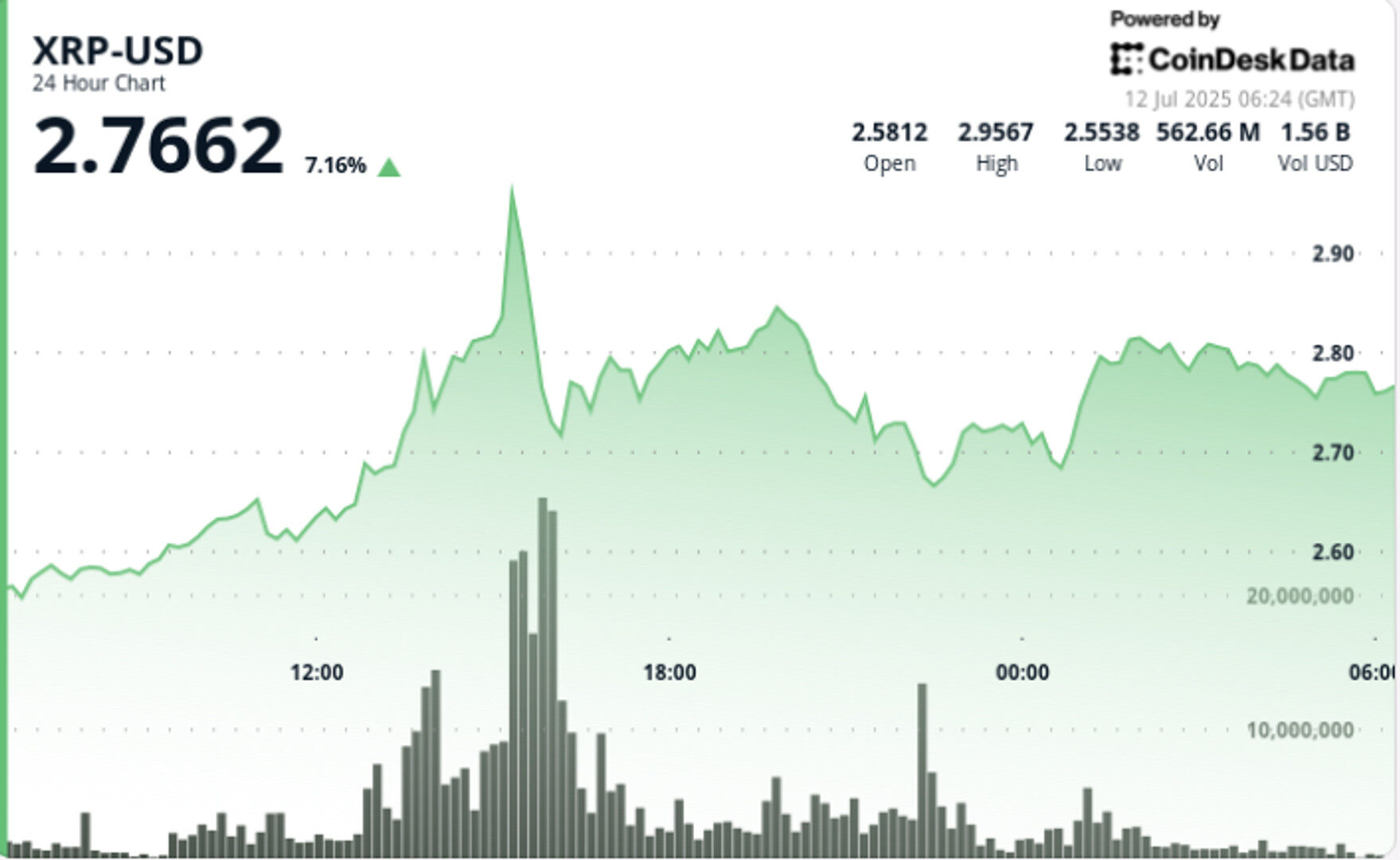

- XRP surged 8% to $2.78, peaking at $2.96, before retracing slightly.

- A $14.03M leveraged long position on Hyperliquid suggests aggressive whale activity.

- Analysts see $2.90–$3.40 as the next resistance, with potential for further gains.

What to know:

- XRP rallied 8% from $2.58 to $2.78 between July 11 06:00 and July 12 05:00, with an intraday high of $2.96 at 15:00 before retracing.

- Afternoon price action saw exceptional volume — over 375M between 13:00–15:00 — with buyers repeatedly defending the $2.70–$2.75 zone.

- A $14.03M leveraged long was opened on Hyperliquid at $2.30, signaling aggressive whale positioning.

- Analysts now target $2.90–$3.40 as the next resistance band, citing bullish structure and capital inflows.

- News Background

Whale wallets have ramped up exposure in recent sessions, most notably with a $14M long established on derivatives venue Hyperliquid. - The trade coincides with a breakout from an ascending triangle structure and a growing belief among technical analysts that the $2.90 region, once cleared, could spark a fast leg toward $3.40 and beyond.

- This comes as Ripple’s broader ecosystem — including RLUSD stablecoin momentum and cross-border settlement integrations — continues to attract institutional interest.

Price Action Summary

STORY CONTINUES BELOW

- Range: $0.35 | Low: $2.58 → High: $2.96

- Peak Time: 15:00 | Sharp retracement followed, but price held above $2.70

- Support Zone: $2.70–$2.75, where demand remained intact through multiple tests

- Final Hour (04:55–05:54): XRP rose from $2.76 → $2.79 (+1%)

- Volume Spike: 2.6M between 05:30–05:35 validated breakout toward session close

Technical Analysis

- Price formed an ascending triangle with higher lows and horizontal resistance tests

- Total trading range of $0.35 = 14% volatility on session

- Afternoon resistance at $2.96; consolidation at $2.78

- Key breakout zone remains $2.90–$3.40; breach would likely trigger accelerated upside

- Late-session breakout confirmed by real volume, not thin order books — a key bullish sign

What Traders Are Watching

- Can XRP flip $2.80–$2.85 into a new base?

- Watch for reaction near $2.90; a clean move through that zone with >200M volume may open path to $3.40

- Failure to hold above $2.70 could invite pullback toward $2.58–$2.60

- Whale long at $2.30 continues to act as downside anchor for bullish bias

Takeaway

Real flows, strong technical structure, and aggressive leveraged positioning underpin XRP’s 8% daily move. The $2.96 rejection showed local resistance, but recovery into the close points to renewed strength.

A confirmed breakout above $2.90 could mark the start of a new bullish leg — with traders already eyeing $3.40 and, in ultra-bullish cases, $5+ as long-term targets.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.